Treasure Island owner stays upbeat on Las Vegas prospects

Phil Ruffin made nearly $1 billion when he sold the New Frontier to a real estate investment group in 2007.

But the Wichita, Kansas, businessman and friend of President Donald Trump said he has no intention of repeating that feat.

The 82-year old said he has turned down a “huge’’ offer from a Chinese company as well as two local operators for TI, which he now owns, because Strip assets are “irreplaceable.”

“They sat in that boardroom and wanted to make an entry in the United States, but we just didn’t want to do it,’’ Ruffin said about his meeting with the Chinese company last year.

“There isn’t any price they could throw at me that would interest me,’’ he said during a recent interview in his office at TI. “Money is not that valuable. Assets are valuable, especially when they are irreplaceable.’’

Ruffin didn’t disclose the Chinese company that offered to buy his property.

Sole ownership a rarity on Strip

The son of a grocery store owner, Ruffin is odd man out on Las Vegas Boulevard these days.

Wall Street’s acceptance of gambling in the 1980s has led to Strip casinos being run and owned by large, publicly traded corporations or the biggest private equity funds.

Ruffin’s property is surrounded by casinos owned by MGM Resorts International, Las Vegas Sands and Wynn Resorts, which have a combined market value of about $100 bil- lion.

Larger gaming corporations have been snapping up smaller competitors at the fastest clip since the start of the great financial crisis last decade. There have been more than 20 gaming industry acquisitions totaling $15 billion over the past two years, and that trend is set to continue, according to Deutsche Bank.

“It is relatively rare historically for any casino to be solely owned,” Las Vegas historian David Schwartz said. “Most of the owners we think about as sole owners — Benny Binion, Sam Boyd and Jackie Gaughan — actually had other investors in the project with them.”

New Frontier

Ruffin first entered the ranks of Strip casino owners when he bought the struggling New Frontier, a 984-room property once owned by Howard Hughes, for $167 million in 1998.

Nine years later, he sold the 66-year old property for $1.2 billion, achieving the highest price ever per square foot for a Strip property.

“The Frontier was a land play always. The land was 100 times more valuable than the hotel,” said Ruffin, who owns land in Kansas, Florida and Belize, with several Marriott-branded hotels.

Cash rich when the financial crisis rolled around in 2008, Ruffin was able to scoop up the 2,885-room TI, then called Treasure Island, for $775 million from debt-ridden MGM Resorts. Treasure Island was built by developer Steve Wynn with a pirate theme, and the property turns 25 this year.

The businessman said he remains very optimistic on the long-term outlook for Las Vegas growth and plans to hand TI to his heirs.

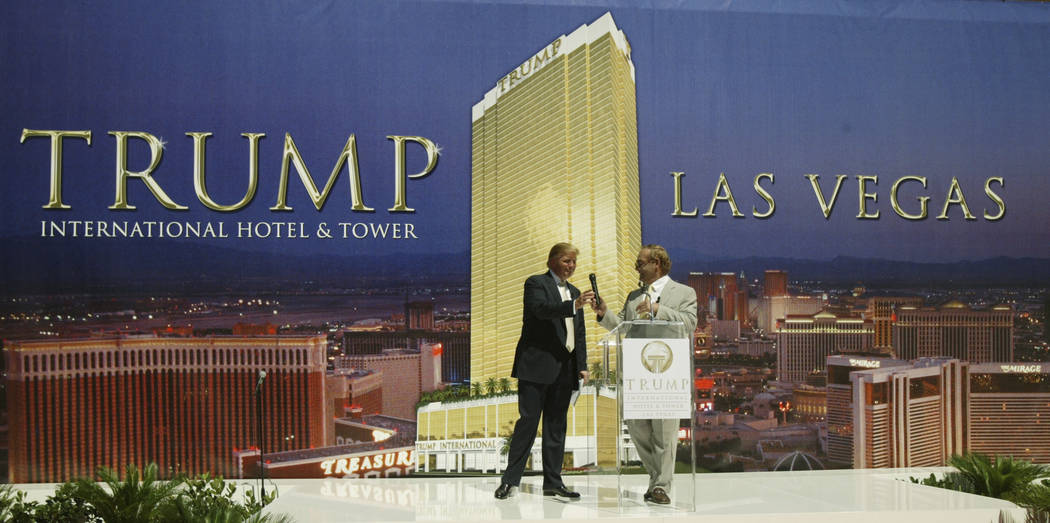

Ruffin said he expects TI and Trump Tower, which he co-owns with Trump, to benefit from development of three projects just to the north.

