Senate kills Dems’ attempt to overturn 2017 Trump tax rules

WASHINGTON — The Senate on Wednesday rejected a Democratic attempt to give relief to people hit hardest by new limits on how much of their state and local tax bill they can deduct from federal taxes.

The regulations were a key part of the GOP’s 2017 tax code overhaul, limiting the deduction permitted for state and local taxes to $10,000.

Republicans enthusiastically defeated the Democratic move on a 52-43, mostly party-line vote.

The state and local tax, or SALT, provision was a major revenue-raising piece of the 2017 law, permitting that measure’s GOP architects to lower taxes elsewhere in the code. But it caused an uproar and cemented strong Democratic opposition to the measure since capping the SALT deduction was seen in part as an assault on so-called blue states with high concentrations of upper-bracket taxpayers.

Republicans from New Jersey were among those who paid a steep political price, losing ground in wealthier suburbs.

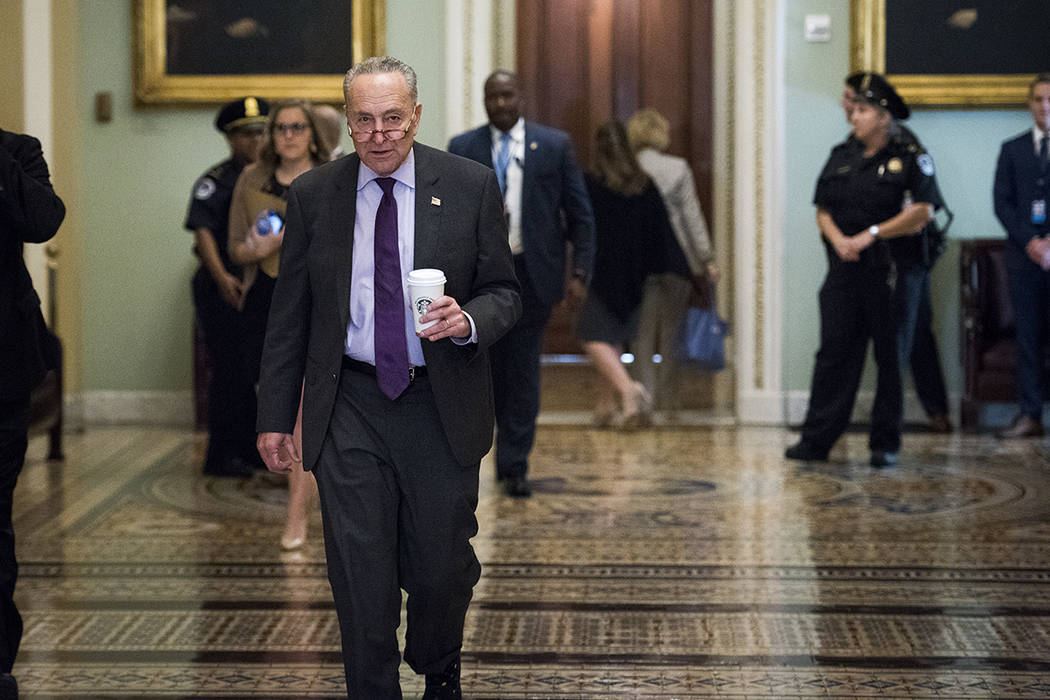

“It’s hurt so many people in New York who are middle class, not wealthy, and in suburbs throughout the country,” said top Senate Democrat Chuck Schumer of New York. “And, by the way, it’s probably one of the major reasons the House flipped from Republican to Democrat. So many of those districts in New Jersey and California, New York, and Pennsylvania were affected by this cap and people rebelled.”

Some high-tax states like New York and California had tried to create workarounds for taxpayers, including creating charitable funds that taxpayers could contribute to in exchange for a state tax credit. The idea was that people could still deduct their charitable contributions from their income for federal tax purposes.

In June, the IRS enacted a rule prohibiting those workarounds. The Democratic plan would have overturned that rule.

Republicans said that the benefits of the Democrats’ failed measure would have overwhelmingly benefited higher-income taxpayers.

“Repealing the SALT cap would give millionaires an average tax cut of $60,000. Meanwhile, the average tax cut for taxpayers earning between $50,000 and $100,000 would be less than $10,” said Majority Leader Mitch McConnell, R-Ky. “The middle-class Kentuckians I represent have zero interest in cross-subsidizing the tax bills of millionaires who live in Brooklyn and the Bay Area.”

One Democrat opposed the move to lift the SALT cap.

“The vast majority of the benefits of repealing the SALT cap would go to high-income Americans,” said Sen. Michael Bennet, D-Colo., one of the Senate’s few remaining Democratic deficit hawks. “Repeal would be extremely costly, and for that same cost, we could advance much more worthy efforts to help working and middle-class families all over the country.”