Judge allows Wynn shareholder lawsuit to move forward

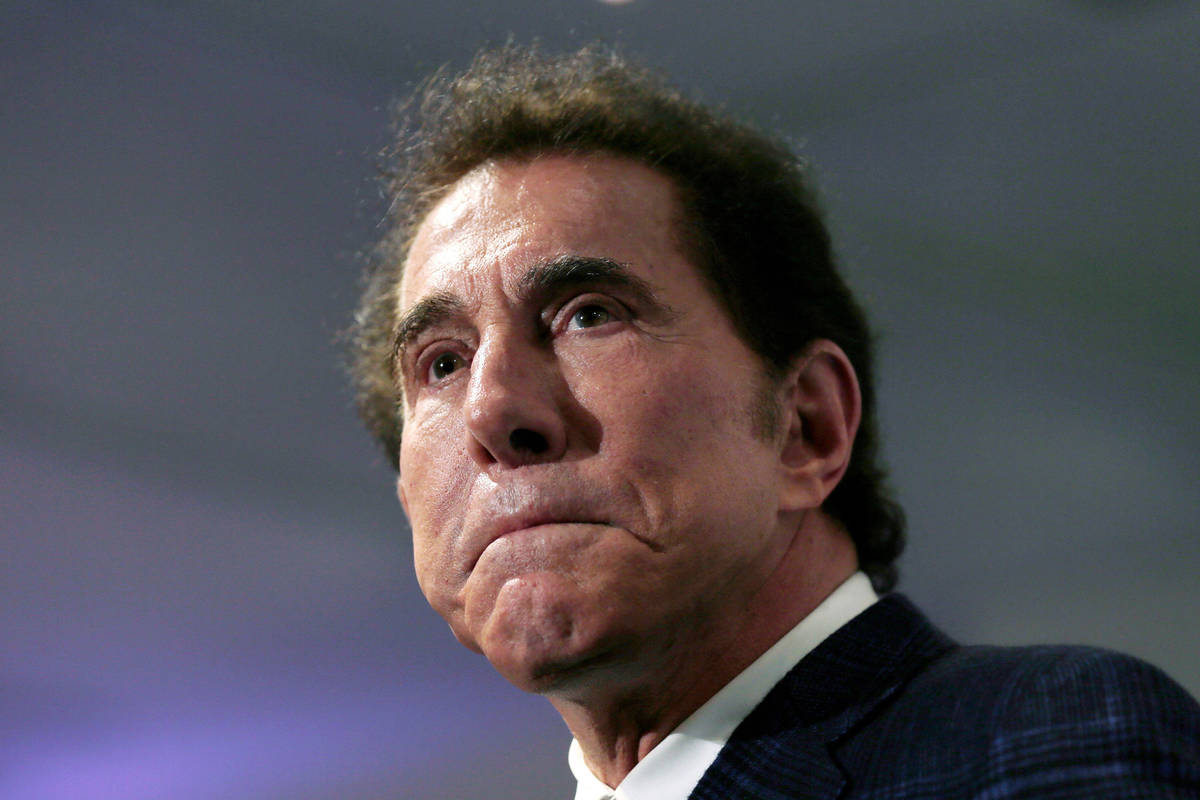

A federal judge has allowed parts of a class-action lawsuit to move forward alleging that Wynn Resorts executives overlooked reports of sexual harassment and misconduct against former CEO Steve Wynn.

U.S. District Judge Andrew Gordon partially revived a securities fraud complaint that claimed company executives violated Securities and Exchange Commission laws and rules through “misrepresentations and omissions.”

The suit was dismissed in May 2020 by another judge, who allowed the plaintiffs to amend and refile their case on behalf of Wynn shareholders who alleged that the accusations devalued the company’s stock.

Gordon ruled that two aspects of the complaint, filed after a Wall Street Journal article detailed reports of sexual assault and harassment from several employees, could move forward. The judge decided that case should focus on the company’s press release responding to allegations raised by Wynn’s ex-wife, Elaine Wynn, “regarding serious misconduct and misuse of Company resources by (Steve) Wynn, along with the former CEO’s response to the article.”

“At this stage, the plaintiffs have sufficiently alleged that” Wynn and executives “were aware of information contradicting their statements that denied misconduct allegations,” Gordon wrote in a 42-page order handed down late last month. “The inference that these defendants were aware of Wynn’s alleged misconduct at the time of their statements is cogent and compelling.”

Wynn stepped down as CEO and chairman of Wynn Resorts in February 2018, after multiple allegations of sexual misconduct and sexual harassment. His Las Vegas attorney, Colby Williams, declined to comment on Gordon’s order.

A lawyer for the lead plaintiffs, John Ferris and Joann Ferris, responded to the ruling.

“The court’s decision underscores the fact that alleged sexual misconduct and harassment by corporate executives are material issues for investors, especially when management turns a blind eye to reports of wrongdoing,” Murielle Steven Walsh, attorney for the plaintiffs told the Associated Press. “This type of misconduct poses a threat to a company’s financial success.”

In February 2019, the Nevada Gaming Commission fined Wynn Resorts $20 million, the highest fine ever assessed by state regulators, for damaging the state’s reputation by the company’s failure to investigate claims from at least eight women that they were sexually harassed in the workplace. Two months later, the Massachusetts gaming commission, where Wynn also operates a casino, fined the company $35 million.

Through a spokesman, the company noted in an email to the Las Vegas Review-Journal that the gaming boards in both states affirmed Wynn Resorts’ good standing.

“The Company looks forward to this case moving beyond the allegation-stage, where the focus will be on the actual evidence, as it was in the regulatory investigations,” the statement read.

Contact David Ferrara at dferrara@reviewjournal.com or 702-380-1039. Follow @randompoker on Twitter.