Gas prices dip 25 cents a gallon, but drivers still feel pinch at pump

Drivers in Clark County are seeing some relief at the pumps as the average price of a gallon of gas dropped to $5.29 on Tuesday, well below Nevada’s average price of $5.38.

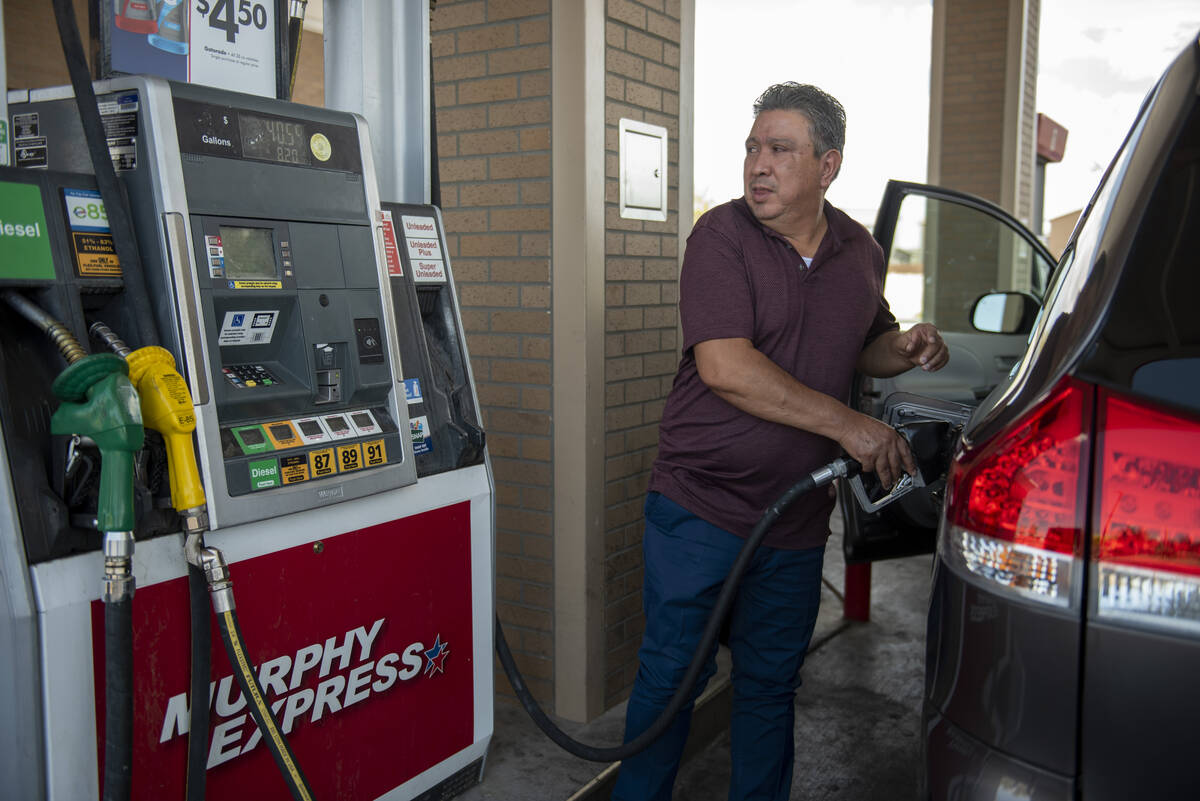

And a sign outside at least one Las Vegas station — a Murphy Express on Craig Road —on Tuesday afternoon boasted unleaded gas for just under $4.95 a gallon.

Enrique Zafra, who was filling his gas tank at the Murphy Express, was happy to see the lower gas prices.

“It’s very good because I work for Uber, and this helps me for work,” Zafra said in Spanish. “It makes it easier to go out and travel a little bit.”

The $5.38 per gallon average price for a gallon of unleaded gas in the Silver State was down 26 cents from its June high of $5.64 while the national average price sits at $4.66 per gallon, down from a high of $5.02, according to AAA.

