$25M mansion, blockbuster Strip sales among top real estate deals of 2021

Like countless other cities, Las Vegas spent the past year grappling with the pandemic and recovering from the economic disaster it unleashed in 2020.

It also saw a burst of lucrative casino sales on the Strip as tourism rebounded from the public health crisis.

Here is my list of Las Vegas’ top 10 real estate deals of 2021.

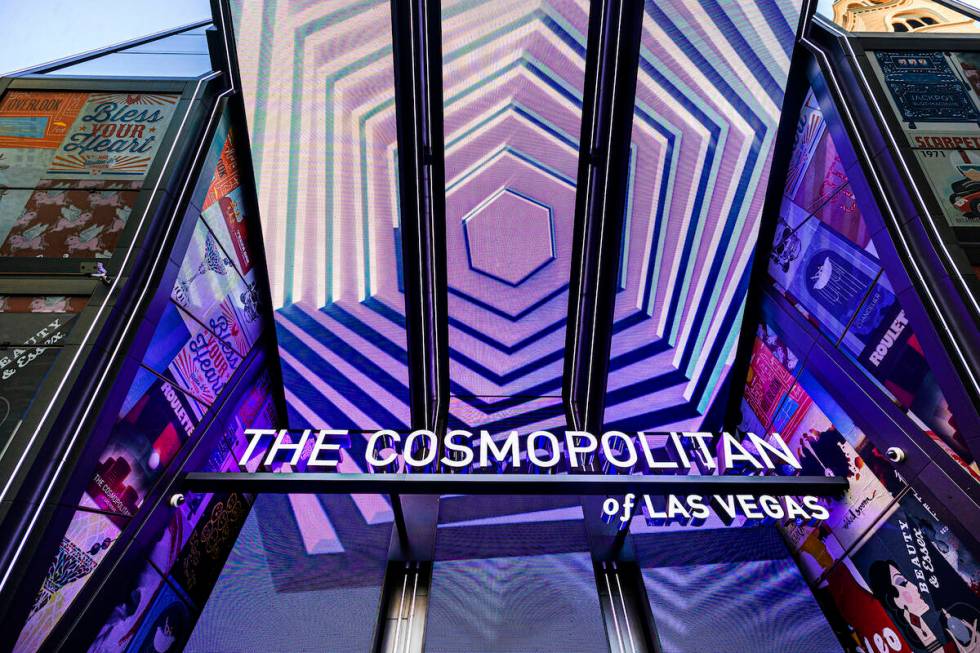

1. The Cosmopolitan of Las Vegas

New York financial conglomerate Blackstone announced in September that it was selling the flashy Cosmopolitan hotel-casino for $5.65 billion, nearly $4 billion above its purchase price in 2014.

As part of the deal, casino giant MGM Resorts International is acquiring the Cosmo’s operations side for more than $1.6 billion.

2. Fontainebleau

The Fontainebleau’s original developer, Jeffrey Soffer, reacquired the still-unfinished project in February.

He teamed with conglomerate Koch Industries to acquire it through a process that lets people avoid foreclosure, and after prior owner Steve Witkoff suspended construction of the north Strip resort amid the early chaos of the pandemic.

Soffer aims to open the 67-story hotel-casino in 2023.

3. $25 million mansion

Billionaire Anthony Hsieh, founder of mortgage firm LoanDepot, bought a newly built mansion in the Henderson foothills in June for $25 million, the most expensive home purchase ever recorded in Southern Nevada.

The three-story, 15,000-square-foot home includes two infinity saltwater pools, a glass wine-storage wall, a sky lounge with panoramic views, a DJ booth and an elevator, listing materials have shown.

Blue Heron founder Tyler Jones, who built and sold the house, confirmed that Hsieh leased it back to Blue Heron, allowing the luxury builder to keep using it as a “show” home.

4. Sands sell-off

Casino operator Las Vegas Sands Corp. announced in March that it was selling The Venetian, Palazzo and the former Sands Expo and Convention Center — now known as The Venetian Expo — for $6.25 billion to investment firm Apollo Global Management and casino landlord Vici Properties.

Sands is exiting the Strip with the deal as it focuses on Asia, but it isn’t leaving Las Vegas entirely.

It bought a new corporate headquarters in the southwest valley in September for $21.55 million.

