‘Mr. Elliot’ promised clients his private Vegas vault was safe. He was wrong.

For years, Las Vegas entrepreneur Elliot Shaikin promoted 24/7 Private Vaults as safer than banks, guaranteeing clients total anonymity and access to their property whenever they needed it.

“When you store your valuables with us, we don’t want to know your name or what you put in your vault,” the 80-something Shaikin said in a 2011 video commercial. “It’s safe and untraceable.”

In a 24-hour city, his message resonated with hundreds of people who valued privacy and did not want to deal with banks. Clients had keys to safe deposit boxes, used an iris scan to access the vault and signed paperwork with an X to keep their identities secret.

Professional gamblers, celebrities, businesspeople and even criminal suspects were among those who stored up to $70 million in cash and an eclectic mix of valuables in safe deposit boxes and safes.

Shaikin, a New York native and Air Force veteran who spent a lifetime distrusting government, opened the business in 1999 with money he earned in commercial real estate in Southern California, friends said.

“He wasn’t a security expert, but he was very much into privacy and individual rights,” one former employee said. “This was his baby, an idea he saw as his legacy. He wanted to find something unique.”

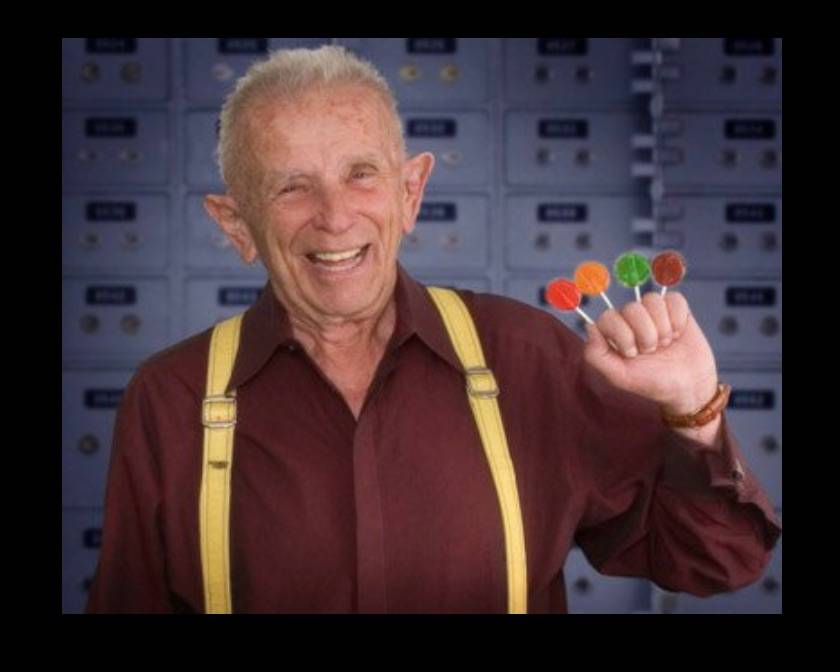

Shaikin seemed to have fun with his video promotions. He called himself “Mr. Elliot” and usually was seen wearing brightly colored suspenders. He promised a “lollipop” to anyone who toured his facility.

“He really basked in the spotlight,” the former employee said. “He was a bit of a ham.”

But Shaikin was serious about luring potential customers. He offered deals to veterans on Facebook. He bragged that the business had a high-tech security alarm system with sensors, doors with reinforced steel leading to the vault area and security officers always on hand.

Shaikin had two hard rules: no drugs and no ammunition. He emphasized that drug-sniffing dogs were there weekly.

The business, in the middle of a bland, half-vacant strip mall six blocks east of McCarran International Airport, was not in a place one would expect to see a secure facility.

As it turned out, 24/7 Private Vaults wasn’t safe at all.

Security problems

Early on the morning of April 14, 2012, the vault company was robbed. Authorities said it was an inside job, something Shaikin didn’t account for when he talked about the protections. An FBI report indicated that the thieves stole “millions of dollars.”

Nearly eight years later, the business is closed, Shaikin is dead, roughly $1 million in cash and property is still unclaimed, and the company is in U.S. Bankruptcy Court.

It took prosecutors until April 11, 2017, several days before the five-year statute of limitations for the robbery ran out, to file felony charges against two former employees, Sylviane Della Whitmore and Larry Anthony McDaniel, and security consultant Phillip D. Hurbace, who did some work for the company.

Prosecutors are seeking to recover more than $2.6 million from the three defendants preparing to stand trial.

Kerin Schroeder, the 70-year-old employee on duty during the 2012 robbery, was handcuffed, bound with duct tape and shocked with a stun gun, as robbers easily evaded security measures and looted safe deposit boxes, court records show.

Hours after the robbery, Schroeder was interviewed by Las Vegas police.

“I had just changed the channel to watch a movie on the TV in my control room, and everything was looking good,” Schroeder told robbery detectives. “There was no one in the parking lot, no one in any of the cameras. There were no customers that were coming into the door. And, um, I was startled by something all of a sudden.”

