MGM selling 2 Strip properties in $4B leaseback deal

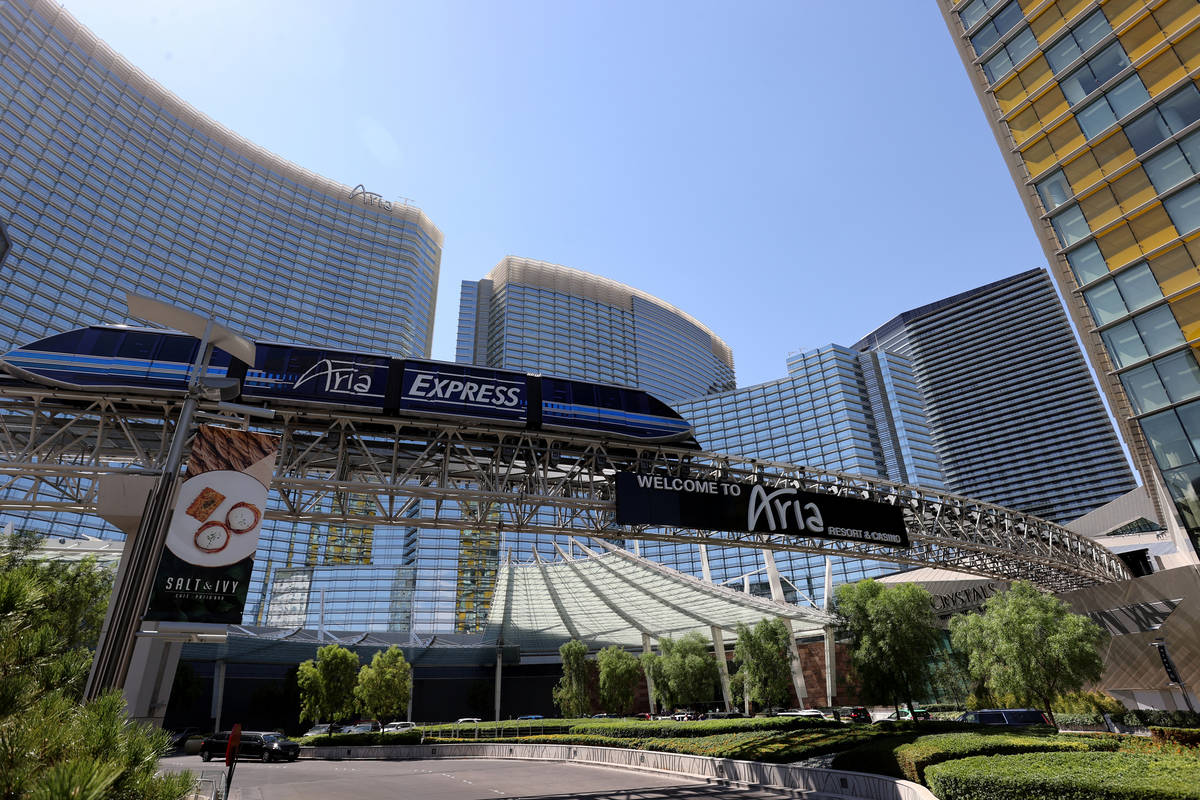

MGM Resorts International has reached another multibillion-dollar sale-leaseback deal with New York financial giant The Blackstone Group, this time for the Aria and Vdara resorts.

MGM announced Thursday that it is buying out its partner in the sprawling CityCenter complex for more than $2.1 billion, giving MGM full ownership of Aria and Vdara, and that it agreed to sell the two hotels’ real estate to Blackstone and lease it back.

Blackstone is buying the towering properties for $3.89 billion in cash and leasing them back to the casino operator for an initial annual rent of $215 million, the news release said.

The deals are expected to close this quarter.

