Gaming stocks fare poorly in July; Shuffle Master an exception

Unless you own shares of Shuffle Master, July wasn’t a great month to be a gaming industry investor.

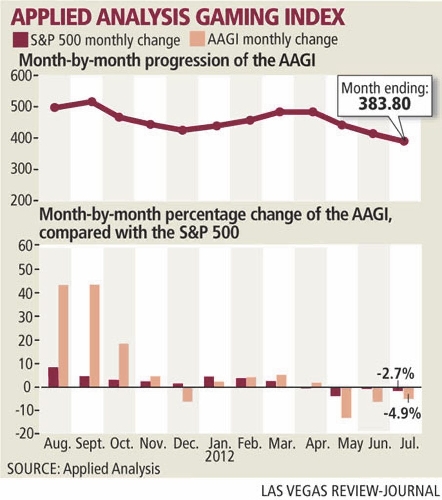

Lackluster second quarter earnings reports and continued economic concerns have spooked the gaming sector. Average daily share prices of publicly traded casino operators and game equipment providers tumbled from June.

Only Shuffle Master, which provides casinos table games, such as Three Card Poker and Ultimate Texas Hold’em, and table game management products, had any marked increase.

Shares of Shuffle Master traded 9 percent higher on a daily basis compared with June. Last week, the company received Nevada’s third interactive gaming license as a technology provider.

Las Vegas-based financial consultant Applied Analysis, which charts stock performances for its monthly Gaming Index, found that all eight casino operators posted month-to-month declines in their valuation, led by a nearly 21 percent decline in shares of Caesars Entertainment Corp.

"Volatility in the high-end gaming market in Las Vegas also produced somewhat unexpected results, which has put a spotlight on the sector," Applied Analysis principal Brian Gordon said in a report to the firm’s clients.

Las Vegas Sands Corp. saw its shares decline almost 10.5 percent on an average daily basis. The company said that its profits and earnings per share in the second quarter fell by more than one-third compared to the same quarter in 2011. The company has significant holdings in Macau and Singapore.

"An economic slowdown in key Asian markets remains concerning for investors in both casino and equipment manufacturing companies," Gordon said.

The news wasn’t good for casino operators in U.S. regional markets.

Shares of Boyd Gaming Corp., Penn National, Pinnacle Entertainment and Ameristar Casinos all fell in average daily share price.

Macquarie Securities gaming analyst Chad Beynon said casino competition from new and emerging markets, such as Ohio and Maryland, is beginning to hurt casinos in older markets.

"Concern around regional gaming companies continues to grow as same-store regional revenues have reversed the positive trends that we saw in the early part of the year," Beynon told investors. "We continue to recommend that investors focus on regional companies that operate in healthier underlying markets and have less exposure to increased competition."

Shuffle Master was the only company with a significant average daily stock price increase.

Shares of slot machine giant International Game Technology were up less than 1 percent, the only other increase during the month.

The declining stock prices sent the Gaming Index down almost 20 points in the month to 383.80, the first time in two years the figure, which takes into account 300 different market variables, fell below the 400-point level.

Contact reporter Howard Stutz at hstutz@reviewjournal.com or 702-477-3871. Follow @howardstutz on Twitter.