John Beckmann has been a Las Vegas casino host for 20 years, luring gamblers with free airfare, show tickets and the like.

And whenever a national crisis pummeled the local economy, he lost big with countless others across the valley.

Beckmann was laid off from Treasure Island days after the Sept. 11, 2001, terrorist attacks. Nearly a decade later, he and his wife lost a fortune on their house after the real estate bubble burst. And now he’s out of a job at Texas Station after the coronavirus pandemic shut off tourism.

His wife is still working, but amid enormous job losses in Las Vegas, he isn’t hunting for work.

“There’s really nothing out there,” Beckmann said.

Local officials have tried for decades to boost employment outside casinos, Las Vegas’ main source of jobs. But such efforts have faced plenty of hurdles, all while the massive tourism industry has kept expanding with more resorts and attractions, drawing ever more visitors and overshadowing gains in other sectors.

This heavy reliance on one industry to fuel the economy has left Southern Nevada prone to extreme booms and busts.

When people have money to burn, Las Vegas heats up. But as seen twice now in the past decade or so, when the national economy gets hit hard, Southern Nevada ends up on life support.

“When things are good, they’re really good; when things are bad, they’re really bad,” said Bob Potts, deputy director of the Governor’s Office of Economic Development.

Early this year before the pandemic hit, around 28 percent of the Las Vegas area’s labor market worked in leisure and hospitality, by far the biggest source of jobs, compared with 11 percent nationally in the industry, according to state and federal data.

Somer Hollingsworth, former longtime head of the Nevada Development Authority, a since-renamed business booster, said Las Vegas is a “one-trick pony” and has long derived its growth from tourism.

“We’re still probably the most undiversified economy in America today,” he said.

Skyrocketing unemployment

Las Vegas started the year on strong footing. But the pandemic shut off much of the economy virtually overnight, turning the Strip into a ghost town and sparking catastrophic job losses.

The valley’s unemployment rate, just 3.9 percent in February, shot up to 34 percent in April after Gov. Steve Sisolak ordered casinos and other Nevada businesses closed to help contain the virus’ spread.

Resorts and other businesses have since reopened, but unemployment remains high in the valley, at 13.8 percent as of October, state officials recently reported.

Sisolak announced new restrictions for casinos and other businesses Nov. 22 to help curb the rapidly worsening coronavirus outbreak, forcing them to further slash customer capacity, from 50 percent to 25 percent, for three weeks. But he did not order them into lockdown again, saying he’s prioritizing Nevadans’ health and safety while “balancing the significant ramifications” that tighter rules will have “on our suffering economy.”

“No state struggles with this more than Nevada due to the lack of diversity in our economy,” he said at a news conference.

Overall, the coronavirus outbreak has kept people home and away from crowds for fear of getting infected, devastating the U.S. tourism industry and threatening the foundation of Las Vegas’ economy: a place people visit from around the country and world, often by airplane, to stay in huge hotels and eat, drink, gamble, party and network, all in close quarters with masses of others, and often indoors.

“We’re the world’s leading center of face-to-face exchanges when you’re not allowed to do anything face to face,” UNLV public policy professor Robert Lang said.

‘Bad publicity’

In 1931, with the U.S. mired in the Great Depression, Nevada lawmakers legalized commercial gambling amid hopes it would spark more business. As a local newspaper declared at the time, “the sky is the limit, and investors can feel safe to place their money here in high class gambling casinos.”

The industry grew, with developers putting up a string of hotels in Las Vegas’ new tourist corridor, the Strip, in the 1940s and ’50s. Amid the building boom, a business group set out to lure other kinds of employers.

The Flamingo hotel-casino is seen in this undated file photo. (Courtesy Nevada State Museum)

The Flamingo hotel-casino is seen in this undated file photo. (Courtesy Nevada State Museum) The Sahara hotel-casino in Las Vegas is seen in this 1950s-era photo. (Las Vegas Review-Journal file)

The Sahara hotel-casino in Las Vegas is seen in this 1950s-era photo. (Las Vegas Review-Journal file) Members of the legendary "Rat Pack," from left, Frank Sinatra, Dean Martin, Sammy Davis Jr., Peter Lawford, Joey Bishop pose in front of the marquee for the Sands hotel-casino in Las Vegas in this vintage publicity photo. (Las Vegas Review-Journal file)

