STEVE SEBELIUS: Democrats fail to raise mining tax in special session

Once again, Nevada lawmakers tried to increase taxes on the mining industry.

And once again, the effort failed.

Why is it so hard for Nevada when the state is literally sitting on gold?

Here are six reasons Nevada doesn’t tax mining more.

1. The North was against it. In 2011 and again in 2013, the Nevada Legislature passed a joint resolution calling for repealing the 5 percent cap on the net proceeds of minerals in the state constitution.

Those measures passed with bipartisan majorities in both houses, twice, although among the Republicans who voted no, most hailed from northern and rural Nevada.

When the measure came before voters in 2014, it failed by the narrowest of margins, just 3,209 votes out of more than 530,000 cast. But the pattern was repeated: The measure failed — often overwhelmingly — in every single county but Clark, where it passed 55 percent to 45 percent.

Oh, the man most directly behind that measure? He was a Republican, too: Former state Sen. Michael Roberson. But he’s from Las Vegas.

2. The North is still against it. In the special session, Assembly Bill 4 would have kept the overall cap on mining taxes in place but only allowed the industry to keep 60 percent of its deductions. But in the Republican caucuses of both houses — where there are more members from northern and rural Nevada than from Southern Nevada — it failed.

3. Former Gov. Jim Gibbons. It was Gibbons — a northerner — when running for governor for the first time, conceived of an initiative to amend the constitution to require a two-thirds vote to raise taxes. Gibbons lost that race, but his initiative passed, twice, and was adopted by voters. Raising taxes has been difficult ever since.

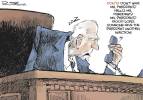

4. The current governor didn’t really push for it. Going into the special session, Gov. Steve Sisolak was asked about raising taxes alongside budget cuts as a means to balance the budget.

“But it’s gonna to be up to the Legislature,” he replied. “I’m not naïve. I knew they need one more vote in the Senate and they need to hold everybody else. That remains to be seen, what leadership wants to do, what appetite there is. And I don’t want to guess as it relates to that. I’ll just wait and see what they come back with.”

Sisolak, at the very least, made history: No governor has ever wanted to leave anything up to the Legislature at any time in the history of the state. Would things have been different had Sisolak campaigned for it? We’ll never know.

5. Tactical mistakes. Democrats need to learn, you can’t cajole Republicans into voting for a tax. They tried that in 2003, and it took two special sessions and God himself allegedly telling a Republican lawmaker it was OK to vote for a tax to end the madness. (True story.)

But divine intervention didn’t happen in the most recent special session, and there was nobody with the mastery of say, former Gov. Brian Sandoval, the last person to persuade the Legislature to raise a major tax.

Instead, Democrats tried first to ram and jam a vote in the dead of night and then persuade a pliable Republican to briefly say he’d vote yes if the money went to education. But even after the tax was amended to apply only to big mining companies, the Republican wall did not break.

6. Legitimate arguments on both sides. Pro-tax advocates are right when they say once the gold is gone, so are the mining companies, and the public should benefit from minerals dug up from publicly owned land. And objections from the industry that “single-industry taxation” is bad policy fall flat when you consider that single-industry tax exemption is perfectly fine.

But pro-mining advocates are right when they argue mining is a key part of the rural economy. It pays higher-than-average wages and offers good benefits. It has, in times of economic trouble, agreed to pre-pay its taxes. Despite billion-dollar revenues, there is something to the notion that if gold becomes too expensive to produce, mining will slow down or stop (although the industry isn’t there just yet).

There may yet be a mining tax in Nevada. Political demographics have changed since 2014, and a statewide initiative today might pass where it wouldn’t have six years ago. The Legislature could pass — with simple majorities — a resolution to get it on the ballot again, although the soonest it could appear would be 2024.

Until then, because of politics, Nevada’s oldest industry will continue to enjoy Nevada’s oldest tax break.

Contact Steve Sebelius at SSebelius@reviewjournal.com or 702-383-0253. Follow @SteveSebelius on Twitter.