Price gap between new and resale homes nearing $100k in Las Vegas

Las Vegas’ housing market has seen fewer sales, slower price growth and a big jump in available listings this year.

Despite the downshift, one thing doesn’t seem to have changed much: The price gap between new and used is still, well, gaping and substantially wider than the national average.

The median sales price of a newly built single-family house in Southern Nevada was around $389,450 in July, compared with $295,000 for a previously owned one, a gap of almost $94,450, according to data from Las Vegas-based Home Builders Research.

Nationally, the median sales price of a new single-family home was $310,400 in June, compared with $288,900 for a resale, a gap of $21,500, according to figures from the National Association of Home Builders.

Of course, prices vary for new homes and resales and depend on such factors as size, location and condition. Also, buying new isn’t always the pricier route, as you can find resales in, say, Summerlin that cost more than what builders are offering in other parts of the valley.

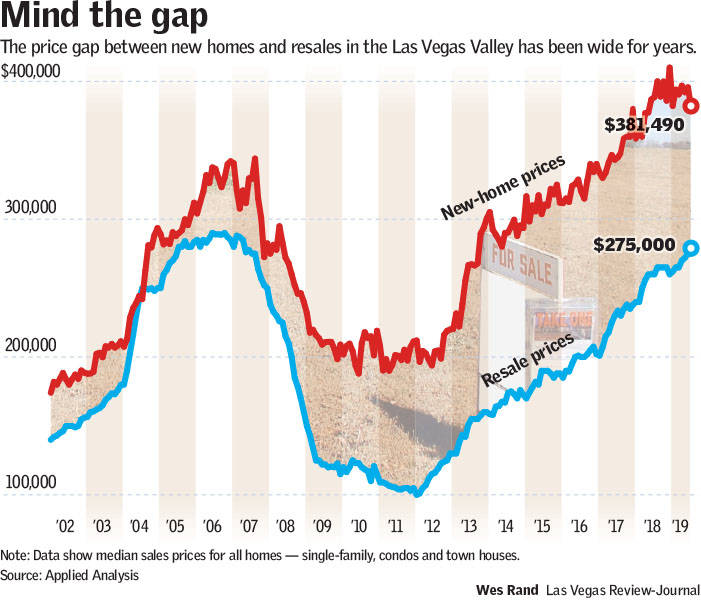

But at median levels, the price gap between new homes and resales widened in Las Vegas as the economy spiraled, and it hasn’t slimmed down yet, even as the gap narrowed nationally.

Overall in the U.S., the price gap was about $20,000 for three or four decades before it peaked at $80,000 to $100,000 over the past few years and then shrank in the past several months as mortgage rates climbed, according to Robert Dietz, chief economist at the National Association of Home Builders.

Coming out of the recession, the price difference widened as developers focused on bigger, more expensive houses, Dietz said. He pointed to higher regulatory costs in that period and noted that it’s easier for builders to pass costs along to high-end homebuyers.

In Las Vegas, the gap wasn’t nearly as wide in the early and mid-2000s as it is now. Prices plunged after the economy crashed, though with the valley awash in foreclosures and underwater houses, resale values fell hardest, according to data from Las Vegas consulting firm Applied Analysis.

The bounce-back has been uneven. Builders’ sales prices have blown past pre-recession peaks, but resale prices are still below their bubble-era highs.

The result: The median price of a new home has been more than $100,000 above that of a resale since 2013, according to Applied Analysis, whose figures encompass single-family homes, condos and townhouses.

Applied Analysis co-owner Brian Gordon said new homes in Las Vegas tend to be an average of about 500 square feet larger than previously owned dwellings. New-home prices also account for land, material and labor costs, and Gordon said the megaprojects in town are putting upward pressure on construction workers’ wages.

Land prices also have been climbing, and as long as dirt keeps getting more expensive, so will new houses, Home Builders Research President Andrew Smith said.

The yawning price gap doesn’t help builders, as it can give buyers a big incentive to shop for a resale. But both sides of the market have tapped the brakes this year.

Nearly 7,770 houses were on the market without offers at the end of August, up 33.5 percent from a year earlier, according to the Greater Las Vegas Association of Realtors, which pulls data from its resale-heavy listing service.

Moreover, builders closed 5,042 sales of single-family homes in Southern Nevada this year through July, down 5 percent from the same period in 2018, Home Builders Research reported.

Smith, however, said the builders’ sales drop isn’t “alarming.” Despite the price gap, demand is there.

“People are still buying new houses,” he said.

Contact Eli Segall at esegall@reviewjournal.com or 702-383-0342. Follow @eli_segall on Twitter.