Sales, gaming tax petitions head to 2021 Legislature

A pair of tax proposals from the Clark County teachers union that would raise more than $1 billion per year for Nevada schools will head to the Legislature next year after gathering more than enough signatures to qualify.

To qualify, the Clark County Education Association needed to gather and submit 97,598 valid signatures from registered Nevada voters. The association said it submitted more than 200,000 signatures for each petition.

One of the proposals calls for a 1.5 percentage point increase in the Local School Support Tax, a component of the state’s sales tax, which would generate more than $1 billion annually. The second would raise another $300 million by increasing taxes on the state’s largest and most profitable gaming establishments. Together, the two proposals aim to raise $1.4 billion in new revenue each year for Nevada.

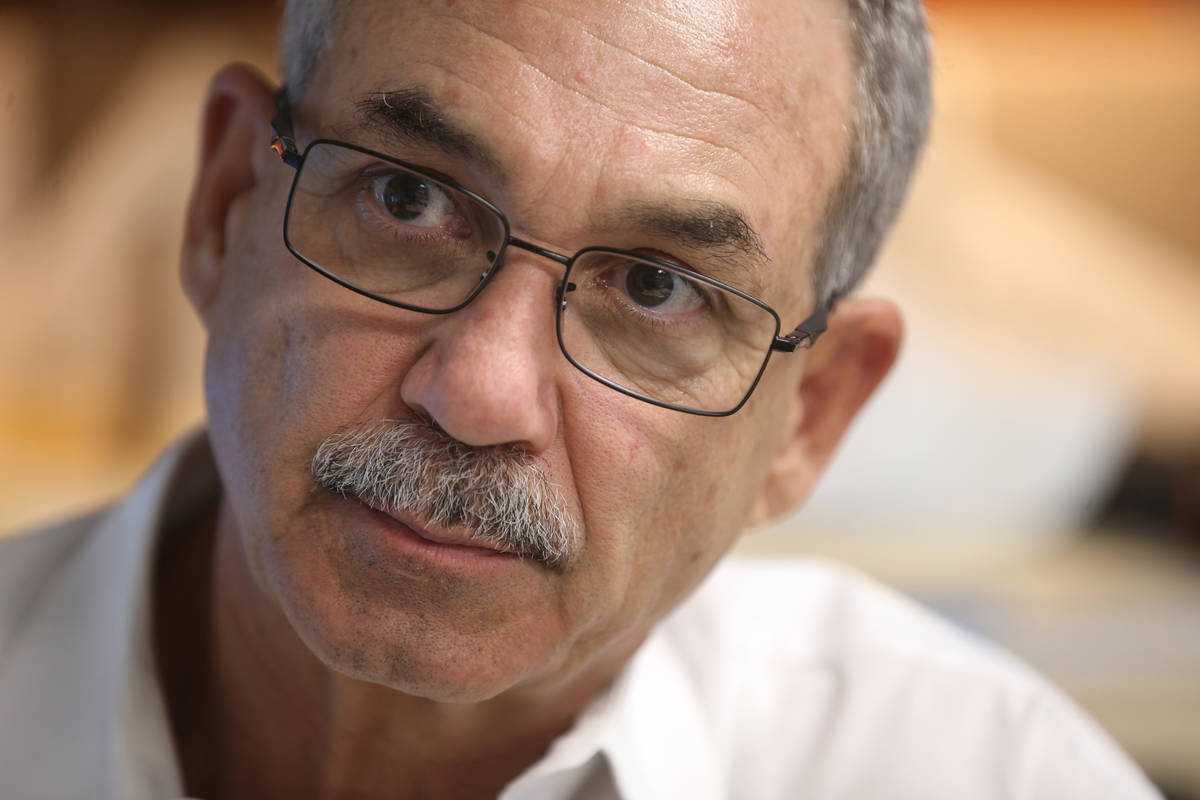

John Vellardita, executive director of the teachers union, said he wasn’t surprised that the petitions gathered the required number of signatures.

He said he was, however, surprised that they gathered more than double the required signatures, especially given that most were gathered amid the COVID-19 pandemic shutdown and related dip in the economy.

The proposals come as the state is facing significant fiscal constraints after Nevada’s economy was ravaged by the COVID-19 pandemic and business restrictions. The state cut hundreds of millions from its current budget this summer, and has told state agencies to plan for 12 percent budget cuts for the next two fiscal years.

The Nevada Resort Association, in a statement Wednesday, said that “now is not the time” to raise taxes on gaming properties, and that it “would further damage Nevada’s recovery efforts, create permanent job losses and further jeopardize capital investment and future economic development.”

The teachers union unveiled the proposals in January — months before the pandemic hit in the U.S.

Vellardita said they “recalibrated” after COVID-19, but said it only reinforced their belief that the state needs to move away from being so dependent on the tourism industry as its major economic driver.

Now that they have been certified, the measures will head to the 2021 Nevada Legislature. If the Legislature fails to act or rejects the measures, the tax proposals would then go on the ballot in 2022 for voters to decide, and would take effect the following year.

Vellardita said their focus now “is to force a conversation in the Nevada Legislature about how do we rebuild and diversify the economy,” after the fiscal constraints that the COVID-19 pandemic has put on the state’s budget.

“And you’re not going to do that without investing in education,” he added.

But Vellardita said they have “absolutely no problem” putting this to voters if the Legislature does not pass it next year.

“If leaders fail to act and the public wants action, it leaves it up to the public to decide that action,” he said.

^

Contact Capital Bureau Chief Colton Lochhead at clochhead@reviewjournal.com. Follow @ColtonLochhead on Twitter.