Genting is building the $4 billion, 3,000-room Resorts World Las Vegas, and the LVCVA has started on a $1.4 billion convention expansion. Wynn Resorts this month announced plans to build a 2,000-2,500-room hotel in the next few years.

“We see nothing but big upside for us,’’ Ruffin said, referring to developments on the north Strip. “We are very positive on Las Vegas. It is going to grow from here.”

His Las Vegas properties posted a strong 2017, he said, without giving profit numbers because they are privately held.

Trump Tower’s earnings before interest, taxes, depreciation and amortization rose 17 percent to 20 percent last year, while TI’s increased 10 percent to 12 percent, he said.

Ruffin is reinvesting some of that money into TI to keep up with competitors. The hotel is upgrading its 220 suites and will refurbish its 2,665 rooms. About 10 Strip properties have recently completed or are carrying out large-scale room renovations.

Ruffin didn’t disclose the amount of the investment, but similar size upgrades at other Strip properties have generally been upward of $100 million.

“We could use some more rooms. But we don’t have any more dirt,” he said, referring to land. “We have expanded as far as we can. So we just upgraded the rooms, and hopefully we can get (the profit boost) in the rate.”

The hotel will modernize the buffet and build a sports bar.

Ruffin said he wouldn’t even consider merging with someone like Boyd Gaming, which is seeking to acquire a Strip asset. Being sole owner enables you to “make quick decisions. We like it that way.’’

Though he sold his 4 acres nearby on the Strip to Wynn Resorts in December, the businessman said he is still interested in acquiring other Strip assets. The Mirage isn’t the only one he has made an offer for.

“We looked at the Strat,” he said, referring to the Stratosphere. “We made a bid, but we came in late I guess.”

Golden Entertainment eventually acquired the Stratosphere and three other properties from American Casino & Entertainment Properties.

He said he has no interest in off-Strip assets and has turned down inquiries for properties like the Lucky Dragon.

Ruffin said he didn’t repurchase the long-abandoned New Frontier property — despite wanting more Strip assets — because the development costs were beyond his means as a private owner.

“The problem for me is that, for a new hotel-casino development, I would have to spend at least $3 billion. It needs a public company to develop,” he said.

Wynn Resorts recently paid $336 million for the land, once considered the site for the Alon. Wynn Resorts now plans a new hotel-casino, Wynn West, on the property.

Work day

Ruffin arrives at work every day before 6 a.m. and speaks with managers at his other business operations scattered around different time zones about investments and cash positions.

His business interests span casinos, commercial real estate, hotels, oil fields, racetracks and truck production.

Ruffin also checks his diversified portfolio of stocks, which include Wynn Resorts, Las Vegas Sands and MGM Resorts, on a Bloomberg terminal beside his desk. He knows the price of Western Texas Intermediate and Brent Crude oil down to the dollar.

He spends part of his day going through comments left by TI guests, which can be about their experience with employees or their views on everything from the size of the TV to pool hour operations. He discusses the reviews with the employees.

“I personally read every one, and we respond to every one. Sometimes customers are better managers than some of your own people.’’

The Review-Journal is owned by the family of Las Vegas Sands Corp. Chairman and CEO Sheldon Adelson.

Contact Todd Prince at tprince@reviewjournal.com or 702-383-0386. Follow @toddprincetv on Twitter.

Ruffin on Trump

— Ruffin said he is “thrilled to death” by Trump’s economic policies, including corporate tax cuts. Ruffin shares the president’s view that the cuts will make U.S. corporations more competitive and create more jobs domestically. Ruffin did not disclose the effect of the cuts on Treasure Island.

— Ruffin said the rally in stock prices is boosting Americans’ 401(k) retirement savings, reiterating one of Trump’s new talking points. “America looks like it is really going to boom for a while,” he said.

— Ruffin said his main concern is the expanding deficit, which is now $20 trillion and growing due to the tax cuts. “At some point, he is going to have to address that,” he said referring to Trump.

— Ruffin did have one piece of advice for his friend that will likely go unheeded by the U.S. president. “No tweets.”