SAUNDERS: Where have all of Washington’s fiscal conservatives gone?

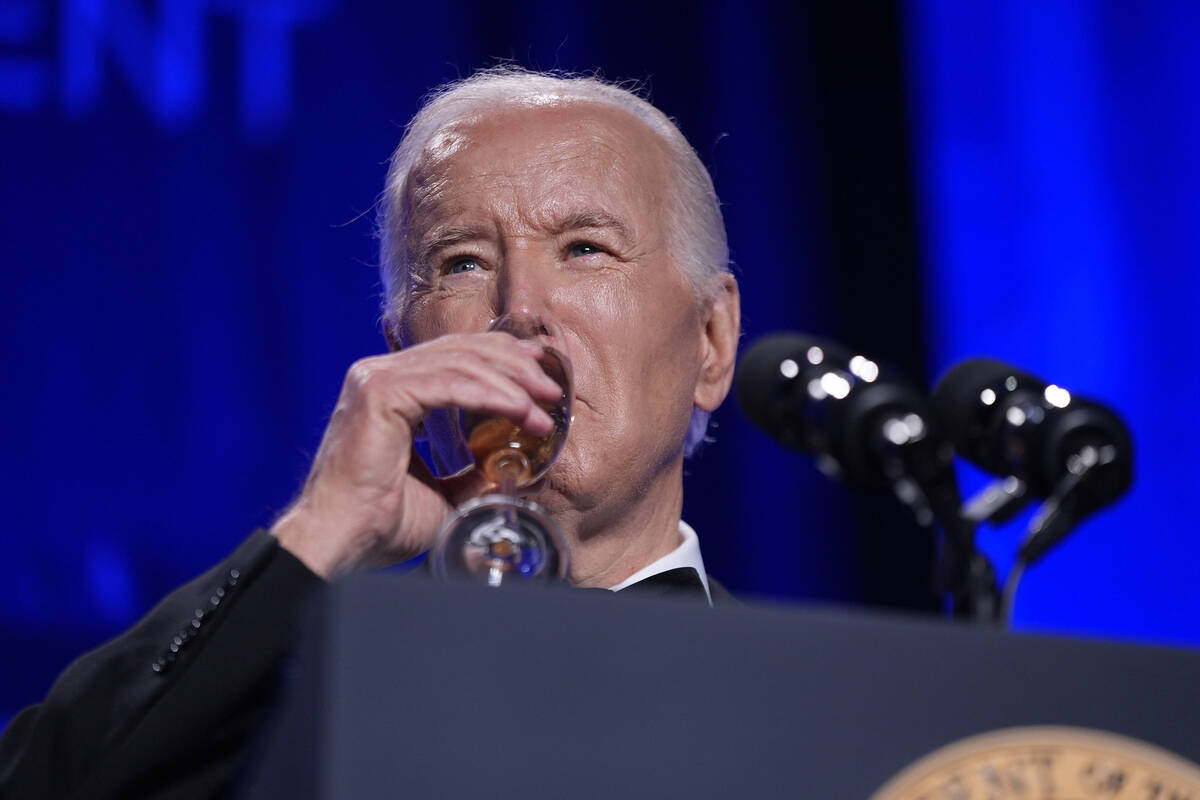

WASHINGTON — The April jobs report found the U.S. economy added 175,000 new positions, but it fell below expectations. Unemployment nudged up to 3.9 percent last month, which at least keeps unemployment below 4 percent for 27 months in a row. Despite the middling reports, President Joe Biden crowed in a statement, “the great American comeback continues.”

The voting public is not on board. According to the RealClearPolitics polling average, 65 percent of Americans think the country is heading in the wrong direction, and just under 25 percent see the country headed in the right direction.

“The reason people are so unhappy is they know where they stood three years ago and they’re still trying to catch up,” David Ditch, an economist with the conservative Heritage Foundation, told me Friday.

To ward off stagnation, the Federal Reserve wants to reduce inflation to 2 percent.

It’s headed in the wrong direction, according to Ditch, co-author of a Heritage paper released in September, “The Road to Inflation: How an Unprecedented Federal Spending Spree Created Economic Turmoil.” The paper laid out how COVID-19 pandemic spending and subsequent overspending in the Biden years “has left the U.S. with a weakened economy, an inflation crisis, and a looming debt crisis.”

But you knew that.

It took 215 years for the national debt to reach $7 trillion. In the wake of COVID, from March 2020 to June 2022, Washington overspent another $7 trillion.

It was understandable that in 2020 then-President Donald Trump pumped money into the economy during (excessive) government shutdowns, but it didn’t end there.

I was there in 2019 at a Peter G. Peterson Foundation summit when Trump Chief of Staff Mick Mulvaney admitted he didn’t know if the administration could get the annual deficit below $1 trillion. That was before COVID.

Biden’s increased spending — including a $95 billion national security package to help Ukraine and Israel (which I support) and efforts to “forgive” student loan debt (which I do not support ) — only will make it harder for future elected officials to balance the books. And when the economy is vulnerable, you don’t raise taxes.

How does America fund the next emergency?

Now the national debt is more than $34 trillion, or over $100,000 for every man, woman and child in America. Five years ago, the per-person debt was around $67,000.

And practically no one is talking about it.

“There’s almost no media coverage about budget issues,” Ditch lamented.

I remember when presidential candidates talked about what they would do to curb deficit spending.

Now Biden, who calls this an economic comeback, campaigns on spending more tax revenue and Trump promises more tax cuts, both of which inevitably will add to the crushing debt burden no matter what the campaigns say.

In Congress, the reliable rump of fiscal conservatives in both parties has evaporated, only to be replaced by ideologues who never think about paying the bills they’re running up.

But we know who will pay for the red ink. Everyone. The only way to stop a future of growing IOUs is for voters to start pushing both parties to remember that someone has to pay for the party.

Contact Review-Journal Washington columnist Debra J. Saunders at dsaunders@reviewjournal.com. Follow @debrajsaunders on X.