Going green not cheap for NV Energy

It’s costing a bundle for local power utility NV Energy to comply with a state law that requires it to buy green energy.

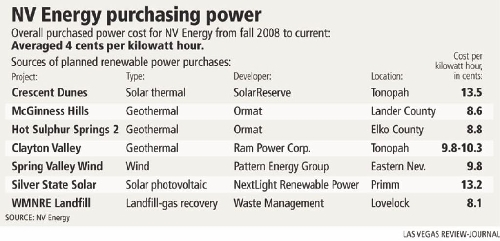

New filings from the company show that it plans to pay 8.6 cents to 13.5 cents per kilowatt hour to buy electricity from seven renewable-power projects included in the 20-year integrated-resource proposal it has pending before the Public Utilities Commission of Nevada.

That price runs two to four times higher than the 4 cents or so per kilowatt hour that the utility paid over the past 18 months for its wholesale power, which comes mostly from natural-gas generation.

NV Energy noted in the renewable filings that “other terms and conditions of the (agreements) … might affect the amount of payments made by NV Energy.”

The company didn’t disclose those factors in its filing.

The costs disclosed in the filings relate strictly to the ratepaying side of the equation. In addition to the rates, many renewable developers are receiving subsidies, the costs of which are unknown to regulators and utilities alike.

The utilities commission, which must decide by July 28 whether to approve the power-purchase agreements, will hold a separate hearing on whether the undisclosed terms should become public.

Observers disagree on how much of a problem the renewable prices pose. Consumer advocates say it may be time to review the state’s green-energy mandate, while supporters of the requirement say the expense is worth it for the long-term benefits clean fuels provide.

But everyone acknowledges what the contracts show: Green power costs more than its fossil fuel-generated counterparts. Just how much more has been the question. Based on NV Energy’s filings, wind, geothermal and waste heat-recapturing come closest to current power-purchasing prices, while solar projects cost the most.

The priciest agreement among the seven before the commission is Crescent Dunes, a solar plant that would use molten salt to capture the sun’s heat during the day for use overnight. NV Energy has agreed to pay 13.5 cents per kilowatt hour for electricity generated by Crescent Dunes.

The cheapest? That would be Ormat’s McGinness Hills geothermal project in Lander County, at 8.6 cents per kilowatt hour.

NV Energy executives said Wednesday that they focus on finding the low est-cost green options.

“We have a mandate we have to meet, and our responsibility is to meet it as cheaply as possible,” said Michael Yackira, the utility’s president and chief executive officer, in a meeting with Review-Journal reporters and editors. “Every action we take as a company is to keep costs as low as we can.”

The company asked regulators to allow as much as 25 percent of its green portfolio to include inexpensive energy-conservation measures, partly to keep the cost of the mandate down, Yackira said.

The utility also turns down 75 percent of the green-energy bids it gets, sometimes due to questions about whether the developer can actually deliver the plant, but often because prices are too high. Consider Copper Mountain, a 58-megawatt solar-photovoltaic project that Sempra Energy built in Boulder City.

NV Energy negotiated in 2008 to buy power from the plant, but California’s Pacific Gas & Electric offered a higher price than NV Energy was willing to pay.

Despite those efforts, the renewable mandate could need revisiting soon, said one state official.

Eric Witkoski, the state consumer advocate charged with protecting the interests of utility ratepayers, said the mandate requiring NV Energy to buy green power is a concern as growth of the utility’s total power demand, or load, slows.

State law requires the utility to obtain 12 percent of its electricity from renewable sources in 2010; NV Energy executives said recently that they expect to surpass that mandate and get 14 percent of their juice from clean sources this year.

The renewable portfolio standard maxes out at 25 percent in 2025.

Witkoski said the standard was less of a concern when demand was expanding 200 megawatts a year or more, because renewable contracts had a smaller effect on a broadly growing portfolio. In 2008, for example, NV Energy’s renewable purchases totaled $89.6 million, while the cost of all of NV Energy’s electric revenue was more than $3 billion.

“The (demand) forecast dropped considerably in 2008 and going forward,” Witkoski said. “Thus, the need for power has been reduced substantially.”

That means the contracts’ costs, as well as the renewable portfolio standard itself, must be reviewed going forward, Witkoski added.

But a former state lawmaker said recently that the portfolio standard serves an important purpose.

“Even if it takes a little cost to get things started, down the road it’s the best thing for the environment,” said Clark County Commissioner Chris Giunchigliani, a former Nevada assemblywoman who co-sponsored the 2001 law. “It also lets us do something with economic diversification and job growth, and it can make us a leader in another way (besides entertainment).”

Besides, Giunchigliani noted, power bills among some residential ratepayers and consumer groups benefit from subsidies that keep them artificially low. That means many households don’t even see the true cost of the fossil fuels behind the biggest share of their electricity invoice.

“We have to be careful what we complain about, because at some point, if we don’t do this, they may end the subsidy of residential power, and that would not help our constituents,” she said. “Sometimes, you have to do things so it’s a win-win for everybody in the long run, even if it costs a little up front. Everyone realizes we have to get away from our dependency on foreign oil and offshore drilling.”

And then there are the environmental costs of extracting and burning fossil fuels such as coal, Giunchigliani said.

Plus, the renewable-portfolio standard is a work in progress, she noted.

Giunchigliani said she believes a tougher standard — one that required a faster buildup to 25 percent — would have forced higher production volumes that would have driven down costs more quickly. And by 2025, alternative energy should be prevalent enough to be competitive with fossil fuels, she said.

Experts wouldn’t speculate on how much ratepayers’ bills would rise as a result of renewable contracts. NV Energy officials said the effects would depend on how energy costs, both for renewable and fossil-fuel generation, trend over time. Witkoski agreed that it’s difficult to predict future energy costs.

NV Energy initially filed the renewable agreements in February without pricing information, saying that such details were competitive matters and needed to be kept private.

For the sake of transparency for consumers, the Review-Journal asked in June, during hearings on the resource plan, to see the contracts with prices included. The state Public Utilities Commission agreed that pricing information should be public, and told NV Energy on June 30 to disclose the cost data.

Contact reporter Jennifer Robison at jrobison@review journal.com or 702-380-4512.