Biden’s big bill may hinge on tax deduction provision

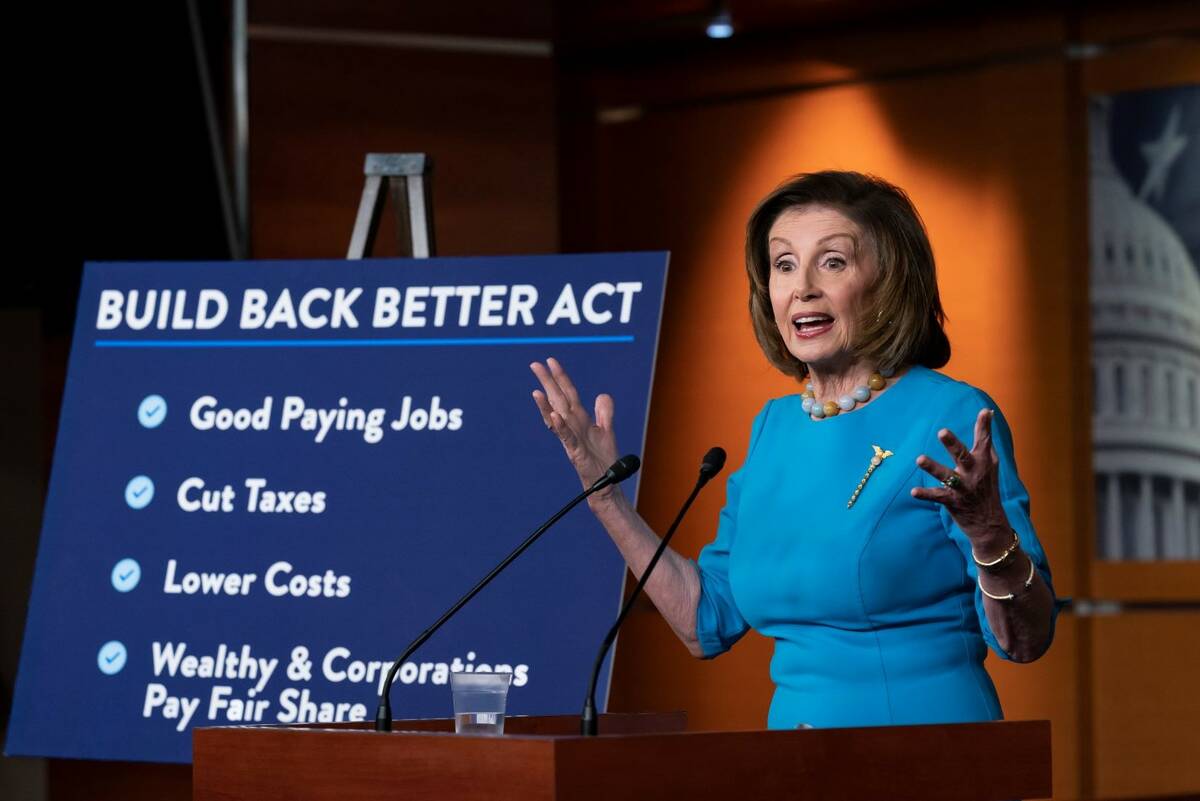

WASHINGTON — A controversial provision in the House-passed Build Back Better Act to expand a federal deduction for state and local taxes is in the cross hairs of Senate Democrats writing their version of the sweeping social benefits and climate bill.

The $1.85 trillion bill passed by the House is funded by tax hikes on the wealthy and corporations, but it includes a raise in the federal deduction for local taxes that has been roundly criticized by liberals and Republicans as a benefit for the nation’s rich.

“At a time when income inequality is skyrocketing our priority should be helping working families, not tax breaks skewed toward the wealthy,” said Rep. Dina Titus, D-Nev.

Titus called the raise in the deduction benefit “unfortunate.” She supports increased social spending and programs in the bill for education, health care, lower taxes for the middle class and initiatives to fight climate change.

She said the bill still contains a modified cap on the federal tax deduction for state and local income taxes.

“I do not support lifting the cap altogether as is being discussed in the Senate,” Titus said.

Residents in Nevada and low-tax states see little benefit from the deduction, but lawmakers in Northeast states and California, which impose state and local income taxes, argue the deduction does help middle-income families. It allows residents to write off state and local income taxes and property taxes from their federal tax bill.

It was tucked into the Build Back Better Act, which passed earlier this month along mostly party lines, 220-213. Only Democrat Rep. Jared Golden of Maine, who protested the deduction’s inclusion, voted against the bill.

Nevada’s congressional delegation voted along party lines to pass the overall package, which would expand pre-kindergarten education to thousands of children in the state, make more residents eligible for health care under Medicare, cut prescription drug costs for seniors and extend the child tax credit.

Nevadans oppose deduction

None in Nevada’s delegation advocated for the state and local tax deduction.

In fact, Rep. Susie Lee, D-Nev., voted against a repeal of the deduction last year when it came before the House as a stand-alone bill.

“While Congresswoman Lee has fought against raising the SALT tax deduction cap, she supports the Build Back Better Act because there’s so much in this bill that will help hardworking Nevada families,” said spokeswoman Zoe Sheppard.

Rep. Steven Horsford, D-Nev., a member of the tax-writing House Ways and Means Committee, helped write the Build Back Better legislation that included an extension of child tax credits that have helped constituents in his mostly working class district, but not the state and local tax provision. That was added to the bill in an amendment before the House vote.

Republicans implemented a $10,000 deduction cap in their 2017 tax cut bill, which lowered tax rates on wealthy earners, corporations and businesses. It expires in 2025.

At the time, House Speaker Nancy Pelosi, D-Calif., said the deduction in the GOP tax cut bill politically targeted blue states.