She said she turned to the left in her chair and was grabbed by two men wearing masks and camouflage jumpsuits, according to a transcript of her interview. She started kicking and screaming, and when one of the suspects put his hand over her mouth, she bit his finger through a leather glove. That prompted him to stun her right shoulder with a stun gun.

“And then I stopped moving, and they told me they didn’t want to hurt me, (but) to shut up and that they had a gun,” she said.

Eventually, the robbers handcuffed Schroeder and wrapped the cuffs with duct tape. Then, they appeared to disarm the alarm system as a third male suspect showed up, she told detectives.

After she calmed down, one of the suspects told her, “We’re gonna get lots of money out of here. If you give me your address, I’ll drop something in your backyard,” the transcript shows. Schroeder declined the offer.

Efforts to reach Schroeder were unsuccessful.

Other vault thefts

State court records show that Shaikin’s security claims were exaggerated.

During the 2012 heist, instructions on how to disarm the alarm system were posted next to the control panel, the room the robbers broke into did not have security sensors, the doors leading to the vault were not solid steel, and no security officers were on hand, records show.

The robbers climbed into a crawl space in the ceiling and were able to drop down into the vault, where they drilled open safe deposit boxes and looted them, records show.

Authorities believe the suspects first broke into a vacant store next door and then entered the business by cutting through drywall, all without being detected. A police report said 33 safe deposit boxes were targeted.

FBI agents later learned that there were a series of additional thefts dating to 2008. Tens of thousands of dollars were stolen.

No charges were ever filed, but Shaikin continued to promote his business as being secure.

“It wasn’t as safe and secure as he advertised,” said U.S. Bankruptcy Trustee Brian Shapiro, who is overseeing the Chapter 7 bankruptcy case. “It was safe and secure in order to be anonymous, and I think that was his big selling point, trying to keep things anonymous.”

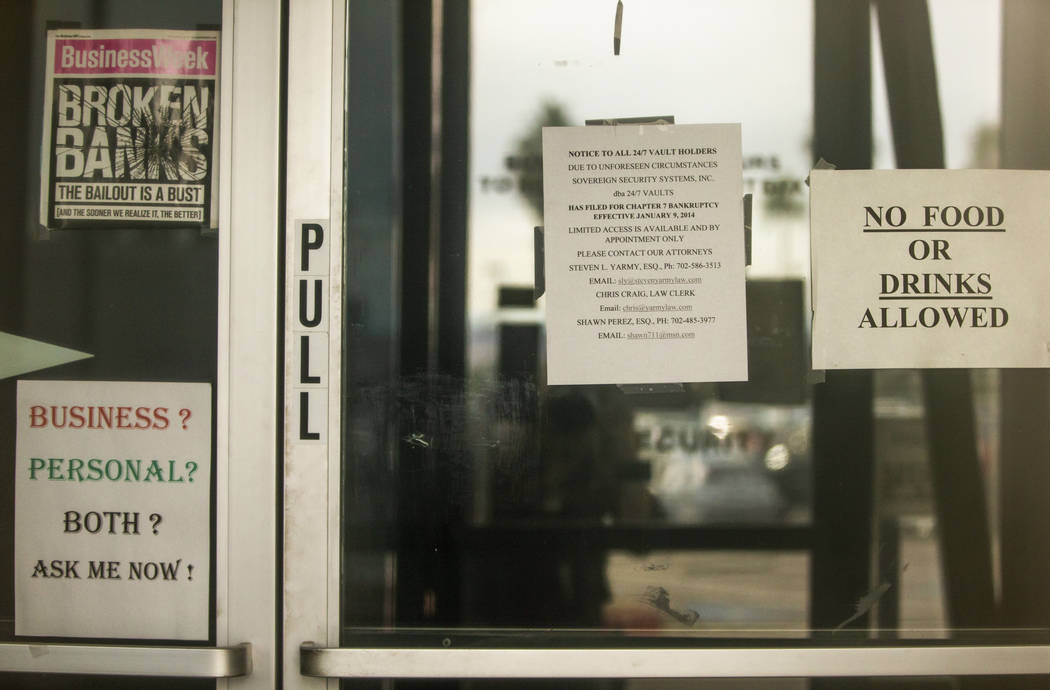

Almost six years after it closed, you can still see the remnants of the once-troubled vault company.

The large, colorful sign and row of track lights and cameras above the entrance remain intact. On one side, the company is flanked by an empty storefront, and on the other side there is now a house of worship with a large banner outside calling itself a “Church for the Unchurched.”

A lawsuit, then bankruptcy

Las Vegas couple Bradley and Lori Burns, who lost $650,000 in cash and jewelry, sued Shaikin months after the 2012 robbery over false security promises. They won a $1 million judgment in October 2014 but never collected the money because Shaikin had died a month earlier just short of his 88th birthday.

Their lawyer, Michael Lynch, said Shaikin’s promises were nothing but a scam.

“It was a snow job intended to instill a false sense of confidence in nonexistent security features at the vault,” Lynch said.

In a sworn affidavit in the case, Shaikin denied any knowledge of the robbery, and he contended he was not liable for the items stolen from the Burnses. Shaikin argued that the couple’s contract was with his corporation Sovereign Security Systems, not him. At the time, Shaikin was sole officer of the corporation.