Members of the legendary "Rat Pack," from left, Frank Sinatra, Dean Martin, Sammy Davis Jr., Peter Lawford, Joey Bishop pose in front of the marquee for the Sands hotel-casino in Las Vegas in this vintage publicity photo. (Las Vegas Review-Journal file) The Las Vegas Strip is seen in this undated file photo. (Las Vegas Review-Journal file)

The Las Vegas Strip is seen in this undated file photo. (Las Vegas Review-Journal file) A new high-rise portion of the Desert Inn is going up in 1963. (Las Vegas News Bureau)

A new high-rise portion of the Desert Inn is going up in 1963. (Las Vegas News Bureau) Within 30 minutes of its opening on Nov. 22, 1989, an estimated 40,000 visitors entered The Mirage, seen here. (Las Vegas Review-Journal file)

Within 30 minutes of its opening on Nov. 22, 1989, an estimated 40,000 visitors entered The Mirage, seen here. (Las Vegas Review-Journal file)The Southern Nevada Industrial Foundation was formed in 1956 to promote industry growth and potentially “provide a stabilizing influence to our well established and highly profitable tourist economy,” a news report said at the time.

The businessmen behind the group wanted the state to buy roughly 126,800 acres of federal land south of the city, where they hoped companies would build industrial plants. They sought a 20-mile buffer so that “factory smog won’t hurt the tourist trade and workers will be less tempted to gamble,” a report said.

The vision never materialized.

Economic development efforts likely weren’t helped by mobsters’ control of Las Vegas casinos. Famously written about in the 1963 best-selling book “The Green Felt Jungle,” Mafia casino ownership tainted Las Vegas’ image. As a Review-Journal editorial put it in 1964, “bad publicity” affected Nevadans’ ability to lure new industry and recruit top professionals.

Still, more casinos kept opening, and not everyone thought Las Vegas even needed other kinds of jobs.

A study commissioned by local businessmen concluded in 1970 that Las Vegas neither needs “nor should ever expect to attract any sizeable non-gambling industries,” a news report said.

Southern Nevada’s population was growing “at an unprecedented rate,” and the region had actually been “more stable” than the U.S. at large during periods of economic stress, the report found.

‘Vulnerable’ economy

Las Vegas, however, was soon in a tight spot. In 1976, New Jersey voted to legalize casino gambling in Atlantic City, and the national economy stumbled through a double-dip recession in the early 1980s.

Nevada was hit hard by the downturns as job losses mounted, federal data shows. To boost business, state lawmakers turned to a source of commerce far from casino floors.

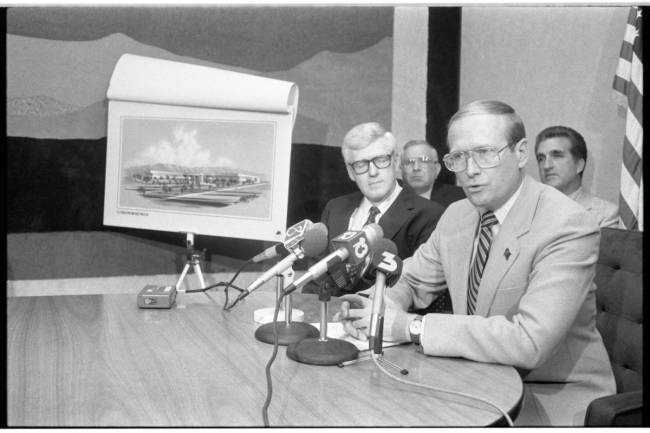

In 1984, then-Gov. Richard Bryan called a special session of the Legislature to change state banking laws, allowing financial giant Citicorp to open a credit card processing facility in Las Vegas.

The newly built complex was expected to employ at least 1,000 people and establish Nevada “as an attractive site for other national firms,” Bryan said at the time.

Local executives were itching to make it happen. Citicorp’s arrival would “represent the single greatest step” Nevada could take to change the state from being “a vulnerable one industry economy,” the North Las Vegas Chamber of Commerce president wrote in support of the effort.

“(S)uch opportunities for diversification do not appear too often,” the top boss at Nevada Power Co. wrote in support of the move.

