Mad City Money program teaches youths the value of financial management

Looks, popularity, grades and sports are usual suspects in the priority list of concerns for high school students, but in mid-April, Cheyenne High School students were hit with the financial reality of being an adult.

The school participated in Mad City Money, a financial simulation run by the Center for Financial Empowerment, a nonprofit whose mission is to educate underserved youths and families in the principles of personal finance.

“Our goal is to teach young people about the financial realities of life,” said Abby Ulm, manager of the nonprofit. “Most of us learned the hard way. We want to make sure students are prepared with the skills and knowledge to go out into the world.”

The program is particularly important because Nevada does not offer financial education classes as a prerequisite for high school graduation, and the state continues to rank near the bottom for financial literacy, Ulm said.

Students were given the role of an adult living in the futuristic Mad City. Once they are assigned with their role, they must work their way through the “city” to choose their wants and needs while building a budget.

During the three-hour event, students visited merchants, selected housing and transportation, bought food, luxuries, household necessities and clothing and paid for day care.

“I was given the role of a minister with a kid, and I had to change my plans to buy items that fit my budget,” said participant Italy Mora, 16. “This really opened my eyes. I have a lot of respect for my parents now because they make all of the financial decisions at home. I realize that college gives you a chance to better your life.”

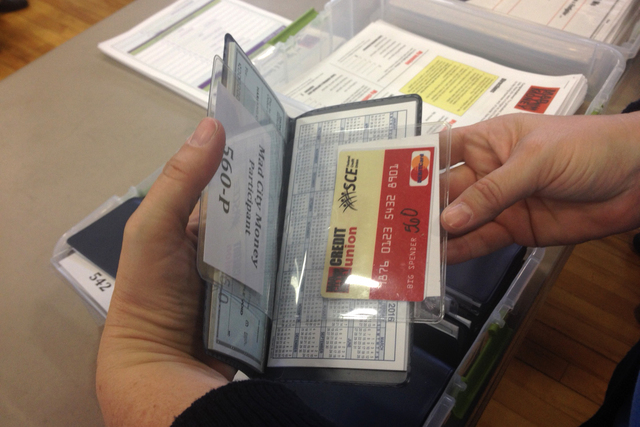

The SCE Federal Credit Union is the primary supporter of the Center for Financial Empowerment, and representatives were at the event to teach students about credit unions.

Approximately 100 students, primarily juniors and seniors, participated.

Dylan Fray, 17, is a student in the high school’s entrepreneurship class and said the program helped him create a better outlook for his business plan.

“This is a big reality check,” Fray said. “I realize now that things are more expensive than I thought.”

The workshop’s goal is to give students a taste of the real world, complete with occupation, salary, spouse, family, student loan debt, credit card debt and medical insurance payments.

They had to do the math and live according to their means or suffer the consequences.

“Financial illiteracy is really an epidemic,” Ulm said. “Those who are between 25 and 34 years old have the second-highest rate of bankruptcies. We want to help young people make better financial choices.”

High schools have two options to participate. They can have students take a two-hour, hands-on simulation or choose a workshop designed for classroom delivery.

Since the program started in 2010, it has taught roughly 1,000 students about financial responsibility, according to Ulm.

“The most common response we get is that kids are really expensive,” Ulm said. “Most students walk away with an appreciation for their parents. They also realize the importance of having a college education since it affects their income and shows them the disparities between going to college and not.”

This is the first time the program has taken place in Nevada, Ulm said.

Damien Hodge, president of the Uplift Foundation of Nevada, contacted Ulm to bring the event to the high school.

“Research shows that minority youths and youths from moderate income backgrounds have less financial training and education than their peers who are (considered well-off),” Hodge said. “There are a lot of smart kids here who could benefit from this program.”

Dr. Zachary Scott Robbins, principal at the school, said he hopes to bring the program to the school every year.

“I want our students to have an opportunity to practice managing money in ways that will lead to community health, wealth and wellness,” Robbins said. “I always say that Cheyenne High School is the pride of North Las Vegas. It’s imperative that we do everything we can to prepare our students for success. They are the future caretakers of our community.”

The nonprofit also teaches a series of financial workshops. The program is free and available to high schools.

For more information, visit center4fe.org.

To reach North View reporter Sandy Lopez, email slopez@viewnews.com or call 702-383-4686. Find her on Twitter: @JournalismSandy.