Study: Nevada margins tax cost — 3,610 jobs

A proposed 2 percent margins tax on Nevada businesses could result in the loss of 3,610 private sector jobs in 2015, according to a new study released Tuesday and commissioned by a conservative think tank that opposes such a levy.

At the same time, the tax would raise $862.5 million in its first year for the state and lead to adding 1,970 public employees, the study found, for a net job loss of 1,640.

The study also said that imposing a margins tax would reduce Nevadans’ disposable income by $240 million a year and decrease investment in the state by $7.1 million annually due to the ripple effects of levying a new business tax.

“The proposed margin tax would diminish economic activity and place Nevada’s above-average long-term competitiveness at risk,” the study concluded.

The study examining the impact of a margins tax on Nevada’s economy was conducted by The Beacon Hill Institute at Suffolk University in Massachusetts for the Nevada Policy Research Institute.

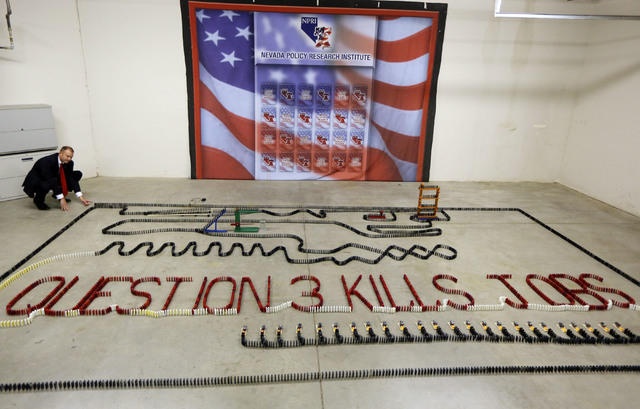

NPRI demonstrated the potential job loss by toppling 3,610 dominoes in a photo and video stunt at its Las Vegas office.

“Until now, the margin-tax discussion has primarily focused on the businesses it would hurt,” said NPRI President Andy Matthews in a statement. “But this study makes clear the tax will have just as much, if not more, effect on the individual residents, employees and families of Nevada. The tax is burdensome, complicated, void of transparency and, worst of all, it would do irreparable harm to thousands of Nevada families.”

Dan Hart, a spokesman for the margins tax proponents, has noted that the levy would affect only 13 percent of Nevada businesses. He also argues that some companies don’t want to locate in the state because of the poor education system.

The margins tax proposal will be Question 3 on the Nov. 4 ballot, listed as the “Education Initiative.” The Nevada State Education Association, or teachers union, backed the initiative to raise more money for education after becoming frustrated with the Legislature and GOP Gov. Brian Sandoval for not spending more on schools, including for new teachers to reduce class sizes.

A previous study by opponents of the margins tax estimated up to 9,000 private-sector jobs could be lost if the proposed levy went into effect. That study was conducted by Jeremy Aguero of Applied Analysis.

The Beacon Hill Institute study was critical of the proposed 2 percent margins tax, noting that it would be levied on any business making more than $1 million in annual revenue whether or not the company was profitable.

“For firms operating with very small margins, the margin tax can easily destroy a firm’s profitability altogether and move it toward insolvency,” the study said. “For firms already operating at a financial loss, the margin tax will exacerbate that loss and hasten the day of potential bankruptcy.”

The study authors also questioned whether any new revenue for education would improve Nevada schools.

“More spending does not necessarily guarantee a desired educational outcome,” the study said. “Nevada already spends a substantial sum, and there is no significant documented relationship between increased spending and student performance. … Voters should seriously weigh the implications on Nevada’s recovering private sector in considering the measure.”

The study estimated potential margins tax revenue, job losses and other impacts for both 2015 and 2018.

By 2018, the margins tax would be expected to raise $938 million a year. The private sector job loss would increase slightly to 3,670, while public sector jobs would grow by 2,115 — resulting in a net loss of 1,555 jobs. The loss in disposable income for Nevadans would rise to $245 million, according to the study. And investment in Nevada would fall by $7.2 million.

“This drop in disposal income is due to a combination of fewer workers earning income, some workers who remain employed earning reduced wages and a higher cost of goods due to the margin tax being passed along to consumers, eroding their purchasing power,” the study said.

In the end, the study concludes that the margins tax, which is patterned after one in Texas, is bad for Nevada.

“In terms of overall state tax policy, a margin tax’s alleged benefits are dubious,” the study said. “Such a tax fails the tests of efficiency, equity, transparency and administrative simplicity.”

Contact Laura Myers at lmyers@reviewjournal.com or 702-387-2919. Find her on Twitter: @lmyerslvrj.