Bryan recently told the Review-Journal that Citicorp’s arrival was a “seminal event.” The local economy was even less diversified than it is now, and it was tough to recruit non-casino-related companies, he said.

Las Vegas was seen as a place to have fun, if not as Sodom and Gomorrah, and the Mafia image “didn’t help,” Bryan noted.

The credit card facility, on Sahara Avenue near Durango Drive, opened in 1985. It closed around 2014 after Citigroup, as the company is now known, switched operations there to mortgage processing and as rising interest rates slashed expected demand for loans, news reports said.

Boom and bust

Not long after Citicorp’s arrival, Las Vegas embarked on a roaring growth spurt — but as with past expansions, it was in tourism.

In 1989, casino developer Steve Wynn opened the Mirage, the Strip’s first modern megaresort. He immediately drew huge crowds to the property known for its volcano out front and lengthy run of Siegfried & Roy performances.

The project sparked what’s now a three-decade-long trend in Las Vegas of building big, glitzy resorts with heavy amenities. Along the way, plenty of older properties were imploded to clear space for new ones.

When 9/11 happened, Las Vegas’ tourism and convention industries were initially hit hard. But the economy rebounded and, soon enough, entered a wild new phase.

Thanks to a flood of easy money, Southern Nevada’s real estate market went into hyperdrive in the mid-2000s. Property values soared, developers flooded the valley with housing tracts and other projects, home-flipping was an easy moneymaker, and investors drew up plans for numerous high-rises.

Las Vegas was flying high. But when the real estate bubble burst and the U.S. fell into the worst recession in decades, Southern Nevada was ground zero for the wreckage.

The region was devastated by plunging home values, sweeping foreclosures and huge job losses. Las Vegas was littered with abandoned, unfinished construction projects, and vacant houses were left all over the valley, enabling a widespread squatter problem.

Momentum stopped

Southern Nevada spent years crawling back from the depths of the Great Recession and was riding a wave into 2020, with billions of dollars of real estate projects underway. Then the pandemic turned life upside down.

Las Vegas rapidly shut down in March over fears of the virus as the Strip became a surreal site of barricaded resort entrances. Tourists vanished, conventions and other big-ticket events were canceled, and the Raiders, fresh off their move from Oakland, California, opted to play their first season in Las Vegas without any fans in their newly built $2 billion home, the 65,000-seat Allegiant Stadium.

Today, tourists are driving and flying to Las Vegas again, but the economy is in rough shape. Visitor totals and gambling revenue remain far below year-ago levels, some resorts are still closed despite being allowed to reopen in June, and the outbreak is still raging.

Don Smale of Boulder City, who lost his construction industry job in 2009 after the economy tanked, said Southern Nevada is a “fun place to live” when everything is booming.

But, he noted, it’s prone to devastating wipeouts.

“If you like surfing big waves, it’s a great place to be,” he said. “If you don’t like getting your surfboard broken every few years, you probably need to go somewhere else.”

Contact Eli Segall at esegall@reviewjournal.com or 702-383-0342. Follow @eli_segall on Twitter.

The business of bombs

Nevada has long been known for having industries that other states have shunned in the past or still do, from gambling to prostitution.

Decades ago, the Las Vegas area also was home to another unique line of work: blowing up nuclear bombs.

Starting during the Cold War, federal officials detonated 100 above-ground nuclear weapons some 65 miles northwest of Las Vegas at the Nevada Test Site from 1951 to 1962. After such tests were banned, 828 underground detonations were conducted through 1992, according to the Nevada National Security Site, as the desert outpost is now known.

The mushroom clouds were a spectacle. According to PBS, Las Vegas' chamber of commerce issued calendars with scheduled detonation times and choice viewing spots, and tourists had bomb-watching picnics.

The test site also provided a big source of of non-casino employment.

During the 1960s, for instance, its peak employment total surpassed 12,000, and in the 1990s it reached nearly 10,500, according to Melissa Biernacinski, spokeswoman for the site's operations management group.

Over the years, test site workers included engineers, heavy-equipment operators, welders, and cooks, said Michael Hall, executive director of the National Atomic Testing Museum in Las Vegas. Physicists who worked on the tests mainly lived in New Mexico and California and would fly in, he added.

This year, employment at the security site - which is contractor-operated and conducts experiments to support the national nuclear weapons stockpile - peaked at 3,239, Biernacinski said.