Vegas high-rise market had record year

The Las Vegas high-rise market broke its all-time record in 2021 by more than doubling sales from 2020 and recording the highest price ever paid at $16.25 million for a unit at The Martin.

It’s a remarkable turnaround for condo sales after a 2020 that saw sales fall 18 percent to 584, from 692 in 2019, because the COVID-19 pandemic pushed people to want more isolation and single-family homes rather than be around other people. That turned around in 2020 as people felt protected by vaccinations and high-rises reopened pools, gyms, spas, salons, restaurants and other amenities buyers desired.

In 2021, Las Vegas saw 1,321 sales in high-rises of five stories, according to Forrest Barbee, corporate broker with Berkshire Hathaway HomeServices Arizona, California and Nevada Properties who tracks the Las Vegas Realtors association multiple listing service.

The 1,321 sales beat the all-time record of 970 sales in 2017. The number had been sliding every year since then, before 2021.

The annual report issued by research firm Applied Analysis, which tracks 21 high-rises along and near Las Vegas Boulevard and downtown and One Queensridge Place in the west valley, showed there were 1,161 sales in 2021, up from 505 in 2020 and 607 in 2019.

The average price paid for a unit in one of those 21 high-rise towers was $561,252 in 2021, a 6 percent increase over the $527,831 paid in 2020. The average price per square foot was $427, a 6 percent increase over the 401 paid in 2020, according to Applied Analysis.

Realtors say while they’re monitoring the impact from the omicron variant, 2022 is off to a good start for the high-rise market. The strong sales in 2021, however, mean there are fewer units on the market. Applied Analysis reported 228 units were listed at the end of 2021 with an average price of $1.15 million, or $707 per square foot.

In contrast, 580 units were on the market at the end of 2020 with an average price of $783,655, or $552 per square foot. At the end of 2019, there were 458 units with an average price of $757,916, or $543 per square foot.

“The high-rise story is similar (to single-family homes) from a volume perspective, but pricing didn’t necessarily parallel the single-family luxury market,” said Anthony Spiegel, a Realtor with the Ivan Sher Group of Berkshire Hathaway HomeServices, Nevada Properties. He had the No. 2 sale of 2021 at One Queensridge Place for $5.6 million, the No. 4 sale for $4.5 million at One Queensridge Place and the No. 5 sale, a 43rd-floor penthouse at Sky Las Vegas for $4.35 million.

“High-rise is still recovering from an unusually asymmetrical effect from COVID due to social distancing and a move toward lower-density living,” Spiegel said. “Yes, the total high-rise sales were up from 584 in 2020 to 1,321 in 2021, an increase of 126 percent, but average sales prices and prices per square foot were relatively untouched. In some buildings, like One Queensridge Place, you did see record prices for units in the building, but you also saw record lows.”

For 2022, Spiegel said Las Vegas will continue to see a record number of sales and expects to see some price appreciation, especially in buildings outside of the Waldorf Astoria, which has historically retained its high valuations. “As we continue to attract a more sophisticated buyer who is accustomed to higher-density living and specifically high-rises — like those from New York City, Miami, Chicago, San Francisco, as well as internationally — the demand will continue to rise. Remember that Vegas is essentially a single-family market with a sprinkling of high-rise products.”

Frank Napoli, a Realtor with the Frank Napoli Group at Berkshire Hathaway HomeServices who represented the buyer on the No. 3 sale at Park Towers at Hughes Center for $5.5 million, called it a great year for high-rises coming out of 2020 when the rest of the real estate market took off.

“During 2020, a lot of amenities (gyms, pools) were shut down, which really had an impact on-high rises on the Strip, because not only were the building amenities shut down but the neighborhood amenities were shut down as well,” Napoli said. “There was fear because we didn’t know what the virus was. Living in common areas and sharing elevators, hallways and lobbies made people nervous.”

Napoli said the single-family market did well in 2020 because people were moving out of high-rises to get into homes and new buyers were looking at single-family homes instead of condos. That’s now changed, and he has a three-story penthouse unit at Sky Las Vegas on the market for $5.99 million — a unit he calls the “crown jewel” at the high-rise that measures 5,200 square feet and includes four bedrooms and six terraces.