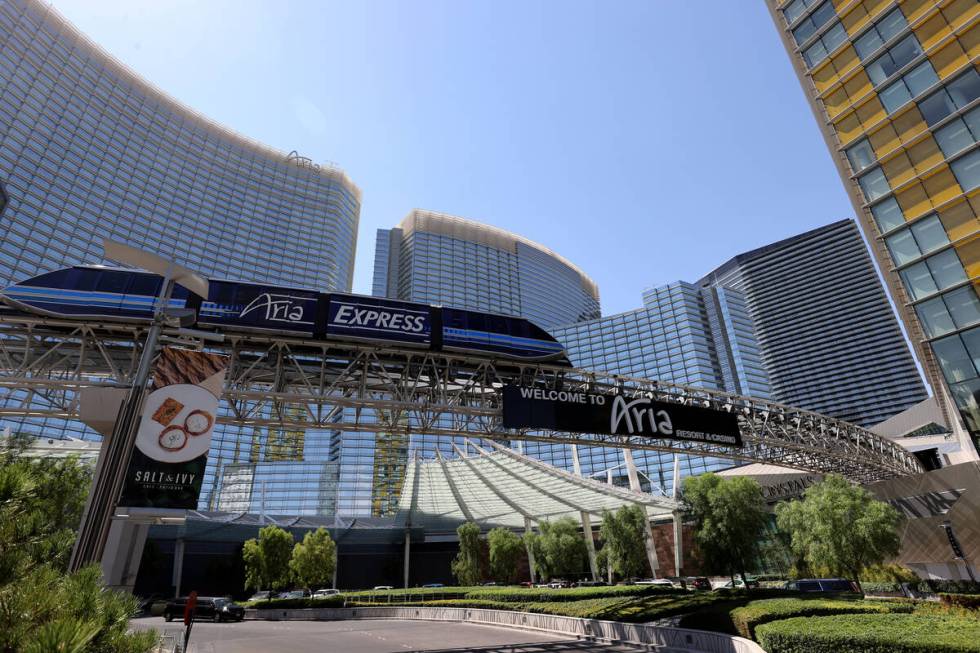

5. CityCenter

MGM Resorts sold the remaining pieces of its CityCenter complex in 2021 for big sums.

It announced in July that it was buying out its partner in CityCenter for more than $2.1 billion, giving MGM full ownership of Aria and Vdara, and that it would sell the two hotels to Blackstone for $3.89 billion and lease them back.

MGM also announced a deal in April to sell 2 acres in CityCenter — the former site of the now-dismantled Harmon hotel — to Las Vegas developer Brett Torino and New York’s Flag Luxury Group for around $80 million.

The buyers are developing a four-story retail project.

6. MGM Growth buyout

Caesars Entertainment spinoff Vici Properties reached a deal to acquire MGM Resorts spinoff MGM Growth Properties in a $17 billion-plus deal, the casino landlords announced in August.

MGM Growth’s real estate holdings include MGM Grand, Mandalay Bay, The Mirage, Park MGM, Luxor, New York-New York and Excalibur.

7. The Mirage

Hard Rock International announced in December that it is buying The Mirage’s operations side from MGM Resorts for more than $1 billion.

Through the deal, it said, it plans to build a guitar-shaped hotel tower on the Strip.

8. The Palms

Station Casinos parent Red Rock Resorts announced in May that it was selling the Palms for $650 million to the San Manuel Band of Mission Indians.

Known over the years as a big party spot, the Palms has been closed since the onset of the pandemic. The new owners plan to reopen the off-Strip hotel-casino in spring 2022.

9. Cal-Nev-Ari

The owners of mining firm Heart of Nature purchased the bulk of Cal-Nev-Ari, a tiny town some 70 miles south of Las Vegas, for $8 million in July, acquiring around 550 acres of mostly vacant real estate from town co-founder Nancy Kidwell.

Heart of Nature, which supplies the agricultural industry and wouldn’t do mining in Cal-Nev-Ari, outlined plans for a new 100,000-square-foot industrial facility, more restaurants, a larger hotel, and homes for staffers who work at the facility.

10. Hockey house

Golden Knights defenseman Alex Pietrangelo sold a Summerlin mansion to teammate Max Pacioretty for $6.4 million in August, less than a year after he bought it for $6 million.

When Pietrangelo acquired it, the 8,321-square-foot home came with a 55-plus-foot-long pool, a putting green, three fire pits, a game room in the basement, and a below-ground garage that could hold around 15 cars.

The Review-Journal is owned by the family of Dr. Miriam Adelson, the majority shareholder of Las Vegas Sands Corp., which operates The Venetian, Palazzo and The Venetian Expo.

Contact Eli Segall at esegall@reviewjournal.com or 702-383-0342. Follow @eli_segall on Twitter.