Casino company stocks suffer in March

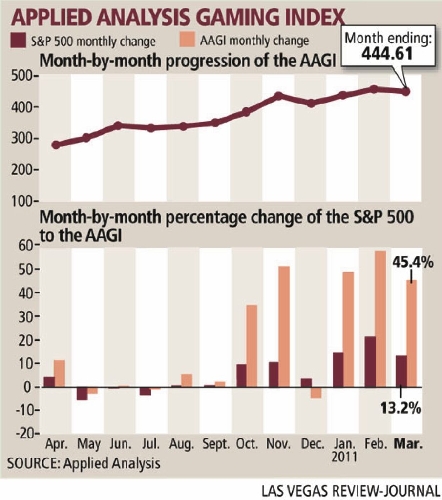

Recessionary fears caused gaming stocks to tumble in March and skittish investors grew concerned that high gasoline costs could keep casino customers from traveling.

Only two gaming companies out of the 10 casino operators and slot machine manufacturers charted by Las Vegas-based financial consultant Applied Analysis saw an increase in their average daily stock prices during the month.

Boyd Gaming Corp., which operates regional casinos in the South and Midwest, along with resorts in Las Vegas and Atlantic City, took the largest tumble in the Gaming Index. The company’s average daily stock price sank more than 16 percent.

Gasoline prices are approaching $4 a gallon in many areas of the country, and three states — Hawaii, Alaska and California — already have them. On Thursday, AAA said in its Daily Fuel Gauge Report that the average price for a gallon of regular self-service unleaded gasoline in Las Vegas was at $3.737, up 1.6 percent from a week ago.

Applied Analysis principal Brian Gordon said the elevated price has a negligible effect on a single budgeted trip from Los Angeles to Las Vegas.

However, Gordon said if oil prices continue to rise six months out, they may contribute to cost increases in airline tickets, which is a greater concern for travel outlook.

“The main area of concern lies with the impact on consumers if prices remain elevated for an extended period of time, reducing household discretionary dollars that could be used for leisure travel purposes,” Gordon said in a report to clients.

The second-largest decline in the Gaming Index was experienced by Las Vegas Sands Corp., which saw its average daily stock price fall more than 13 percent in March.

An investigation of the company by the Securities and Exchange Commission and U.S. Department of Justice were sparked by allegations raised in a wrongful termination lawsuit filed by the former head of Las Vegas Sands’ Macau operations.

Macquarie Securities gaming analyst Chad Beynon said in a research note Thursday that Las Vegas Sands needs to settle the lawsuit and deal with the government investigations.

“We believe uncertainty surrounding these investigations could remain an overhang on the stock,” Beynon said. “Our view remains that the market is overreacting to these investigations. Most investors we have spoken to have viewed the recent pullback in the stock as a buying opportunity.”

Shares of regional casino operator Pinnacle Entertainment were down 11 percent in March. The company announced a marketing alliance with Wynn Resorts Ltd.

Gordon said he expects to see similar deals in the gaming industry.

“With capital investments in new resorts likely to remain limited, particularly in the Las Vegas market, many gaming operators and hoteliers are seeking to leverage their existing assets and brands, rather than their balance sheets,” Gordon said.

Contact reporter Howard Stutz at hstutz@reviewjournal.com or 702-477-3871.

Chinese authorities probe Las Vegas sands subsidiaryA publicly traded subsidiary of Las Vegas Sands Corp. told the Hong Kong Stock Exchange on Thursday it was being investigated by Chinese authorities for alleged breaches of regulations.

Sands China Ltd., which covers the company’s holdings in Macau, said in a statement to the stock exchange that the company was asked by the Hong Kong Securities and Futures Commission to produce “certain documents.”

Analysts told news services in Hong Kong the investigation concerns allegations that were raised in a wrongful termination lawsuit filed in Clark County District Court by Steven Jacobs, who spent more than a year as the CEO of Sands China.

In court filings, Jacobs accused Sands China and Las Vegas Sands of using improper leverage against Macau government officials.

The allegations have led to investigations by the Gaming Control Board, the Securities and Exchange Commission, the Department of Justice and the FBI into possible violations of the U.S. Foreign Corrupt Practices Act.

Las Vegas Sands Chairman Sheldon Adelson has said the ex-employee’s lawsuit was “pure threatening, blackmailing and extortion. That is what it is all about.”

At an investment forum, Adelson said the Jacobs’ lawsuit “was not a serious case.” He said the company was cooperating with authorities.

HOWARD STUTZ/LAS VEGAS REVIEW-JOURNAL