“In 2021, confidence in that type of living went back to normal,” Napoli said. “I see that continuing through this year. High-rise is a great option for anybody looking for a primary residence, secondary home or investment property. I have clients, now, that are taking (investment money) out of neighboring states to Las Vegas where we would be looking at single-family or commercial space, high-rise is now a more common option for these buyers. They rent well, show a good return and the numbers still haven’t caught up to the rest of the market in terms of appreciation.”

Napoli said a lack of inventory of single-family homes helped prompt buyers in 2021 to choose high-rises as a second option. High-rises such as Park Towers and One Queensridge Place also made improvements that enticed buyers, and now the Waldorf Astoria is making upgrades as well, he added.

Barbee said the problems the high-rise market faced in 2020 with confidence levels during COVID-19 and the ability to finance condo units has been overcome. There’s also greater interest because the price or some condos are more affordable than single-family homes.

“There’s suddenly a lot of confidence here in this market, and the other banks are playing ball and providing financing that weren’t before,” Barbee said. “Suddenly, we got sports teams coming from everywhere and there’s got to be a number of people that are speculating that they’re going to be able to rent them out at high prices during events like, New Year’s Eve and the Super Bowl. You can make some short-term rental money. And, regardless of what the prices are here, they pale in comparison to the prices in New York, London and Zurich. They are still a bargain for people used to that lifestyle.”

Michelle Manley, a luxury Realtor for Award Realty, said they’re as busy as ever as they enter 2022. She closed on a two-bedroom condo on the 33rd floor at the Waldorf Astoria for $4.08 million. It was the No. 7 sale for the year with the buyer from the San Francisco Bay Area choosing it as a primary residence.

“There was a time when people wanted out of high-rises because they didn’t want to ride an elevator with someone,” Manley said. “The demand has been incredible since the high-rises opened their amenities back up. The floodgates opened and people are leaving California in droves. It’s the pent-up demand from the shutdown.”

Manley said she doesn’t see buyers frightened off by the omicron variant at the moment but doesn’t know if that will change. There are plenty of people attracted to the high-rise lifestyle, she said.

“We have tremendous interest and are getting a lot of calls,” Manley said. “I put another one-bedroom under contract at the Waldorf (Wednesday). I’m expecting a great market, and for things to continue.”

The highest current listing on the market is for $15 million at Panorama Towers. The three-story unit has more than 8,000 square feet. The No. 2 listing is $10 million at The Martin, which is part of the three-tower Panorama Tower complex that had the record sale of the year at $16.25 million.

