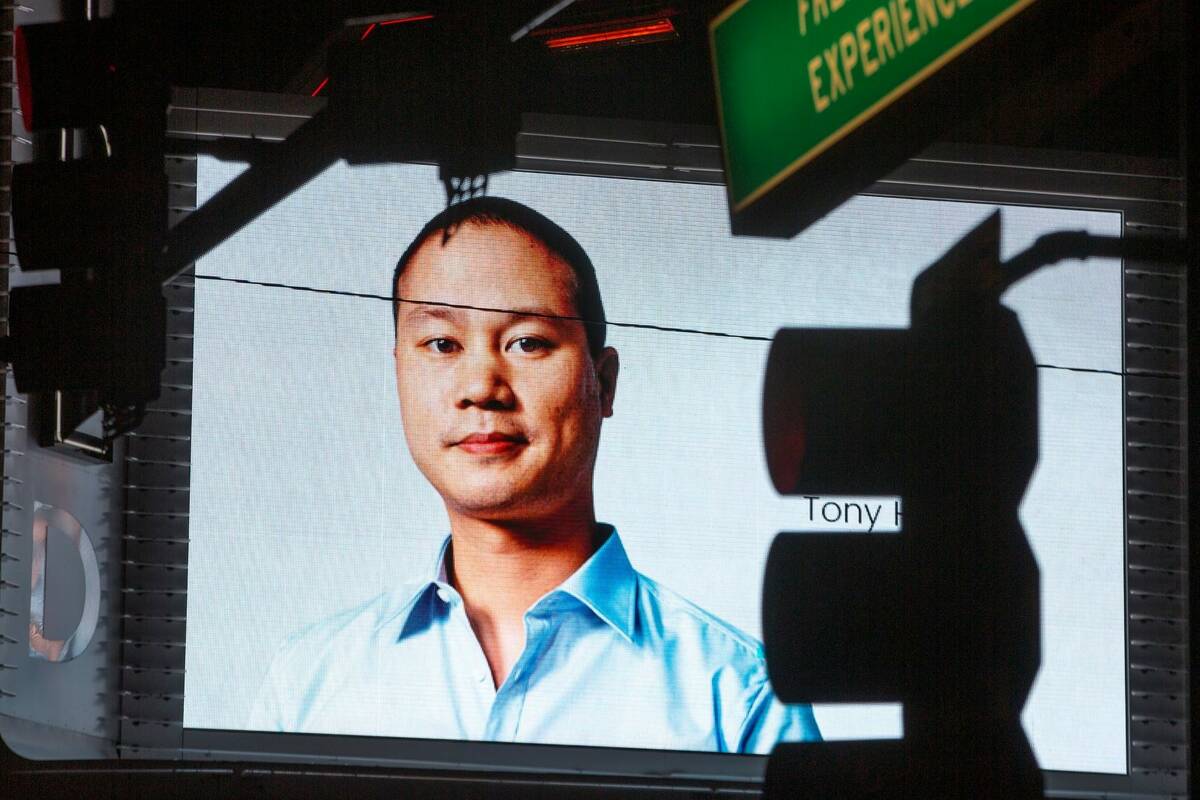

Tony Hsieh’s assets top $500M, filing says

Las Vegas tech mogul Tony Hsieh had assets worth more than $500 million, according to court documents filed this week.

The amount was revealed in a preliminary inventory of the former Zappos CEO’s assets, filed Thursday night in his estate’s probate case. Hsieh was unmarried and died without a will at age 46 on Nov. 27, 2020, from injuries he suffered in a Connecticut house fire.

Hsieh’s father, Richard, and brother Andrew are overseeing his estate. More than $150 million in creditor’s claims have been filed in the probate case from multiple companies and Hsieh’s associates.

According to the preliminary inventory, Hsieh’s assets included limited liability companies, real estate holdings and personal bank accounts, and are worth at least $523 million.

Hsieh’s most expensive real estate property was the Zappos office, 400 Stewart Ave., which is worth $19.8 million, according to the document.

The court filing also indicated he had more than $400 million in one bank account.

Lawyers for Hsieh’s family did not immediately respond to a request for comment.

In previous court filings, Hsieh’s relatives have described his alarming behavior in the year leading to his death, including drug use and delusional thinking. The legal battle over Hsieh’s estate also has featured allegations that people close to Hsieh took advantage of him financially as his health spiraled downward.

Much of the legal battle over Hsieh’s estate involves Jennifer “Mimi” Pham, who, in court filings by her lawyers, was described as Hsieh’s assistant, right-hand person and friend for 17 years.

She also has filed more than $130 million in creditor’s claims, the largest of which, at $75 million, is the “anticipated profit” from Hsieh’s venture in the documentary-movie streaming service Documentary+ that launched in January.

On Friday, Life is Beautiful festival head Justin Weniger filed another creditor’s claim against Hsieh’s estate. The filing, much of which is heavily redacted, stated that a 27.7 percent equity interest in the music festival is “justly due and owned” by Weniger’s company, 1122 Holdings, but that “no payment have been made thereon which are not credited.”

“Weniger files this claim out of an abundance of caution in order to meet the statutory deadline in the event he and/or 1122 Holdings is deemed a creditor of the Estate,” according to the creditor’s claim.

Weniger’s lawyers did not immediately respond to a request for comment.

Other creditor’s claims in Hsieh’s probate case include a $40,000 claim for a custom “ceiling brain prototype”; a $19 million claim from a Utah film studio one of Hsieh’s companies rented in the weeks prior to his death; and a $12.5 million claim from a man who said he was to be paid $450,000 a year under a loosely defined job title that included working on “random projects like koi fish or tree houses.”

Contact Katelyn Newberg at knewberg@reviewjournal.com or 702-383-0240. Follow @k_newberg on Twitter.