Blackstone, which has been acquiring real estate across Southern Nevada for years, will be the landlord for several MGM-operated properties in Las Vegas when the deal closes. The latest sale, however, comes as Southern Nevada’s tourism industry starts to regain its footing after getting crushed by the coronavirus outbreak.

It also gives a boost to the Strip’s real estate market, which has seen mixed results since the pandemic hit, and gives MGM a huge infusion of cash.

‘New growth opportunities’

MGM is buying government-owned holding company Dubai World’s 50 percent stake in their remaining holdings in CityCenter, a 67-acre, $8.5 billion complex that features multiple properties and owners.

Bill Hornbuckle, president and CEO of MGM Resorts, said in a news release Thursday that CityCenter “has consistently elevated the Las Vegas experience over the years” and that the transaction with Blackstone “demonstrates the unprecedented premium value of our real estate assets.”

MGM expects to use proceeds from its real estate deals “to enhance our financial flexibility and secure new growth opportunities,” he added.

The company later said that those funds could go toward online gaming and mobile betting expansion and other company properties.

Once the sale-leaseback deals for Vdara and Aria, as well as the previously announced deal for MGM Springfield in Massachusetts, are complete, MGM will strictly operate, but not own, all of its U.S. properties.

It said operations shouldn’t change at either Aria or Vdara as a result of the latest deal.

Analysts weigh in

It was a matter of when, not whether, MGM would make a move like this, according to Barry Jonas, a gaming analyst with Truist Securities.

“MGM has made it clear for some time now that they saw themselves as the natural full owner of CityCenter,” Jonas told the Review-Journal on Thursday.

The sale-leaseback deals should bring in enough money to pay down existing debts and fund the purchase of the other 50 percent of CityCenter ownership, Jonas said.

J.P. Morgan analyst Joseph Greff said in a Thursday note that the news implies that there continue to be buyers for properties on the Strip, and that bodes well for other casino operators such as Caesars Entertainment Inc.

Still, the deal came as a surprise to Rich Hightower, an analyst with Evercore ISI.

Hightower said the timing was strange, as his understanding was MGM is in “pretty good shape, balance-sheet wise” and didn’t need an immediate cash influx.

The first deal, the CityCenter buyout, largely hinged on Dubai World’s willingness or interest in selling its ownership stake to MGM, he said. Perhaps the sale-leaseback was a deal of opportunity for either MGM or Blackstone.

But who was — and who wasn’t — part of the second part of the deal surprised Hightower.

“Anybody who follows (MGM Growth Properties) was a little bit disappointed that they were not able to play a role here,” he said of MGM’s real estate spinoff.

Blackstone

Las Vegas’ casino real estate market has seen plenty of action over the past several years, and in many cases, Blackstone has been in the middle of it.

The firm, led by billionaire Stephen Schwarzman, acquired The Cosmopolitan of Las Vegas in 2014 for $1.73 billion. It also bought the Bellagio’s real estate in 2019 for about $4.2 billion and leased it back to MGM Resorts, and partnered on a $4.6 billion deal in early 2020 — shortly before the pandemic hit — to acquire MGM Grand and Mandalay Bay’s real estate and lease the properties back to MGM Resorts.

Tyler Henritze, head of real estate acquisitions in the Americas for Blackstone, said in a statement to the Review-Journal that Las Vegas is one of Blackstone’s “highest conviction markets, and this transaction reinforces our confidence in the city and a robust recovery.”

“CityCenter is a complementary addition to Blackstone’s portfolio of high-quality assets on the Strip and we look forward to continuing our partnership with MGM Resorts,” he said.

Henritze also said such deals are attractive for several reasons, including “long-term leases with stable cash flows and no capital expenditure obligations, and in this case, a full corporate guaranty of rent payments from a best-in-class operator.”

Contact Eli Segall at esegall@reviewjournal.com or 702-383-0342. Follow @eli_segall on Twitter. Contact Mike Shoro at mshoro@reviewjournal.com or 702-387-5290. Follow @mike_shoro on Twitter.