Strip land values push higher after plunging in recession

When casino giant Genting Group bought a mothballed project site on the north Strip a decade ago, it sparked hopes for a sleepy section of Las Vegas Boulevard.

It also marked a steep plunge in property values for the famed casino corridor.

On March 4, 2013, Boyd Gaming Corp. announced that it sold the partially-built Echelon resort property for $350 million in cash to Malaysia-based Genting. The sale amounted to roughly $4 million per acre, and by that measure, it was a bargain compared to what buyers paid years earlier, before the economy crashed, for land on the Strip.

But a lot has changed in the past decade.

Yes, Las Vegas’ economy got derailed by the pandemic. But in the years since Genting bought the plot for what’s now Resorts World Las Vegas, land values on the Strip have pushed higher, and the north edge of the corridor has seen more activity.

Rising sales

Michael Parks, hotel-casino specialist with real estate brokerage CBRE Group, who has done numerous deals on and near the Strip, agreed with the notion that Boyd’s sale marked a bottoming out for land values following the frenzied mid-2000s bubble.

The peak, he noted, was casino owner Phil Ruffin’s sale of the New Frontier in 2007 for $1.2 billion, or more than $30 million an acre, to Israeli investors. The buyers imploded the hotel, with plans to develop a megaresort, but the economy soon tanked and they never built it.

Land sales on the Strip were largely slow-going for years after Genting’s purchase but have since gained momentum.

Among last year’s deals, real estate firm The Siegel Group acquired roughly 10 acres on and near the north Strip for $75 million, and a North Dakota tribal nation purchased most of the 15-acre former Route 91 Harvest festival site, on the south Strip, for more than $90 million.

These and other sales, however, were surpassed by two blockbusters in the pedestrian-choked center Strip area.

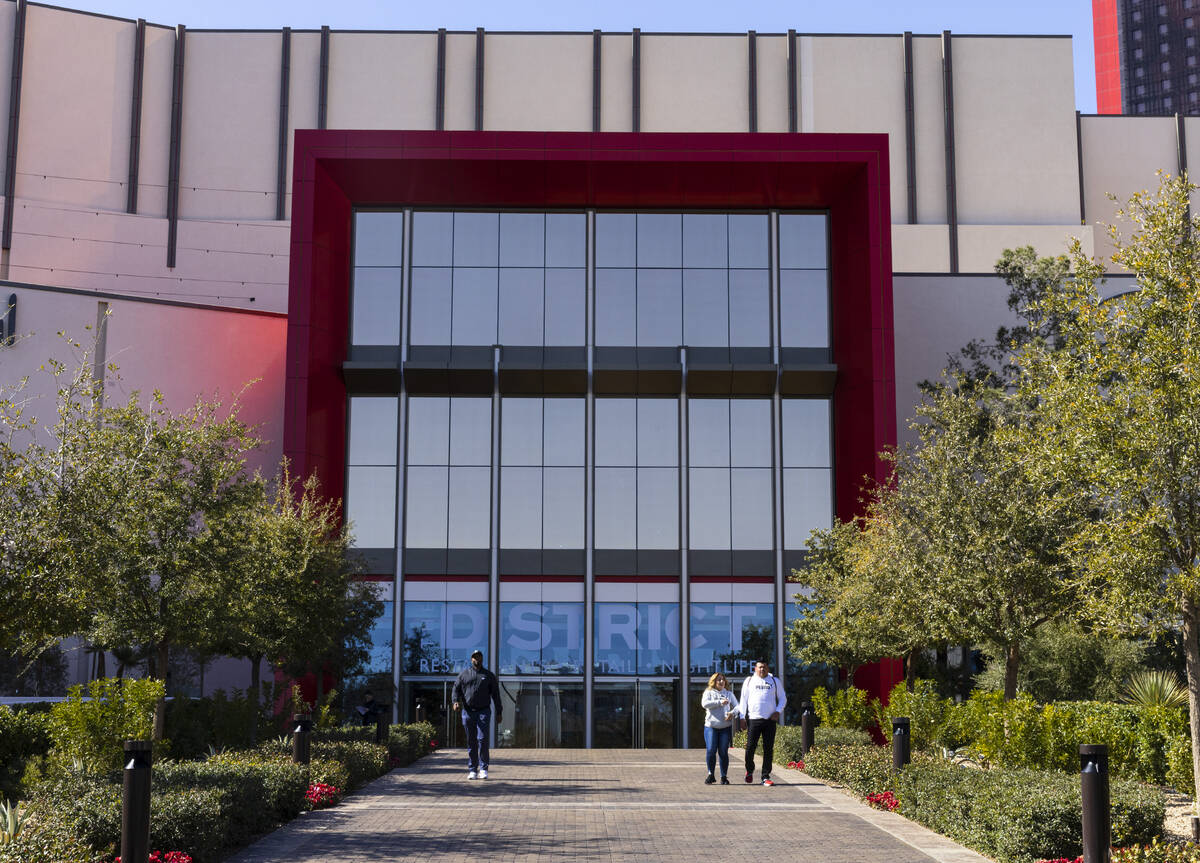

Developer Brett Torino and New York’s Flag Luxury Group acquired 2 acres on the Strip in 2021 for around $80 million, or $40 million an acre, and have since built a retail complex. And last year, Houston billionaire Tilman Fertitta purchased roughly 6 acres of real estate for $270 million, or more than $43 million per acre.

He has already torn down buildings there, with plans to develop a 43-story casino-resort.

Quiet stretch of Strip

A decade ago, after Las Vegas’ once-supercharged real estate market imploded and the broader economy crashed, the north Strip wasn’t the most inviting place.

Besides the skeleton of Echelon — Boyd had stopped construction years earlier — the area included the stalled, unfinished Fontainebleau skyscraper, big land tracts where massive projects never materialized and minimal foot traffic.

It was “just a glaring example of how hard the Strip, and Las Vegas, was hit as a result of the recession,” Parks said.

The north Strip still isn’t bustling with foot traffic, and there are still big parcels of land with an uncertain future. But the area has gained momentum.

The 67-story Fontainebleau, reacquired two years ago by original developer Jeffrey Soffer, is under construction and scheduled to open in the fourth quarter this year.

Resorts World debuted in June 2021 to a crowd of at least 20,000 people on its opening night, and the Las Vegas Convention Center’s new $1 billion West Hall opened the same month.

The Las Vegas Convention and Visitors Authority’s $120 million sale of a 10-acre plot on the north Strip, approved in 2021, fell through this past December. But the tourism agency is slated this month to again consider selling the parcel, spokeswoman Lori Nelson-Kraft told me, without naming the buyer.

This being Las Vegas, you never know if a project plan will stall or fizzle, if something big and flashy will get built, if a property will get flipped to a new owner, or if a landowner will go years without striking a deal to sell.

But if a plot of land on the Strip does change hands, don’t be surprised if it trades for heavy bags of cash.

Contact Eli Segall at esegall@reviewjournal.com or 702-383-0342. Follow @eli_segall on Twitter.