EDITORIAL: Action needed to address the Social Security crisis

There are different types of crises.

Some are self-created. President Joe Biden has a real talent for this. Think: Pulling our military out of Afghanistan before ensuring U.S. citizens and Afghan allies had a chance to escape. Or the surge in illegal immigration caused by rolling out the welcome mat along the Southern border. Or rising gasoline prices after shutting down the Keystone Pipeline. Or runaway inflation after passing a massive spending package.

Other crises are unexpected. Two years ago, who would have predicted the ravages caused by a novel coronavirus?

But other crises are slow developing. They’re obvious for all to see, yet few people want to take the short-term steps necessary to head off larger problems in the future. That’s the situation America finds itself in with Social Security.

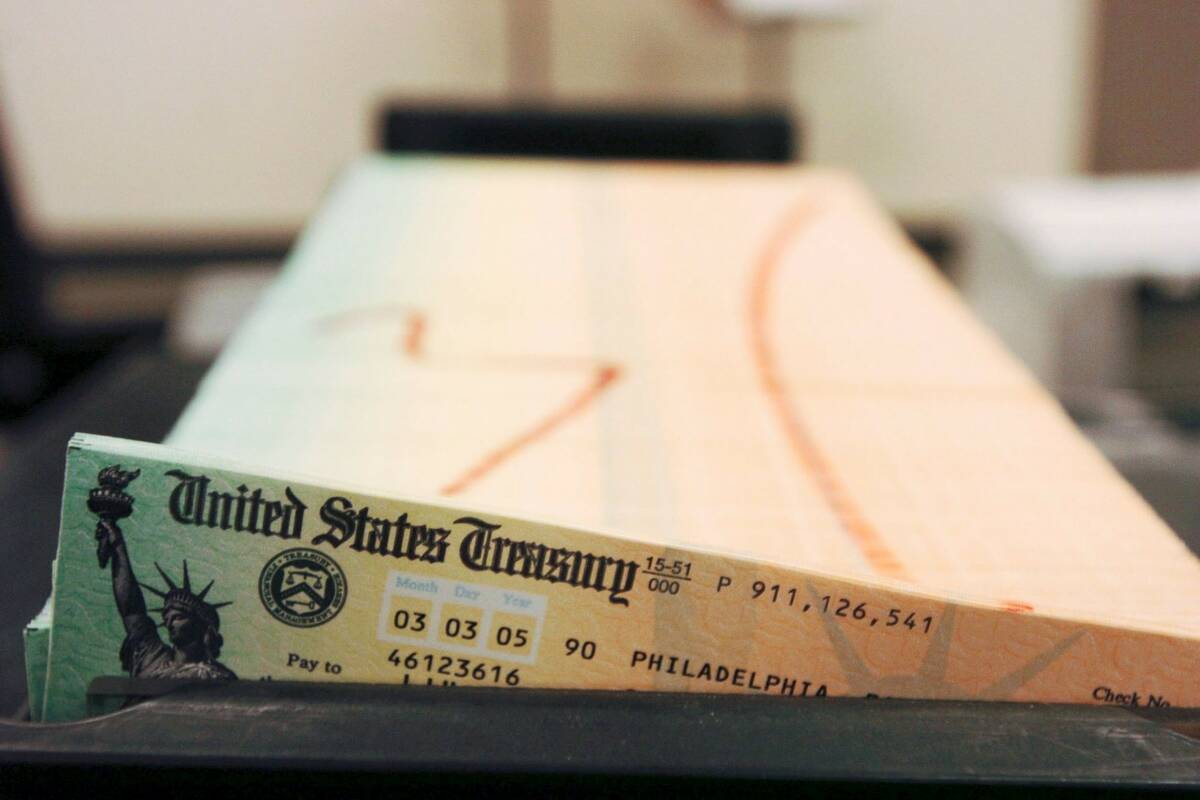

Last week, Social Security trustees released the program’s annual report. This year, Social Security is expected to pay out more in benefits than it takes in. The report also projected that the Social Security Trust Fund will be empty by 2033, which is one year sooner than its previous estimate. If you include the Disability Insurance Trust Fund, benefits last until 2034.

This represents a massive deficit. Heritage Foundation analysts estimate that Social Security is short almost $20 trillion over the next 75 years.

That should concern every American, especially those who rely on Social Security. The report states that after the trust funds run out, “Continuing tax income will be sufficient to pay 78 percent of scheduled benefits.”

Ignoring this reality makes it only worse. From 2010 to 2020, Social Security’s deficit went from $6.5 trillion to $19.8 trillion, according to Heritage. Numbers that large are difficult to understand, so it helps to put it in personal terms. In 2010, Social Security needed a 2.15 percentage point increase in payroll taxes to remain solvent. In 2020, that had increased more than 50 percent to a 3.36 percentage-point increase. That would boost Social Security taxes from 12.4 percent to 15.76 percent.

How much easier this problem would have been to solve a decade or two ago.

But sober, clear-minded leadership on this issue is hard to come by. It’s certainly not coming from Mr. Biden and congressional Democrats, who are now pushing for another $3.5 trillion spending bill.

Social Security is on the road to insolvency without structural changes. America is broke. If the country’s leaders aren’t willing to institute reforms that would address those facts, they should at least stop making the country’s fiscal problems worse.