Neighboring Arizona makes gains on Nevada sports-betting business

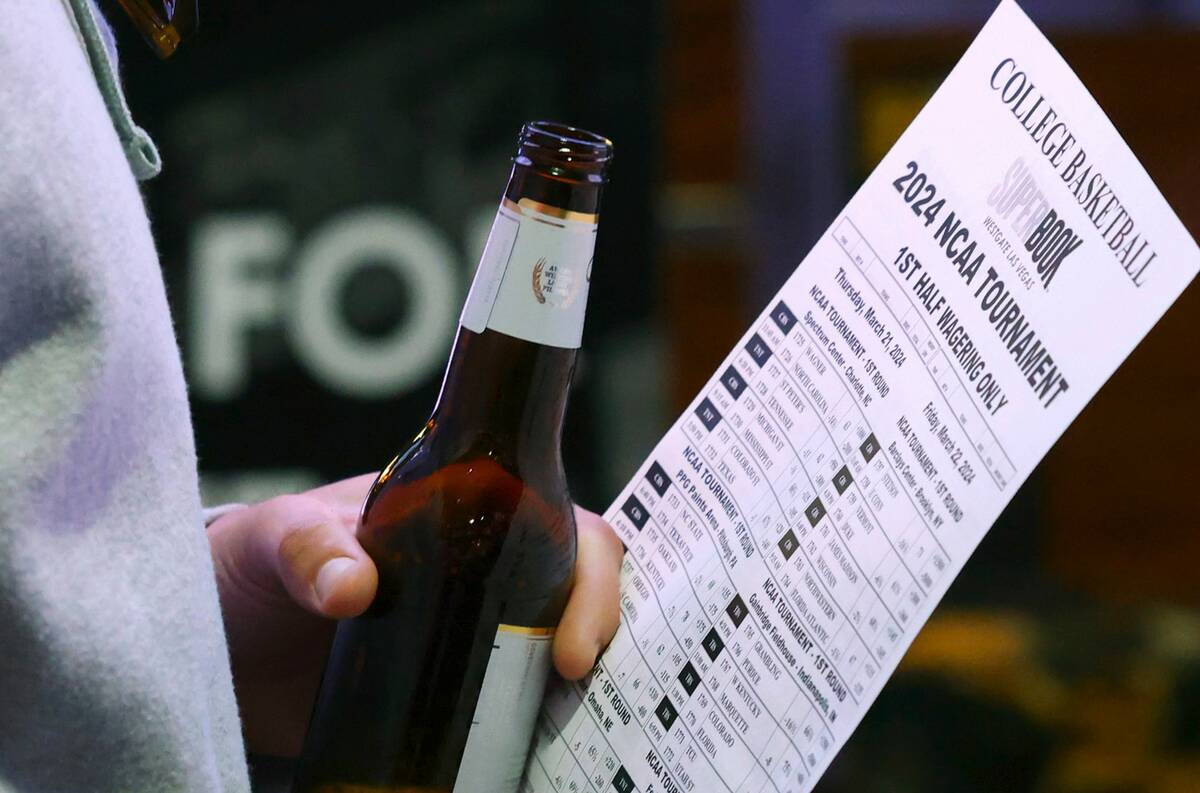

Arizona, Nevada’s closest geographic competitor for legal sports wagering, may be gunning for the Silver State after a record sports handle was recorded there in March.

Buoyed by hosting the NCAA Tournament’s Final Four this year, the Arizona Department of Gaming reported last week that the state’s 16 vendors took $760 million in wagers, an all-time high for the state, which has had legal sports betting only since September 2021. That total was up 17.8 percent from March 2023.

Nevada, which is no slouch for March Madness betting, took $784.4 million in wagers at 180 licensed sportsbooks, down 5.5 percent from a year ago.

Another key difference between Nevada and Arizona is that around two-thirds of sports bets in Nevada are made through mobile apps. In Arizona, almost all the action is taken through apps.

Chris Altruda, a sports wagering expert who formerly wrote for ESPN and The Associated Press, monitors sports wagering among the states that have legalized sports betting for SportsHandle.com.

