Nevada startups have access to new funding through federal program

The funding pool available to Nevada-based startups is about to become larger — by potentially $90 million or more.

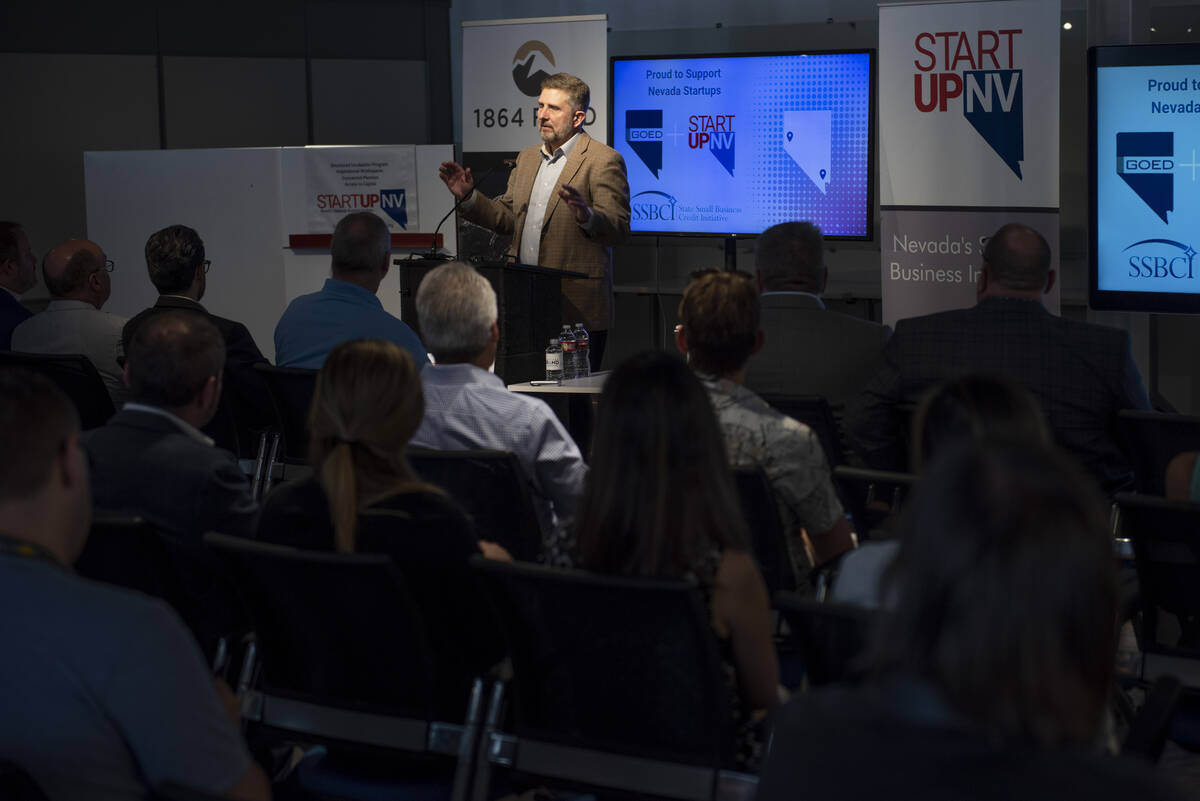

State Treasurer Zach Conine announced on Wednesday a partnership with StartUpNV, a Las Vegas-based incubator and startup accelerator, that will provide more than 40 Nevada-based companies with additional funding through a federal program called State Small Business Credit Initiative.

SSBCI was first created in 2010 but was reauthorized after the 2021 passage of President Biden’s American Rescue Plan Act. The new version offers states a combined $10 billion to help fund small businesses and support local entrepreneurs.

“The availability of this capital will allow new and innovative ideas to not just start here, but continue to grow here,” Conine said during a news conference at the downtown Las Vegas International Innovation Center@Vegas.

The goal of the funding program, administered by the Governor’s Office of Economic Development, is to help create access to capital for Nevada’s startup community while also creating a path towards diversifying Nevada’s tourism-reliant economy so it can handle economic downturns.

“It’s about making the pie bigger,” Conine said. “When we bring these start-up companies when they are early in their formation, it gives us the opportunity to grow and change and employ more people here, down the road.”

StartUpNV Executive Director Jeff Saling said that the state will get to administer potentially more than $90 million and the funds will be dispensed over the next 10 years in three tranches.

He said an estimated $60 million of the SSBCI funds will go toward helping small businesses and $30 million toward venture capital programs managed by StartUpNV. He said the SSBCI funding should help the nonprofit incubator support as many as 12 startups each year, up from the roughly seven companies it helps annually.

Funding breakdown

The SSBCI funds will be coinvested in 10 companies at the pre-seed stage — less than $500,000 in revenue — and 30 companies at the seed stage, revenue ranging from $500,000 to $2 million, over a three-year period, for firms participating in the StartUPNV Accelerator.

The SSBCI funding will match investments made by StartUpNV, which includes a new $10 million venture capital fund called 1864 in honor of the year Nevada gained statehood.

The exact details of which companies can qualify is still being finalized, according to Saling, but all 40 companies will have participated in StartUpNV programs such as its business accelerator.

“StartUpNV is going to operate both a pre-revenue incubator for companies at the earliest stages of development, as well as a pre-seed and seed accelerator round for companies that are at the viability and early scalability level,” Conine said.

This sort of investment in new companies from government agencies can have huge impacts on where businesses decide to locate, said Ed Nabrotzky, CEO of Las Vegas-based See ID.

“Having an ecosystem that can fund these startups and these great ideas will make Nevada grow and be a tremendous force going forward,” Nabrotzky said.

See ID helps businesses track items and improve security. The company was able to grow its operations with the help of StartUpNV. Using the services offered in Nevada was crucial for the company to stay in the state, according to Nabrotzky.

“In the early stage, raising money becomes an all encompassing activity,” he said. “States that don’t participate in that early formation lose the great harvest later on as the company grows and becomes a business that any state would want.”

But creating a good environment for startups doesn’t just revolve around state-funded programs, according to Conine.

“Founders have choices too, so we want to create the type of state they want to live in,” he said. “That’s not just on the economic side … that means having enough housing, having good schools, having a workforce that they can hire from all of these things dovetail together.”

The amount of funding and disbursement timeline has been updated in the story.

Contact Sean Hemmersmeier at shemmersmeier@reviewjournal.com. Follow @seanhemmers34 on Twitter.