Qurantine streaming and lack of sports put cable TV on the spot

It’s hard to imagine how anyone survived the Spanish Flu outbreak of 1918 without television — let alone without hundreds of thousands of hours of content at the fingertips of many shut-ins.

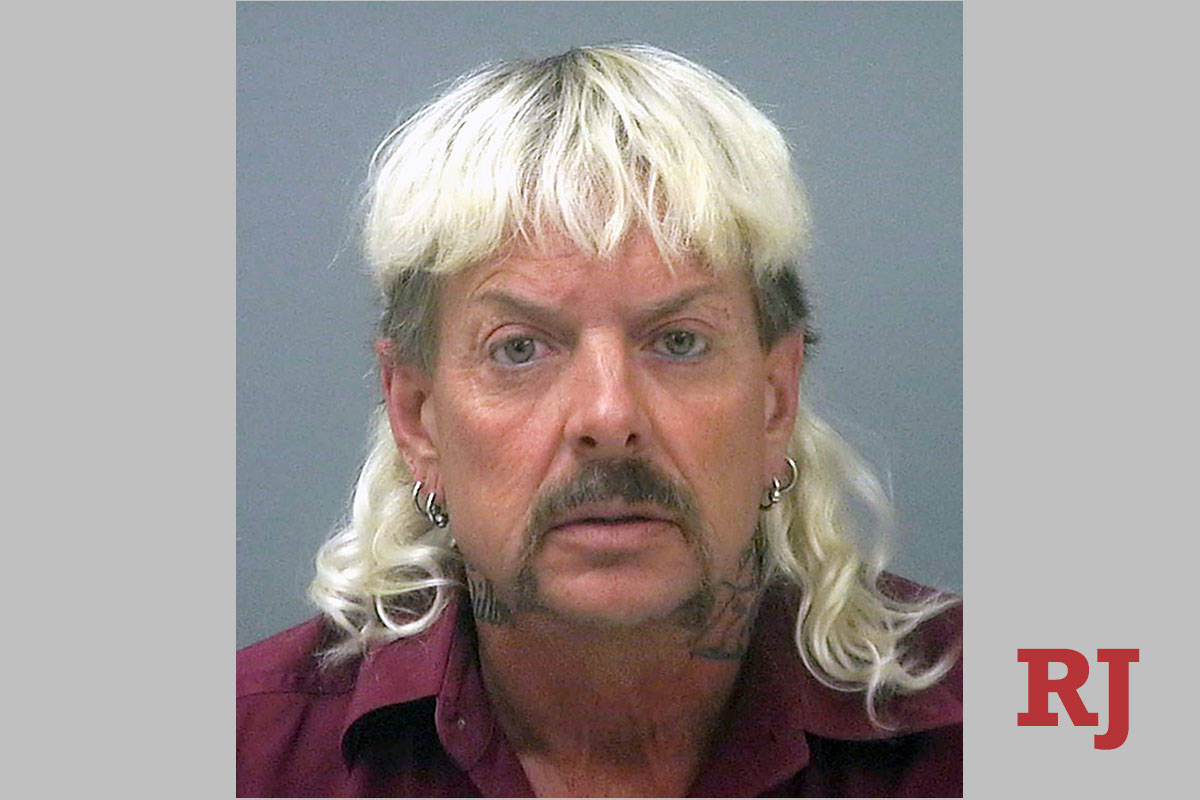

Not surprisingly, with most every other recreational activity shuttered, the use of streaming services has exploded. Combine that with the almost complete lack of live sporting events, the primary reason many subscribers remain tethered to traditional pay TV, and cable and satellite providers have been put under one of the harshest spotlights since Carole Baskin.

Are “Tiger King” references still a thing? Are any pop-culture references? Stay away from other humans long enough, and it becomes really hard to tell what passes for snark these days.

Anyway, as for streaming, aka America’s only pastime, the statistics have been eye-opening.

