Southwest Gas to explore alternatives to Icahn bid to buy company

Southwest Gas Holdings Inc. announced Monday its board of directors will review a range of strategic alternatives to Carl Icahn’s unsolicited buyout attempt.

Shareholders of the Las Vegas-based utility showed their approval of the utility’s move aimed at maximizing shareholder value.

Shares on Monday climbed $4.75, or 5.65 percent, in trading nearly three times the daily average on the New York Stock Exchange. After hours, shares continued to surge $1.03, 1.2 percent, to end near $89.25 a share.

The frenzied trading followed Monday morning’s announcement. The board said it received another bid “well in excess of Carl Icahn’s $82.50 per share offer,” but did not disclose the amount or source of the bid.

“As a board, we determined that the best path forward is to explore a range of strategic alternatives, including a sale of the company, to maximize the value of the company on behalf of all of our stockholders,” Michael Melarkey, chair of the Southwest Gas board, said in a release. “We plan to move forward expeditiously.”

Southwest indicated it would not make any further comments about the bids and the review process.

Southwest Gas, a wholly owned subsidiary, delivers natural gas to more than 2 million customers in Arizona, California and Nevada.

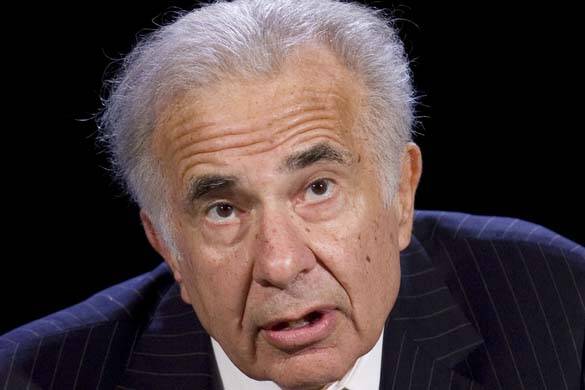

Representatives of the activist investor, who owns a 4.9 percent stake in the company, did not respond to requests for comment about the board’s decision Monday.

On March 28, the board, following a review with the assistance of its financial adviser Lazard and legal advisers Cravath, Swaine & Moore LLP, unanimously determined that the revised tender offer from Icahn to acquire outstanding common shares of the company for $82.50 per share in cash is “inadequate, structurally coercive, highly conditional, undervalues the company and is not in the best interests of all of its stockholders.”

Icahn made an initial unsolicited offer of $75 a share to buy the company in October, a move that was viewed as part of an escalating feud between him and Southwest management.

Icahn accused Southwest Gas management of making “a number of egregious errors at the expense of shareholders” and that he was “extremely disappointed” with management over the past few years.

“However, the purchase of Questar you are currently being rumored to make at the price you are willing to pay will make all past errors pale in comparison,” Icahn, who has a reputation as an aggressive corporate raider, wrote in a letter he made public.

Questar Pipelines consists of 2,160 miles of interstate gas pipelines in the Rocky Mountains transporting and storing gas across Utah, Wyoming and Colorado, according to Southwest Gas.

Southwest Gas responded with its own letter on Oct. 13 defending its decision to buy Questar, which it described as a “compelling, high-return suite of assets with unique strength and stability.” The company board argued the pipeline would provide “extremely attractive energy transition opportunities” via renewable natural gas, hydrogen and carbon dioxide transportation.

When the deadline of Icahn’s offer expired in late December, it was extended, and Southwest Gas continued to push back against it.

“Tendering into Mr. Icahn’s offer would only encourage an opportunistic attempt to acquire Southwest Gas at an inadequate price and contingent upon a long list of ambiguous conditions, some of which Mr. Icahn has made no move to fulfill,” according to a company statement.

Contact Richard N. Velotta at rvelotta@reviewjournal.com or 702-477-3893. Follow @RickVelotta on Twitter.