EDITORIAL: How inflation hurts low-income Americans

President Joe Biden promised not to raise taxes on Americans making under $400,000 a year. He failed to mention how unexpected inflation would effectively lower their incomes.

Inflation has risen sharply over the past few months. In May, prices rose by 5 percent compared with a year ago. That was the largest year-over-year increase since 2008. Compared with April, prices rose by 0.6 percent. In April, the month-over-month increase was 0.8 percent and 0.6 percent in March.

That’s a dramatic increase from the end of the last year, when monthly increases were 0.2 percent.

Average consumers aren’t looking at aggregate numbers. They’re doing a double take when they see the grocery receipt or the price of lumber. They’re trying and failing to find an affordable used car and decent gasoline prices. Ordinary American are starting to realize that their money isn’t going as far as it used to.

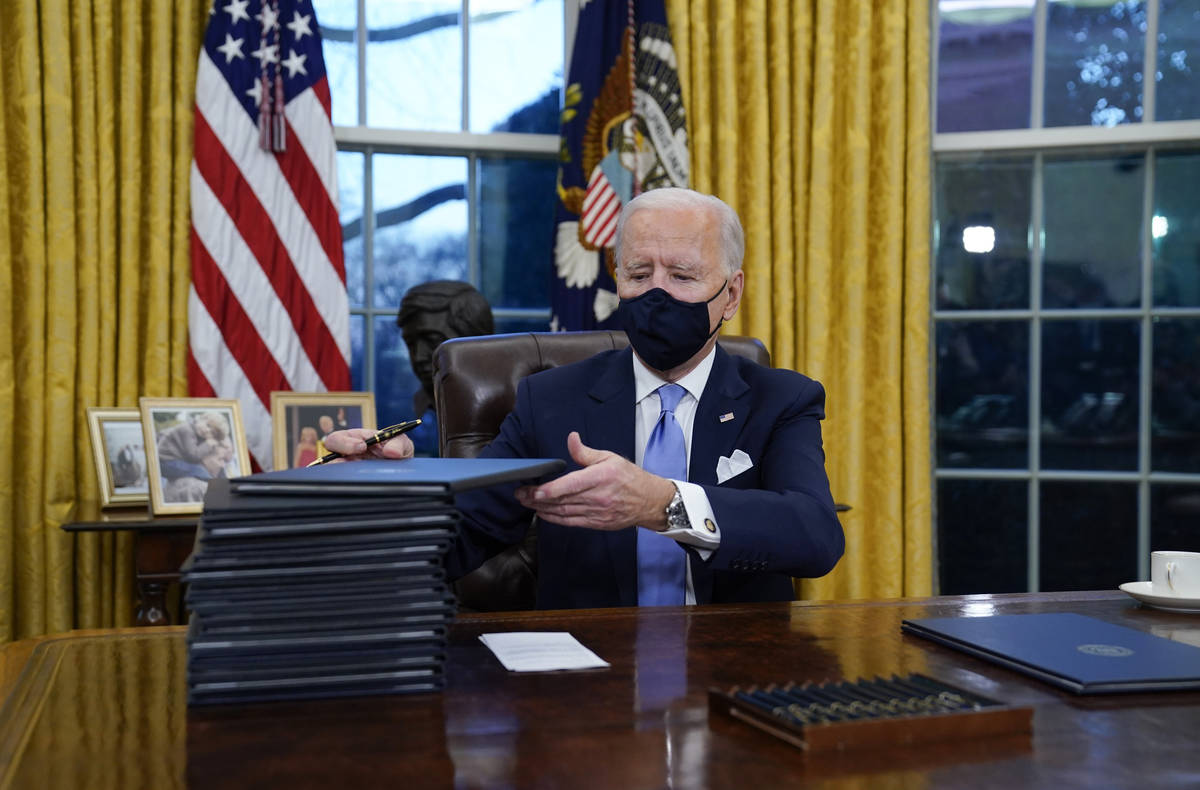

This shouldn’t come as a surprise. In March, Mr. Biden signed the $1.9 trillion American Rescue Plan into law. He was “saving” an economy that was already surging thanks to vaccines and people emerging from their virus-induced cocoons. That bill included $1,400 stimulus checks and increased unemployment benefits.

Giving people more money to spend, however, didn’t increase the amount of products available. In addition, paying people not to work doesn’t increase the number of goods available.

The classic definition of inflation is too many dollars chasing too few goods. Mr. Biden’s rescue plan certainly accomplished that.

On Tuesday, Federal Reserve Chair Jerome Powell testified before a Senate subcommittee and dismissed concerns about rising prices. “Inflation has increased notably in recent months,” he said. One concern is the “exacerbating factor of supply bottlenecks, which have limited how quickly production in some sectors can respond in the near term.”

Mr. Powell contended that high inflation will “drop back toward our longer-run goal” soon.

Let’s hope he’s correct and this is simply a reflection of the COVID bounce-back. Moderately high inflation is an inconvenience for the upper-middle class. But it can cripple a low-income family’s standard of living. That’s already happening.

“Rising inflation for the past two months has outstripped wage gains, meaning that real average earnings have fallen,” a Wall Street Journal editorial noted recently.

That’s a far cry from Mr. Biden’s assurance that he’d finance his spending plans by plundering the rich. High inflation functions as a de facto tax increase by reducing purchasing power. Unlike the American tax code, inflation is regressive.

Easy money sounds good. It may even feel good in the short-term. But rising inflation is yet another reminder that fiscal discipline is the best course forward.