Nevada gaming revenues decline almost 6 percent in September

Let’s not start panicking yet.

That’s the message from analysts reviewing Nevada’s September gaming revenue results, released Wednesday by the Gaming Control Board.

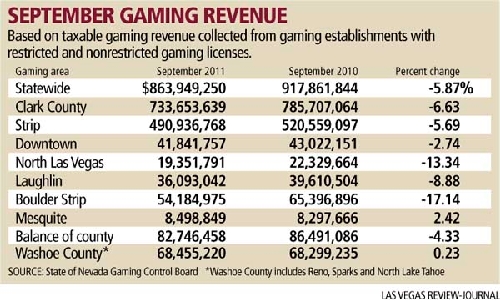

Casinos statewide saw their take from customers decline almost 6 percent to

$863.9 million, the second straight monthly revenue drop. On the Strip, casinos saw gaming revenues fall almost 5.7 percent to $490.9 million in September, which was the market’s second straight monthly tumble.

The statewide and Strip gaming revenue declines in September and August followed three straight months of gaming revenue increases. For the first nine months of the year, gaming revenues are up 1.9 percent statewide and 3.9 percent on the Strip.

However, when the industry lives and dies by relying on baccarat, casino operators often will experience a down month. Removing baccarat from equation, Strip gaming revenues would have been up 4.3 percent during the month.

“It’s a volatile game,” Control Board senior research analyst Michael Lawton said. “Over the past 10 years, baccarat has become a much larger piece of the pie. For all table games, it has gone from 12 percent of the revenues to 30 percent.”

Deutsche Bank gaming analyst Carlo Santarelli said the good news was that other indicators from Strip casinos were healthy.

“While the headline number doesn’t reflect the stabilization theme on the Strip, slot and table revenue, excluding baccarat, were up,” Santarelli told investors. “Even more encouraging, in our view, Strip slot and table volumes, excluding baccarat, were up.”

Wells Fargo gaming analyst Dennis Farrell Jr. saw similar trends. He told investors to expect modest revenue improvement from large gaming operators, such as Caesars Entertainment, Las Vegas Sands Corp., MGM Resorts International and Wynn Resorts Ltd., as demand for visiting Las Vegas rebounds over the next year.

“Despite weaker year-over-year results in September, we believe ongoing improvements in slot revenue, generally positive table revenue trends and encouraging management commentary regarding trends in October provide further evidence that the Las Vegas market is in a gradual recovery,” Farrell said in a research note.

On the Strip, revenues from baccarat declined 36.4 percent to $81.3 million; wagering on the game was down 34.8 percent from a year ago, to $643.4 million. Still, the figures were the third-largest September on record for baccarat, Lawton said.

“The game is really driven by events,” Lawton said.

However, Lawton said the amount Strip gamblers wagered on slot machines rose 5.8 percent in September, the sixth time in the last seven months the figure had increased.

Stifel Nicolaus Capital Markets gaming analyst Steven Wieczynski told investors to pay attention to the slot machine results as an indication of a broad-based stabilization in gaming trends.

“While the early innings of the Las Vegas recovery story were largely supported by strength in high-end international baccarat play, continued improvements in slot handle and nonbaccarat win are particularly encouraging,” Wieczynski said.

Revenues fell more than 6.6 percent throughout Clark County, with declines of 17 percent at casinos along the Boulder Strip and 13 percent in North Las Vegas.

The September figures were mixed throughout the state.

Gaming revenues at casinos in Reno increased 2.6 percent, while revenue at Lake Tahoe-area casinos fell by double-digit percentages.

The gaming taxes collected by Nevada in October, based on September’s gaming revenues, declined almost 9 percent, to $51.4 million. For the first four months of the fiscal year, gaming tax collections are down 5.5 percent.

Contact reporter Howard Stutz at hstutz@reviewjournal.com or 702-477-3871.

Follow @howardstutz on Twitter.