Northern Nevada’s Washoe County hasn’t fared quite as well, although prices have dipped, with the average price at $5.82 per gallon Tuesday.

The price drops are the result of a decrease in demand for gas within the United States and across the globe, according to John Treanor, Nevada spokesman for AAA.

“The main reason for that is a lack of demand, or lack of demand for the global oil market, as well as a lack of demand for daily drivers here in the country,” Treanor said Monday.

That decrease is partly because of lower demand in some foreign countries. Treanor said Chinese demand for gas has gone down in recent weeks as the country has issued another set of lockdowns for areas experiencing a rise of coronavirus cases.

Patrick De Haan, the lead petroleum analyst for GasBudddy, said that a decrease in demand due to multiple factors, including the ongoing coronavirus pandemic and Russia’s war with Ukraine that has reduced global supply, has led to a tight gas market with “no margin for error.”

He also said dropping prices could be in part due to “alarms growing” about potential for a recession both in the U.S. and across the globe.

U.S. demand is dipping also because high gas prices have caused everyday drivers to change their behavior, Treanor said. “But demand for road trips, like those trips at 50 miles or more, is still high,” he said, while also noting Americans are fueling up less during the day.

Feeling the pinch

Las Vegan Mark Wynants estimates he spends $200 per month on gas. He said that he stays home more because of high gas prices and hasn’t taken much notice of the recent dips in gas prices after months of increasing prices.

“Anything over $5 a gallon is still a lot to me,” Wynants said Monday while filling up his car at the Chevron station at the intersection of Charleston Boulevard and Rancho Drive.

Americans are increasingly feeling the burden at the pump. A recent poll from Gallup showed that 67 percent of Americans in June said that gas prices are causing hardship for them, with 22 percent saying it’s a severe hardship.

The poll numbers mark a jump from earlier this year. In April, just over half of Americans were saying that gas prices are causing a hardship.

Gallup reports the hardship numbers on gas prices are among the highest levels since the company started polling this issue in 2000. The highest number for this poll came in September 2005 when 72 percent of people said gas prices were causing a hardship.

Treanor said it’s difficult to predict future gas prices, but the supply of oil and demand for gas are key to determining the price.

Price trends in the oil and gas market are only stable for one to two weeks into the future, according to De Haan. “There is too much uncertainty to look beyond that,” he said.

One key factor for gas prices is the sale price of crude oil barrels, Treanor said. In the first week of July, the price for Western Texas Intermediate crude oil barrels dropped below $100 for the first time since May; now that barrel price is just above $95.

Uncertain future

De Haan said the lower barrel prices are a good sign for consumers, but he noted that uncertainty remains about future prices. He pointed to Citigroup estimates that oil prices will go to $65 by the end of year and JPMorgan Chase predicts a “stratospheric” price of $380 a barrel, according to a Fortune Magazine report.

Citigroup’s low barrel estimated prices are based on an expectation of a recession, which will decrease energy demands while JPMorgan Chase’s high prices are based on fears Russia could further reduce the world’s oil supply in response to sanctions.

“Nobody really knows where we go from here,” De Haan said.

Treanor agreed that oil barrel prices face an uncertain future and that like gas prices, they are tied to supply and demand.

“If demand keeps going down, then in theory, prices are gonna keep going down, but if demand increases, then prices might increase,” he said.

De Haan expects in the short term that gas prices will continue to go down but that it may take awhile for consumers to notice because gas stations have “incredible latitude” to set their own prices. While some stations will be quick to pass savings to consumers, others may keep prices high, he said.

He advises consumers to shop around for stations with lower prices because that may spur gas stations to lower prices in order to compete.

Contact Sean Hemmersmeier at shemmersmeier@reviewjournal.com or on Twitter @seanhemmers34

Review-Journal photographer Steel Brooks contributed to this report.