Nevada lawmakers want to tax fun, sex and fast times

CARSON CITY — All Nevada businesses that offer live entertainment — including brothels, the Las Vegas Motor Speedway, the massive Electric Daisy Carnival and Burning Man — would have to pay an 8 percent tax under a bill to be introduced Wednesday.

Assembly Speaker Marilyn Kirkpatrick, D-North Las Vegas, said Monday that her live entertainment tax bill is nearly completed and will cover “everybody,” ending exemptions for specific businesses and taxing some, such as brothels, that were previously ignored.

Asked specifically whether the tax would include Burning Man, the speedway and brothels, she repeated, “Everybody.”

Kirkpatrick said she did not know whether the tax would be revenue neutral or bring in money for the state. She said her goal is a good tax “policy” that would be fair and affect all entertainment businesses similarly.

Senate Revenue Committee Chairman Ruben Kihuen, D-Las Vegas, said that senators have been working with Kirkpatrick on the entertainment tax bill and that their goal is to catch all businesses that have not had to pay in the past, including strip clubs, the Electric Daisy Carnival, the Las Vegas Motor Speedway and Burning Man

“We want to make sure everyone is contributing,” Kihuen said. “They should pay something. Constituents of ours are making them profitable.”

FLAT RATE

Sales at events such as concerts — everything from admission tickets to concession stand food — is now taxed at 5 percent or 10 percent, depending on the size of the arena, stadium or club. Businesses such as outdoor concerts not associated with casinos, professional boxing matches, the speedway and the Reno Aces and Las Vegas 51s games are specifically exempt.

Another exemption covers clubs and places where the volume of music does not exceed the volume of “casual conversations” of the patrons.

Those exemptions would be wiped away, and the distinction based on the size of the venue — 10 percent for venues with fewer than 7,500 seats, 5 percent for bigger ones — would be replaced by a flat 8 percent tax.

Senate Majority Leader Mo Denis, D-Las Vegas, said eliminating exemptions makes sense.

“If you are looking at it from a tax policy standpoint, there should not be too many exemptions,” Denis said.

But if eliminating exemptions increases the state’s overall revenue, Kirkpatrick’s proposal would trigger a negative response from anti-tax Republicans.

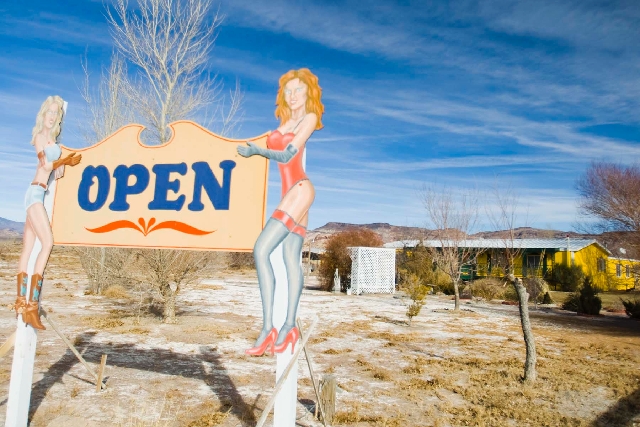

Kirkpatrick would say little about the specifics of her bill, but if she really meant everybody, the state could start taxing entertainment provided in brothels and by escorts.

Brothels and escort services are not specifically exempt from the entertainment tax, so their inclusion would represent a policy change for the state. The Nevada Brothel Association periodically has volunteered to be taxed on the services prostitutes provide, but lawmakers always have rejected them, apparently out of concern it would further legitimize prostitution, which is legal in most Nevada counties.

But there’s a difference between willingness to pay a tax and what the state might want to collect.

George Flint, the director of the Nevada Brothel Association, said he offered Kirkpatrick a $5 per patron admission tax to brothels early this session, “and she said she would take it.”

He added he hopes that the $5 tax is in her bill because brothels cannot absorb an 8 percent tax on the total charges paid by patrons for sex acts.

DETAILS UNCLEAR

Representatives of other business that might be affected by changes in the entertainment tax structure had less to say about Kirkpatrick’s plan.

David Goldwater, a lobbyist for the Las Vegas Motor Speedway, said he understands that Kirkpatrick is removing the entertainment tax exemption the speedway now enjoys.

“I haven’t seen anything yet,” he added. “We look forward to working with her on tax policy.”

The Democrats said last week that they were about to announce their complete tax plan for the 2013 session, but Denis said Monday that the plan wasn’t done and would be released “when we are ready.”

He added that “mining should be taxed (more)” and that the plan will include parts of Senate Bill 400, a proposal by Sen. Tick Segerblom, D-Las Vegas, that would tax gold and silver still in the ground.

“Mining has to be a piece of it (the tax plan),” Denis said.

This tax would be implemented only if voters approve Senate Joint Resolution 15 during the 2014 election. This question calls for lifting the constitutional requirement that minerals be taxed at 5 percent of their selling price, minus deductions.

Denis said Kirkpatrick’s bill will be part of the overall plan, which faces long odds as Republicans and Gov. Brian Sandoval oppose new tax increases.

Democrats need at least one Republican in the Assembly and three in the Senate to secure a two-thirds majority to pass taxes and override a veto.

Assembly Minority Leader Pat Hickey, R-Reno, reiterated Monday that Republicans will want something in return — such as Public Employees Retirement System reforms and bills that reduce spending — before they consider tax increases.

“If Democrats want Republicans to seriously consider their proposals to raise revenues (taxes), they will have to consider our measures (reforms), in order to save taxpayer dollars,” Hickey wrote in his weekly Internet column. “Otherwise, they are DOA (Dead on Arrival) — plain as that … time is ticking away.”

Contact Capital Bureau Chief Ed Vogel at evogel@reviewjournal.com or 775-687-3901.