Borgata may gain from shrinking market

Boyd Gaming Corp. told investors last month it planned to change out a few of the restaurants, nightlife spots and other nongaming attractions inside several of the company’s area casinos to boost overall revenue.

This particular plan has been met with success along the Strip, but has been slow to be embraced by regional markets. Gaming revenue can’t always be counted on to boost a company’s bottom line.

J.P. Morgan gaming analyst Joe Greff told investors the idea will help Boyd’s Coast Casino properties and Sam’s Town to better prepare for demographic shifts in the locals market.

“While the persistent weakness in gaming spend is clearly an ongoing issue, Boyd believes that growing consumer interest in nongaming attractions is an opportunity for the company to take advantage going forward,” Greff said after an investment meeting with Boyd executives.

Greff said the company hasn’t targeted which properties will be in line for the renovations. The process will be a multiyear reinvestment.

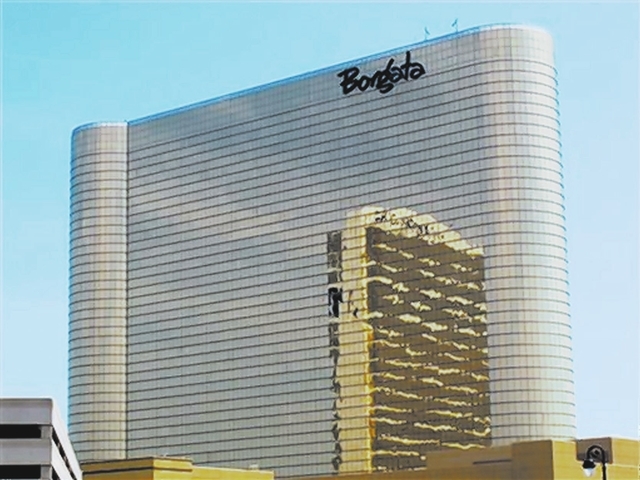

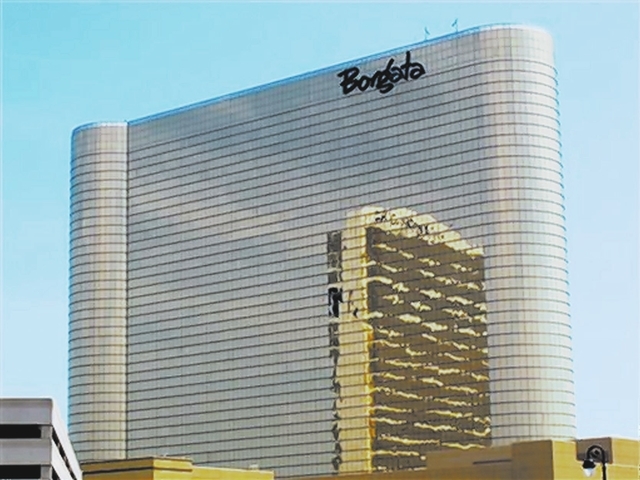

Borgata, the company’s flagship resort in Atlantic City, may see a revenue boost from a far different means.

That’s because Atlantic City is shrinking.

The Atlantic Club closed earlier this year. The aging Showboat is scheduled to close Sunday while the 2-year-old Revel will shut down after Labor Day Weekend. Trump Plaza is closing Sept. 16.

In a city that has seen gaming revenue decline more than 60 percent in the past seven years, the Borgata remains the class of the market.

Boyd Gaming owns the Borgata in a 50-50 joint venture with MGM Resorts International. The company also operates the hotel-casino and its adjoining nongaming Water Club hotel.

In the second quarter that ended June 30, Borgata reported net revenue of $181.9 million, which included $6.7 million from online gaming.

Borgata alone produced almost as much quarterly revenue as Boyd’s Las Vegas locals and downtown casinos combined.

Analysts asked company leadership about any effect the casino closures will have on the Borgata.

“This is obviously not welcome news for anyone,” Boyd Gaming CEO Keith Smith said in prepared remarks. “While all these closures are painful for the local economy, they should help create a more rational environment in this market.”

Which means Atlantic City casino patrons will look for other options.

Smith said Borgata picked up a few customers when the Atlantic Club closed. But the lower-end-of-the-market Atlantic Club had a different customer base from Borgata, which crosses many markets.

“There are more customers and just less places for them to go, so that will work to our advantage,” Smith said in response to an analyst’s question. “Some of those customers will find their way to the Borgata. Clearly, it always has been the premier facility in the area, so I think we will see some pickup from there.”

Atlantic City has suffered as neighboring eastern states — Pennsylvania, New York, Maryland, and Delaware — added forms of gaming. Borgata, however, increased its market in face of the competition.

As for New Jersey’s online gaming activities, which launched in November, Borgata is a partner with European giant Bwin.party. The casino’s online presence controls a market-leading 28.8 percent of the activity, currently run by six Atlantic City casinos.

The next largest competitor, Caesars Entertainment Corp. and its WSOP.com brand, is 10 percentage points behind Boyd.

Smith told analysts online gaming has grown Borgata’s business. Seventy-five percent of the accounts were created by gamblers who were not previously Borgata customers.

Many of those online players are now live-casino Borgata players as well.

With the company’s Midwest and Southern casinos challenged by reduced customer spending habits, Borgata is key to Boyd Gaming’s continued growth.

New Jersey, however, is debating the future of Atlantic City and is considering allowing gaming to expand to other parts of the state.

“There’s a lot of conversations by the politicians about it, and it’s something we’re clearly paying attention to because it could have an impact on Atlantic City,” Smith said.

Borgata has survived competition from neighboring markets since its 2003 opening. Smith said the resort will be a strong brand in the region.

If something were to happen in northern Jersey I think Borgata will have a very good chance of being able to participate,” Smith said.

“I don’t think there’s anything imminent. I don’t think we’re overly concerned that something’s going to happen in the next year or two.”