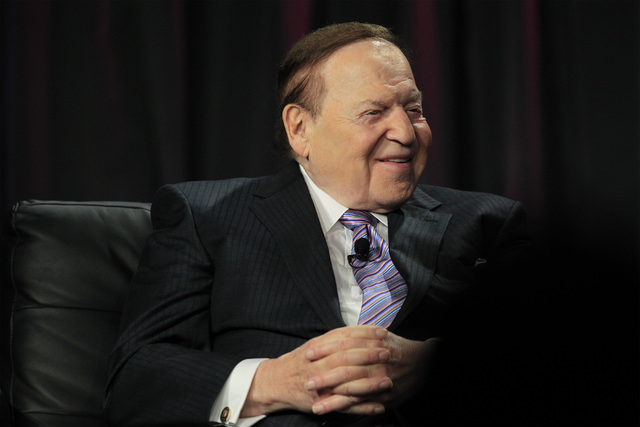

Adelson adds CEO of Sands China to his job description

Las Vegas Sands Corp. Chairman Sheldon Adelson will take over as CEO of the company’s Macau subsidiary following the retirement of the division’s chairman.

The move comes as Macau — which provides more than 65 percent of Las Vegas Sands’ overall revenue — is amid its worst gaming slump on record.

A statement Friday from the company’s Sands China Ltd. said Adelson, the 81-year-old billionaire and company founder, will replace Edward Tracy, whose retirement was announced in a Securities and Exchange Commission filing this week.

Adelson, who controls 53 percent of Las Vegas Sands through personal and family holdings, is also CEO of the parent company. He will take over the subsidiary March 6.

Las Vegas Sands President Rob Goldstein will become interim president of Sands China.

Goldstein, who has been with Las Vegas Sands since 1995, was named president in December after Michael Leven retired.

According to the SEC filing, Tracy, 62, is expected to remain as a consultant. He had been Sands China CEO for more than three years.

Las Vegas Sands has the largest holdings of the three Nevada-based companies that operate in Macau. Las Vegas Sands holdings in Macau include The Venetian Macau, Sands Macau, Four Seasons Macau and the multihotel Sands Cotai Central complex.

The company is expected to open another hotel on the Sands Cotai site this year and is developing the $2.7 billion Paris-themed Parisian on Cotai that is expected to open in 2016. In December, the company said it received the final government approvals needed to complete the project, which will have 3,000 hotel rooms and a 50 percent scale replica of the Eiffel Tower.

The company said its total investment in Macau is $10 billion, which includes retail, convention and meeting space and hotel rooms.

“Business strategy has always been decided by Mr. Adelson all this while, so in terms of strategy, I wouldn’t expect any change,” Goh Shengyong, a Hong Kong-based gaming analyst at BNP Paribas told Bloomberg News. “It would be more of realigning and getting Macau and Singapore to report directly to Vegas.”

Las Vegas Sands operates the Marina Bay Sands in Singapore, which is not part of the changes in Macau.

Overall, revenue at Macau’s 35 large and small casinos fell 2.6 percent in 2014 to $44.1 billion, the region’s first-ever annual decline.

Macau has had seven straight monthly gaming revenue declines, culminating with December’s 30.4 percent dip, the market’s largest-ever monthly drop.

Macau’s casino industry has suffered since June. A crackdown on corruption by the Chinese government has focused on junket operators who bring high-end baccarat gamblers to the casino’s ultraexclusive private gambling rooms. Several operators have been linked to Chinese organized crime triads.

The crackdown has scared away high-end business, which was largely responsible for Macau’s record $45.2 billion gaming revenue total in 2013.

Las Vegas Sands will announce its fourth-quarter and year-end results next week. Adelson is expected to address Macau on a conference call with analysts.

During a keynote address at the Global Gaming Expo in October, Adelson expressed his belief that Macau will recover.

“Macau is cyclical. It comes and goes,” Adelson said.

Las Vegas Sands shares fell 8 cents, or 0.15 percent, to close at $53.89 on Friday.

Contact reporter Howard Stutz at hstutz@reviewjournal.com or 702-477-3871. Find him on Twitter: @howardstutz