The House version of Build Back Better raised the cap from $10,000 to $80,000. It would cost the U.S. treasury $290 billion in revenue, according to the Congressional Budget Office.

Republicans claim the benefit to wealthy families undercuts President Joe Biden’s message that the Build Back Better Act is fully paid for by tax hikes on the rich.

Overall, the Congressional Budget Office analysis estimated the $1.85 trillion bill would add $160 billion to the deficit over 10 years. That projection did not include revenue Democrats said would come from increased Internal Revenue Service enforcement of current tax laws.

Senate takes up the bill

Senators return this week from the Thanksgiving recess with negotiations to continue writing their version of the social spending package touted as an economic boost for working Americans.

Republicans are unified in their opposition to the bill, and have seized on the state and local tax deduction to fight it.

Some Democrats have winced at the deduction. Right- and left-leaning tax policy think tanks agree it benefits the wealthiest in high-tax states while doing little to nothing for working class families, particularly those in low-tax states like Nevada.

“You cannot talk about taxing the wealthy, and then give them a tax break,” said Sen. Bernie Sanders, I-Vt.

Sanders is seeking a compromise that would limit the deduction to those earning less than $400,000 a year. He is working with Sen. Bob Menendez, D-N.J. on a compromise that is supported by Nevada’s senators.

Sen. Catherine Cortez Masto and Sen. Jacky Rosen, both Nevada Democrats, said the Build Back Better Act should focus on delivering middle class tax cuts and lowering costs for state residents.

Cortez Masto, through a spokeswoman, supports negotiations, and to make sure “adjustments to the SALT cap are more targeted than the House proposal.”

A Rosen spokesman said the senator wants any changes to the deduction cap “more narrowly tailored towards helping middle-income households.”

At the White House, spokeswoman Jen Psaki said the deduction was not in the president’s original package, but part of a compromise to advance the bill to the Senate.

“The president’s excitement about this is not about the SALT deduction,” Psaki told a White House news briefing. “It’s about the other key components of the package, and that’s why we’re continuing to press for it to move forward.”

Details of the exemption

House legislators raised the $10,000 cap to $80,000, raising the cost of the Build Back Better Act by roughly $300 billion, according to the Tax Foundation, a right-leaning think tank.

Roughly 98 percent of the benefit would go to families with six-figure incomes, according to the Tax Foundation analysis.

Currently, only 11 percent of households take the deduction, according to the Tax Policy Center, a left-leaning think tank of policy experts from The Brookings Institution and the Urban Institute. The benefit is weighted to high-tax coastal states, according to studies by both liberal and conservative tax policy analysts.

Seven states, California, New York, Texas, New Jersey, Maryland, Illinois and Florida, claimed more than half of the deductions nationwide, according to the Tax Foundation.

California claimed the most, about 19.8 percent, with the average benefit about $20,000.

Nevada, with no state income tax, accounted for just 0.59 percent of the deductions, with an average deduction of $6,400. It ranked in the bottom third of states with residents claiming the benefit, according to Tax Foundation analysis based on Internal Revenue Service figures.

In Nevada, the benefit disproportionately has helped high-income earners.

Still, Democrats in high-tax states such as New York, New Jersey, California and Maryland claim the state and local tax deduction aided middle class families who paid state and local income taxes, as well as property taxes to provide critical services like education, parks and social programs.

Democrats see the cap as a blue-state penalty imposed by Republicans, amounting to a double tax, while Republicans view it as a blue-state benefit.

“They’re both a bit right,” according to the Tax Policy Center analysis.

Republicans — whose 2017 tax cut plan was embraced by the wealthy and corporate executives — have relished turning the tables on Democrats for giving the well-to-do a tax break.

Conservative campaign groups like the Heritage Action for America and the National Republican Senatorial Committee have already used the provision as an election-year issue, targeting Democrats in competitive races like Lee and Cortez Masto in Nevada.

Progressives, too, object that it’s hard to make the case the social spending package that makes the wealthy and corporations pay their fair share while giving a tax break to high-wage earners. Sanders quipped that the wealthiest Americans under the increased deduction would be “better off than they were with Trump.”

Rep. Kevin Brady, R-Texas, the ranking Republican on Ways and Means, claimed the Democratic bill gives a benefit to the penthouse and the expense of the janitor.

“Where are their priorities?” Brady said during a House speech on the bill. “The SALT windfall for the wealthy is 50 times larger than help a parent supposedly gets from the child tax credit.”

Republican Rep. Mark Amodei, R-Nev., voted against the Build Back Better Act, and the repeal of the state and local tax deduction in the last Congress. He voted for the 2017 tax cut bill that capped the deduction.

Even the compromise sought by Sanders would lower the cost of the deduction to between $150 billion and $200 billion, according to the Committee for a Responsible Federal Budget, a right-leaning advocacy group.

Sen. Ron Wyden of Oregon, chairman of the Senate Finance Committee, has referred questions about the state and local tax deduction to Senate Minority Leader Chuck Schumer, D-N.Y., who supports it. Other senators from high-tax state also seek a higher cap on the deduction, or its elimination after it expires.

Schumer wants the chamber to vote on the Build Back Better Act before the Christmas recess. Any Senate revision of the law would require subsequent action by the House. There are a half dozen Democratic House members, led by Rep. Tom Souzzi, D-N.Y., who insist on raising the deduction’s cap.

Known as the “SALT Caucus,” members have enough votes to prevent final passage of the Build Back Better Act if it returns to the House with a provision they don’t want. “No SALT, No Dice,” they said in a statement.

Contact Gary Martin at gmartin@reviewjournal.com. Follow @garymartindc on Twitter.