Index of gaming stocks slides in May

MGM Mirage’s one-day stock surge wasn’t enough to boost the gaming sector during May.

The company’s average daily stock price in the month, along with those of Las Vegas Sands Corp., Wynn Resorts Ltd. and Boyd Gaming Corp., fell when compared with April, an index compiled by Las Vegas-based financial adviser Applied Analysis shows.

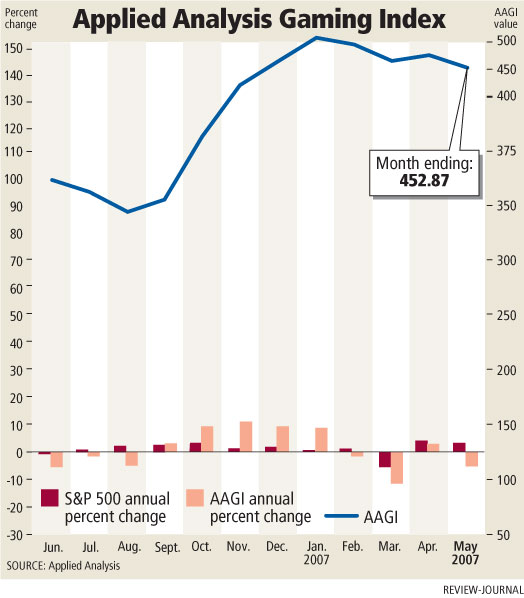

The index, which charts the stock progress and market variables of six casino operators and three gaming equipment manufacturers, fell 25.4 points in the month to 452.87 points.

On May 21, MGM Mirage majority shareholder Kirk Kerkorian announced he wanted to explore buying Bellagio and the under-construction $7.4 billion CityCenter development from the company. No details or structure were announced and MGM Mirage formed a committee of nonmanagement board members to explore the potential transaction.

The news sent shares of MGM Mirage soaring more than 27 percent in value during one trading day on the New York Stock Exchange and also helped drive up the share prices of some of the company’s leading competitors.

However, because the news came out with only seven stock trading days left in the month, the effect will most likely be felt in June’s average daily stock prices, as long as the prices remain high, analysts said.

Applied Analysis partner Brian Gordon said soft first-quarter earnings reports from Las Vegas Sands hurt the average daily stock price for that company and others. Shares of Las Vegas Sands traded down almost 10.7 percent during May when comparing its average daily price with April.

"Because of the company’s market capitalization (more than $27.5 billion as of Thursday), that sort of element has a definite impact on the index," Gordon said.

The average daily stock price of MGM Mirage fell 4.7 percent in May, Wynn Resorts was off 3.25 percent while Boyd Gaming fell 3 percent. Harrah’s Entertainment and Station Casinos had relatively flat months since the two companies are going through private equity-backed buyouts that will remove them from the publicly traded sector.

Some gaming analysts believe a deal, if any, between Kerkorian and MGM Mirage will take well into the summer to develop. In the meantime, Gordon said the announcement showed the major gaming operators are always looking at ways to be creative in altering their corporate structure.

"When MGM Mirage is considering a retooling of the company or its assets, it shows that any of these operators could explore different alternatives," Gordon said.

Goldman Sachs gaming analyst Steve Kent said gaming stocks throughout the industry will be affected by how well Las Vegas Sands does in opening the $2.4 billion Venetian Macau this summer. Also, MGM Mirage is opening the $1.1 billion MGM Grand Macau at the end of the year.

"Macau is the key theme for the next 12 months," Kent said in a note to investors Thursday. "From an operational perspective, Macau is the key right now because so many of the operators have some direct or indirect exposure to it. The valuation and growth plans of Wynn Resorts, MGM Mirage, PBL Melco, and even Harrah’s will be affected by (the Venetian Macau) opening. Asian gaming, widely considered as an extraordinary opportunity, may be called into question if Las Vegas Sands does not succeed."

The May 16th announcement that New York based Elad Properties would pay more than $1.2 billion for the 34.5-acre New Frontier site brought up the continued evaluations of what Strip land is worth. Gordon said the deal didn’t have much of an effect on stock prices or the index.

Meanwhile, manufacturers saw a slight jump in their average daily stock values. A one-day Wall Street rumor that slot machine giant International Game Technology was the target of a private equity buyout caused a surge in the company’s stock value.

Kent said the implementation of server-based gaming technology will be the measure to judge the slot machine makers over the next year.

"Right now, we have four major slot companies battling for market-share gains," Kent said. "But to truly revolutionize the outlook for this group, central-server technology has to move from testing to reality. At best, the ability to change slots on the fly, by using a central computer system, is probably one to two years away."

| Average Daily Stock Price | |||

| May 2007 |

April 2007 |

Percent change |

|

| MGM Mirage | $68.08 | $71.45 | -4.71 percent |

| Harrah’s Entertainment | $85.45 | $85.25 | 0.24 percent |

| Las Vegas Sands | $79.37 | $88.86 | -10.68 percent |

| Wynn Resorts | $98.11 | $101.40 | -3.25 percent |

| Boyd Gaming | $46.83 | $48.28 | -3 percent |

| Station Casinos | $87.67 | $87.33 | 0.39 percent |

| Intl Game Technolgy | $39.77 | $39.62 | 0.40 percent |

| WMS Industries | $41.69 | $41.07 | 1.51 percent |

| Bally Technologies | $24.23 | $23.25 | 4.20 percent |

| SOURCE: Applied Analysis |