He said clients knew from the contract that the contents of their boxes were “not insurable by 24/7 Private Vaults,” and they were encouraged to get their own insurance.

Early in the bankruptcy case in 2014, there was yet another break-in, which authorities also suspected involved Shaikin’s employees. The suspects broke into the vacant store next door in the same manner as the 2012 robbery and drilled open additional boxes. It is unclear what, if anything, was taken.

The vault shut down a couple of months later.

Shapiro was left to deal with those who lost their valuables and get the personal property back to the rest of the anonymous clients.

“It was extremely difficult because I had literally no names,” he said. “When people signed in, it was simply with an ‘X.’ So I had to literally drill those safes to see if I could figure out whose items they belong to based upon the items contained in the safes.”

24/7 Private Vaults contrac... by Las Vegas Review-Journal on Scribd

He added, “It had to be the most unique case that I’ve ever been involved in. I came into this case seeing literally 1,000 anonymous safe deposit boxes, not knowing if they were full or if they were empty. I ended up running the business for a little while trying to get people to come in to get their items.”

Shapiro said he never found drugs in the boxes.

“Rather, I saw a lot of cash, millions of dollars in cash,” he said. “I saw lots of gold, silver, coins, different types of collections from coin collections to stamp collections, baseball card collections, divorce decrees, wills, trusts and things of that nature.”

The boxes also included poker chips, betting slips, passports, search warrants, death certificates, comic books, hard drives and cellphones, Shapiro said.

Shaikin had bragged that he had customers from around the world, including China, Russia and South America.

Shapiro recalled one well-known client, hip-hop producer Mally Mall, who drove up in a Rolls-Royce in 2014 looking for a diamond ring in his box. Shapiro asked to see the ring, but Mall never showed it to him as he left complaining about something being missing from his box.

Mall pleaded guilty in October to a federal charge of running an illegal prostitution business and is to be sentenced in March. He could not be reached for comment.

Most of 24/7 Vaults’ clients eventually got back their assets, but about 200 boxes, with roughly $1 million in cash and property, were not claimed, Shapiro said.

The trustee turned over the contents to the Nevada treasurer’s unclaimed property division in November.

Charges from the robbery

Two of the criminal defendants, Hurbace and Whitmore, are charged in a 32-count federal indictment with planning and carrying out the robbery with other unknown suspects. They also face felony counts of money laundering and interstate transportation of stolen property. McDaniel is not charged with the robbery but faces money laundering and stolen property counts.

“The 2012 robbery had several hallmarks of an inside job committed by employees,” federal prosecutors said in court documents late last year. “The robbers knew how to enter the building without detection, the code to the alarm, how to get into the vault area without passing the iris scanner and how to drill into the vaults to open them.”

Hurbace’s lawyer, Assistant Federal Public Defender Raquel Lazo, declined to comment. Lawyers for McDaniel and Whitmore, who also uses the last name Cordova, both said their clients did not participate in the robbery.

“The government doesn’t have a monopoly on the truth,” said Todd Leventhal, who is defending McDaniel. “In this case, they charged the wrong people.”

Defense lawyer Robert Draskovich, who represents Whitmore, said she passed an FBI polygraph and “maintains her innocence. She was not involved in any way.”

Six months after the vault robbery, Whitmore deposited $269,000 into her bank account, prosecutors allege in court papers. Whitmore, a former manager of the business, earned $52,000 a year at 24/7 Vaults at the time.

Hurbace bought a car with $16,833 in cash a month after the robbery and six weeks later purchased a house in California with $141,636 in cash, prosecutors wrote. In 2015, Hurbace tried to sell a high-end watch stolen in the robbery from Bradley Burns. An appraisal Burns provided police valued the watch at $345,000.

McDaniel and Whitmore, who live together, are also charged with illegally transferring an unknown amount of cash from the vault to themselves during the bankruptcy proceedings between Jan. 31, 2014, and Feb. 4, 2014. The charge is related to the burglary, believed to have occurred during that period.

The couple are not facing charges in the 2014 break-in. But the government alleges in the indictment that McDaniel and Whitmore engaged in six-figure financial transactions after the 2014 theft. Prosecutors have not explained why McDaniel and Whitmore were not charged with that burglary.

The day after the break-in was discovered, prosecutors wrote, McDaniel deposited $387,200 in cash into a bank account in his mother’s name. Months later, he deposited another $390,000 in cash into two of his bank accounts. Whitmore deposited $190,000 into her bank account six months after the burglary, prosecutors alleged.

McDaniel and Whitmore admitted to FBI agents that they had stolen money from safe deposit boxes on other occasions between 2008 and 2009. But both denied participating in the 2012 robbery.

They are to stand trial before U.S. District Judge Andrew Gordon on May 26.

Contact Jeff German at jgerman@reviewjournal.com or 702-380-4564. Follow @JGermanRJ on Twitter. German is a member of the Review-Journal’s investigative team, focusing on reporting that holds leaders and agencies accountable and exposes wrongdoing. Support our journalism.