Bally completes $1.3 billion SHFL entertainment purchase

Slot machine giant Bally Technologies on Monday completed its $1.3 billion buyout of gaming equipment rival SHFL entertainment, forming one of the most diverse manufacturers in the casino business.

The merger combines the gaming industry’s second-largest slot machine provider in Bally Technologies, with SHFL, the largest provider of unique table games, and table game management systems and equipment. SHFL also has a large slot machine division in Australia, a market that Bally hopes to expand.

The deal, which was announced in July, was approved by Nevada gaming regulators last week.

The companies said the merger would result in $30 million in annual cost savings.

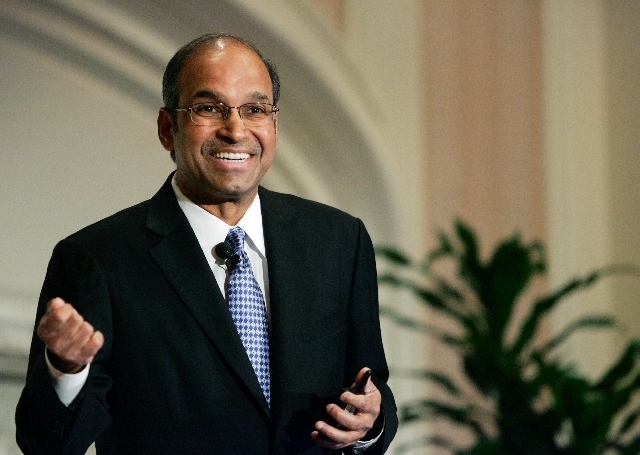

Bally Chief Executive Officer Ramesh Srinivasan said Monday the transaction combines “two best-in-class, highly complementary and customer-centric gaming technology companies that will be even stronger together.”

SHFL shareholders will receive $23.25 per share in cash for each share of SHFL stock.

In an interview, Srinivasan said said the cost savings from the deal doesn’t mean job reductions. Bally has 1,300 employees in Nevada and 3,400 workers worldwide. SHFL employs 350 people in Nevada and 900 workers globally.

Srinivasan said Bally would now have seven different reporting divisions and the company would utilize SHFL’s new corporate headquarters off the Las Vegas Beltway, as well as the company’s corporate campus south of McCarran International Airport.

“These are two very profitable companies,” Srinivasan said. “This is a very positive growth story.”

He said Bally wasn’t planning any additional acquisitions but intends to spend the next few years paying down its corporate debt, which grew by roughly $1.1 billion because of the buyout.

The company also announced a new senior management team that includes several executives coming over from SHFL. However, SHFL CEO Gavin Isaacs, a one-time chief operating officer at Bally, announced his departure from the newly mergers company.

Bally told investors it would provide an update on the integration and cost savings when the company announces second quarter earnings in early February.

“While we had previously anticipated an update on guidance and reporting structure prior to the fiscal 2014 second quarter report, it is ambiguous at this time whether that will in fact be the case,” Deutsche Bank gaming analyst Carlo Santarelli told investors.

He added that sales of Bally’s systems division products, such as casino management software, seems to be carrying the company. Santarelli said revenues from gaming operations — slot machines in which Bally share’s revenues with casino — is “stagnating” despite new game placements.

“We believe current valuation likely puts a range around shares and we expect industry and competitor struggles to eventually catch up with Bally, though we feel the near term is largely stable on this front,” Santarelli said.

Shares of Bally closed at $72.23 on the New York Stock Exchange, up 47 cents or 0.65 percent.

Contact reporter Howard Stutz at hstutz@reviewjournal.com or 702-477-3871. Follow @howardstutz on Twitter.