Las Vegas Sands to return $47.4 million, avoid criminal charges

Las Vegas Sands Corp. has reached a deal with federal prosecutors to pay more than $47.4 million to the U.S. government in order to avoid criminal charges over alleged money laundering activities.

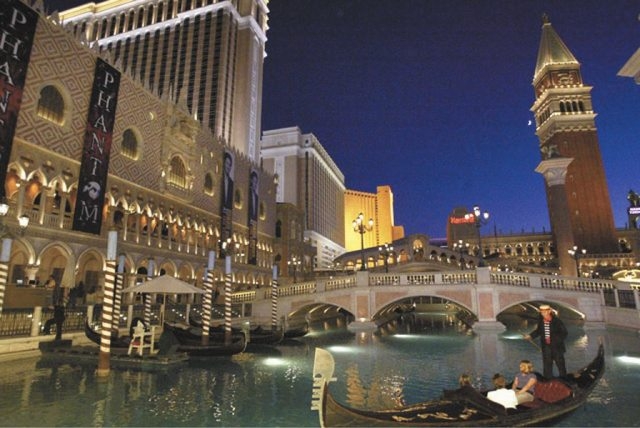

In an agreement signed Monday night with the U.S. Department of Justice, Las Vegas Sands accepted an assertion by prosecutors that the casino operator failed to alert authorities when a high-stakes gambler, who was later linked to international drug trafficking, made numerous large and suspicious deposits at The Venetian in 2006 and 2007.

The U.S. Attorney’s Office in Los Angeles said it agreed to end a two-year criminal investigation and will not seek an indictment against the company, which is controlled by billionaire Sheldon Adelson and operates two casinos on the Strip and resorts in Macau, Singapore and Pennsylvania.

Las Vegas Sands spokesman Ron Reese said the company “fully cooperated” with federal prosecutors “and that effort was recognized by the government.”

Gaming Control Board Chairman A.G. Burnett said Tuesday that state agents will analyze the terms of the settlement to see if Nevada gaming regulators will file any charges against Las Vegas Sands.

“Now that the agreement has been finalized, it will be determined if there were any violations of the state’s Foreign Gaming Act,” Burnett said.

In a research note late Tuesday Credit-Suisse gaming analyst Joel Simkins said the $47.4 million payment to the government is less than many observers expected.

“We believe this ruling removes a key overhang to the longer-term Las Vegas Sands story,” Simkins said. “And, we believe it will come as a relief to many investors who may have anticipated a more substantial punishment.”

The money-laundering probe was not part of a ongoing Justice Department and Securities and Exchange Commission investigations of Las Vegas Sands over potential violations of the Foreign Corrupt Practices Act.

Those charges were raised in a wrongful termination lawsuit filed by the former CEO of the company’s Macau casino operations. The case is pending trial in Clark County District Court.

The money laundering charges stemmed from gambling activity by businessman Zhenli Ye Gon, a dual citizen of China and Mexico who transferred more than $45 million to the Venetian in 2006 and 2007.

Ye Gon now faces drug-trafficking charges in Mexico.

Investigators said Las Vegas Sands did not comply with a federal law requiring that casinos report suspicious financial transactions involving customers.

“For the first time, a casino has faced the very real possibility of a federal criminal case for failing to properly report suspicious funds received from a gambler,” U.S. Attorney André Birotte Jr., who represents the Central District of California, said in a statement.

“This is also the first time a casino has agreed to return those funds to the government,” Birotte said. “All companies, especially casinos, are now on notice that America’s anti-money laundering laws apply to all people and every corporation, even if that company risks losing its most profitable customer.”

Birotte said Las Vegas Sands has since implemented a “robust compliance program” that should prevent future instances of unreported suspicious activity.

The agreement was signed by Las Vegas Sands President Michael Leven and General Counsel Ira Raphaelson. The company has 10 days to pay the $47.4 million.

In a statement of facts filed by the U.S. Attorney, prosecutors acknowledged at least one Las Vegas Sands officer warned Venetian personnel about Ye Gon’s activities, although the company was not aware of his alleged criminal activities prior to March 2007.

Ye Gon lost more than $90.1 million gambling at the Venetian. Of that total, $36.5 million was a loss of credit advanced by the casino and written off as bad debt.

The gambler wire transferred money to Las Vegas Sands Corp. and subsidiary companies “from two different banks and seven different Mexican money exchange houses.”

In a statement, Anthony Williams, the Special Agent in Charge of the Drug Enforcement Administration in Los Angeles, said “millions of dollars earned from illegal drug trafficking were transferred through casino accounts in a complex scheme designed to thwart law enforcement detection.”

According a statement from the U.S. Attorney, Las Vegas Sands admitted “in hindsight that it failed to fully appreciate the suspicious nature of the information or lack thereof pertaining to Ye Gon.”

Contact reporter Howard Stutz at hstutz@reviewjournal.com or 702-477-3871. Follow @howardstutz on Twitter.