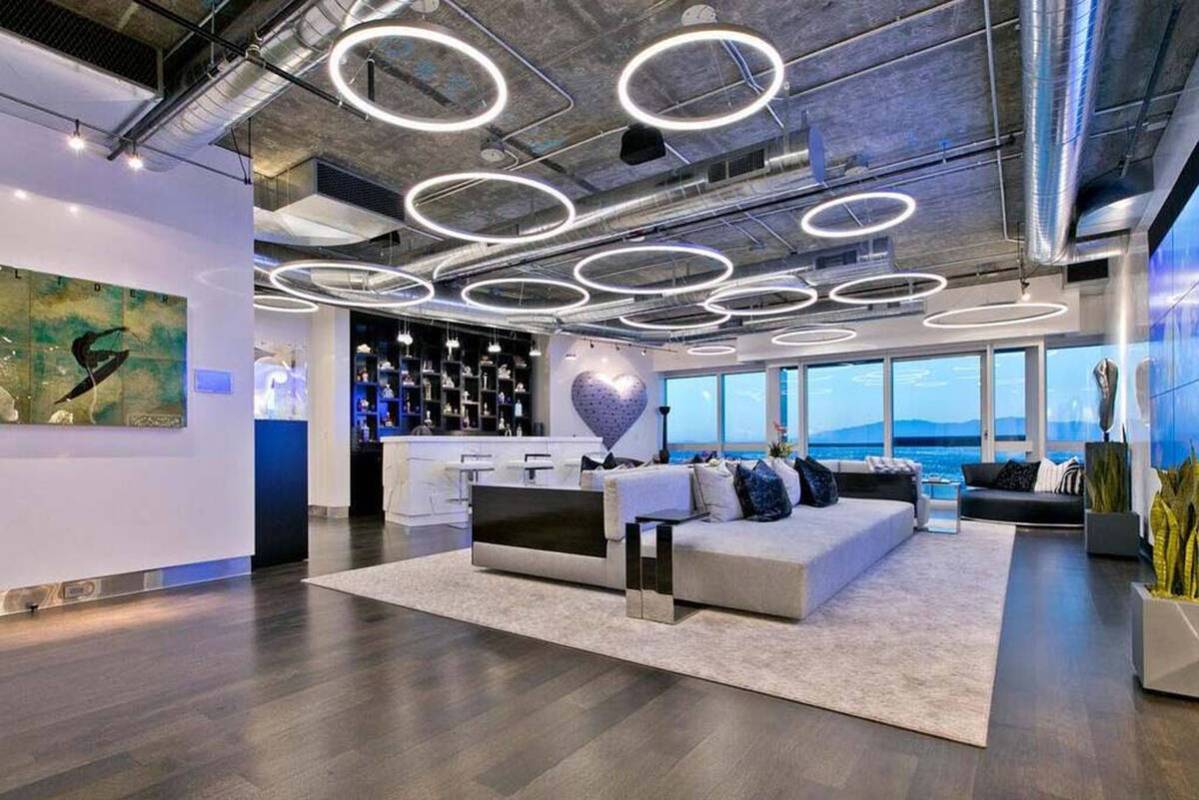

That record-selling penthouse measures 12,940 square feet and has five bedrooms, including two master bedrooms, and eight bathrooms and has an additional 2,000 square feet of balcony space with four terraces. It has a 360-degree view of the entire valley.

It’s equipped with a professional gym, steam room, sauna and cold plunge. It has a catering kitchen, private wine room, bar, game room and theater. It also has a custom circular fish tank that has a bed in the middle where you can watch the fish swim around.

“To have the biggest sale is great,” said listing agent Michael McGraw, a Realtor with Elite Realty who says his previous high was $7.5 million for a single-family home. “It was a one-of-a-kind property. It’s the best year I have had in 22 years of doing real estate. It was crazy during COVID having had it twice, myself.”

Cristine Rosa Lefkowitz, a Realtor with Berkshire Hathaway HomeServices, Nevada Properties, said she sees no sign of the high-rise marketplace slowing. She had the listing on the No. 3 sale of the year at Park Towers and has an active listing for $9.8 million at the top-floor penthouse at Turnberry Place. It covers more than 10,000 square feet with six bedrooms and private terraces. It covers the 38th and 39th floors, and Lefkowitz calls it a house in the sky with high-end finishes.

“I had one of the best years of my career last year,” Lefkowitz said. “Thank God. I’m very grateful because 2020 was a really bad year for high-rises. It proved to be a winner in 2021. The luxury high-rises are strong.”

High-rise sales by towers

1. In its 2021 report, Las Vegas-based Applied Analysis showed that MGM Signature, the condo-hotel property, led the year with 167 sales, far surpassing the 47 in 2020. The average sales price was $310,741, besting the $268,125 in 2020. The average price per square foot was $445 compared with $390 in 2020.

2. Panorama Towers was No. 2 with 118 sales and average price of $770,010. It had 65 sales with an average price of $510,988 in 2020.

3. Turnberry Place was No. 3 with 94 sales and average price of $813,447. It had 37 sales in 2020 with an average price of $942,081.

4. Turnberry Towers was No. 4 with 90 sales and average price of $490,481. It had 45 sales and average price of $484,878 in 2020.

5. Trump Las Vegas, a condo-hotel tower, was No. 5 with 82 sales at an average price of $286,136. It had 45 sales with an average price of $387,155 in 2020.

Among other condos, Juhl had 69 sales, followed by One Las Vegas, 66; condo-hotel Palms Place, 66; Allure, 63; Veer Towers, 60; and Sky Las Vegas, 47.

Among high-end residential towers, One Queensridge Place had 35 sales and an average price of $1.71 million in 2021. It had 10 sales with an average price of $1.55 million in 2020. The price per square foot rose from $495 in 2020 to $522 in 2021.

The Waldorf Astoria had 34 sales and an average price of $2.13 million in 2021. It had 16 sales and $2.3 million average price in 2020. The price per square foot was $1,152 in 2021, equivalent to $1,159 in 2020.

In 2021, Park Towers had seven sales and average price of $1.95 million and price per square foot of $608. In 2020, there were two sales with an average price of $1.92 million and per-square-foot price of $439.