Although Arizona doesn’t break down wagering by event, Altruda is convinced that having the Final Four at State Farm Stadium in Glendale boosted interest in betting within the state. It also didn’t hurt that the University of Arizona was in the tournament as a No. 2 seed. It lost to Clemson in the Sweet 16.

“Though the Arizona Department of Gaming does not break out handle figures by sport-specific categories, it is evident that Phoenix serving as host of the Final Four gave plenty of sportsbooks a heightened bounce when it came to March action,” Altruda said in recent commentary about Arizona numbers.

Hosting big events

Hosting a major event can boost sports betting numbers. Nevada noticed that with record Super Bowl wagering in February when the game was played at Allegiant Stadium. The Final Four will come to Allegiant in 2029.

Altruda noted that FanDuel — a vendor in Arizona that isn’t licensed in Nevada — set a state record for handle at $265.1 million. Its biggest rival, DraftKings, which also isn’t licensed in Nevada, wasn’t far behind with its own monthly best of $255.3 million.

Nevada does not break out handle or revenue by vendor.

“March also showed just how important mobile sports betting is to Arizona as its record handle was within $25.5 million of Nevada, where Las Vegas serves as a bucket-list destination for sports bettors who are also big fans of college basketball and the NCAA Tournament,” Altruda said.

“Arizona’s mobile handle accounted for 99 percent of the total handle compared to 64.6 percent in Nevada, and shows the Grand Canyon State’s 16 digital operators — regardless of market share penetration — are doing the right things needed to attract and retain business through both promotional offers and customer satisfaction.”

It would be interesting if FanDuel or DraftKings ever sought licensing in Nevada because they have national recognition, often offer promotional discounts to new players and offer fantasy sports games. But it isn’t likely they would venture into the state because of state policies requiring in-person verification of identification when first registering for wagering apps. Nevada companies have resisted allowing remote registration popular in most U.S. states that allow sports betting.

Change in policy?

After seeing last week’s April Nevada gaming win numbers, which included a decline in sports wagering, Altruda believes Nevada may need to re-examine its in-person registration policy.

“With Nevada still requiring in-person registration to gain access to mobile sports betting apps since the Las Vegas Strip is a gambling destination beyond sports wagering, it feels like the Silver State is quickly reaching a day of reckoning where this requirement may need to be waived,” he said. “Simply put, there are not enough in-person sporting events being held in Las Vegas and the state that will help stimulate substantial retail handle — this in turn puts pressure on sportsbooks to match year-over-year revenue totals with less action.”

Altruda said the jury is still out on how much Arizona can gain on Nevada’s sports wagering territory.

“It remains to be seen if Arizona can stay within shouting distance of Nevada when the NFL season rolls around this fall since pro football continues to be the primary mover of sports betting handle in the U.S.,” he said. “But in less than three years since launch, Arizona has positioned itself nicely to have the opportunity to challenge the original champion of legal sports wagering in this country for handle bragging rights at that time of year.”

Altruda has compiled a Top 10 list of states by sports betting handle, and Arizona has climbed into eighth place, well behind No. 3 Nevada.

Nevada has taken $40.1 billion in sports bets all time through March.

Leading the pack is New Jersey, $50.87 billion (through April), followed by New York, $43.42 billion (through April). New Jersey benefits from being in business for decades while New York capitalizes on its high-volume population.

Behind Nevada are Illinois, Pennsylvania, Colorado, Indiana, Arizona, Michigan and Virginia.

Evolution continuing

The sports betting landscape continues to evolve since the U.S. Supreme Court lifted the ban on states taking sports bets with its decision on the Professional and Amateur Sports Protection Act in 2018.

It’s unclear whether Nevada would ever lift its in-person registration requirement, a move that would need legislative action.

And meanwhile, sports betting remains a clouded issue in neighboring California, which could become the nation’s largest market if sports wagering is ever legalized there.

If that happens, all bets are off on where Nevada will rank nationally.

Contact Richard N. Velotta at rvelotta@reviewjournal.com or 702-477-3893. Follow @RickVelotta on X.