For the seven days starting March 23 — that’s the week after Gov. Steve Sisolak’s March 17 directive for residents to “Stay Home for Nevada” — streaming usage in Las Vegas jumped 65 percent over March 2-8, the last full week most of America remained open.

Updates of those local streaming numbers from Nielsen weren’t available, but the ratings company noted that, for the week beginning April 13, Americans spent 154.6 billion minutes streaming — an increase of nearly 100 percent from the same week a year ago.

Among other milestones, Disney Plus passed the 50 million global subscriptions mark in early April. For comparison, the service’s initial goal was 60 million subscribers by September 2024.

And, with 15.7 million new subscribers in the first quarter, Netflix more than doubled its worldwide expectations of 7.2 million. In a letter to shareholders, though, the company said it didn’t expect those increases, or the dramatic spike in its streaming numbers, to last. “We expect viewing to decline and membership growth to decelerate as home confinement ends, which we hope is soon.”

Amen.

‘Grossly unfair’

One of the less obvious reasons for the streaming binges we’ve been on over the past two months is the fact that, without live sports to watch, we have a lot more time on our hands.

ESPN has a certified blockbuster with the Michael Jordan documentary series “The Last Dance,” but otherwise, the company has had to rely on airing everything from past WrestleMania events and old spelling bees to NBA players taking part in competitions involving H-O-R-S-E and the NBA 2K video game.

Now that the initial curiosity factor has worn off, subscribers have started noticing they’re still paying premium prices for that content.

In 2017, the top four sports providers — ESPN, Fox Sports, the NFL Network and NBC Sports — combined to charge cable customers $12.99 a month, whether they watched those channels or not. ESPN’s four most popular channels — ESPN, ESPN2, ESPNU and the SEC Network — made up $9.06 of that.

That’s a steep bill, but it’s somewhat understandable when you factor in the billions of dollars ESPN lays out for the rights to NBA, NFL and major league baseball games. With none of that content even on the horizon, though, customers are wondering what they’re paying for.

One of those customers is Letitia James.

“It is grossly unfair that cable and satellite television providers would continue to charge fees for services they are not even providing,” James, the New York attorney general, wrote Wednesday in a letter to major cable and satellite businesses. “These companies must step up and immediately propose plans to cut charges and provide much needed financial relief.”

Cutting the cord

Subscribers may take matters into their own hands.

A survey of cable TV subscribers conducted by KilltheCableBill.com and Mindnet Analytics reported that 33.2 percent said live sports were a “very significant” reason they subscribed to cable, and 12.6 percent said they were “very likely” to cancel their subscriptions if major live sports didn’t return to TV before June 1.

That would follow other cord-cutting trends.

An April 21 survey for digital marketers The Trade Desk showed 74 percent of 18- to 34-year-old viewers have never had cable, have already gotten rid of it or are planning to cut the cord. Of those in that age group who still have cable, the report said, 18 percent plan to cut the cord by the end of 2020.

Sports is the one area of TV viewing that doesn’t have an easy streaming alternative. ESPN Plus, available as a $4.99 a month add-on, offers some events from MLB, NHL, UFC, Top Rank Boxing, MLS and some international soccer, but it doesn’t give subscribers access to regular ESPN content or live NBA or NFL games.

That restriction may not be the case for long, though. As part of an agreement announced Wednesday, Amazon will air one late-season Saturday NFL game exclusively on Prime and Twitch.

Susie Black-Manriquez, manager of communications for Cox Las Vegas, said it was too early to tell what long-term effect our quarantine streaming binges may have on the company’s subscriber rates.

But, she said, the company is already focused on the fees being paid to those sports channels.

“We’re in discussions with the networks, but right now they continue to charge us full price for this programming. If we receive any money back from the networks, we will pass all of it along to our customers.”

Contact Christopher Lawrence at clawrence@reviewjournal.com or 702-380-4567. Follow @life_onthecouch on Twitter.