Lawsuit: More than $4M stolen from ATMs throughout the Las Vegas Valley

A lawsuit filed by the CEO of an ATM provider alleged that over the course of nearly two years, more than $4 million was embezzled from ATMs through the use of fraudulent receipts by employees of a company contracted with the provider to load cash into ATMs.

According to a police report filed in August by V. Ravi Chandran, chief executive officer of 247 ATM Providers, one of the employees Chandran suspected to have been involved was 19-year-old Conner Rebolledo, who was killed July 19 in what police said was a planned robbery against him.

Two suspects accused of killing Rebolledo, Skylar Bailey and Emiley Ridout, messaged about Rebolledo’s Instagram page, saying that he always had money on him and liked to show it off, records show. Their arrest reports said that Rebolledo was previously employed at a company that refilled ATMs and had to handle large sums of cash, which he would regularly post on Instagram.

There is no indication that Rebolledo’s death is linked to any events described in the lawsuit, which was filed Oct. 1 against Zyng Corp and its subsidiary, Zyng Technologies.

Bailey, Ridout and a third defendant, Nathan Nava, are facing charges, including open murder, in connection with Rebolledo’s death.

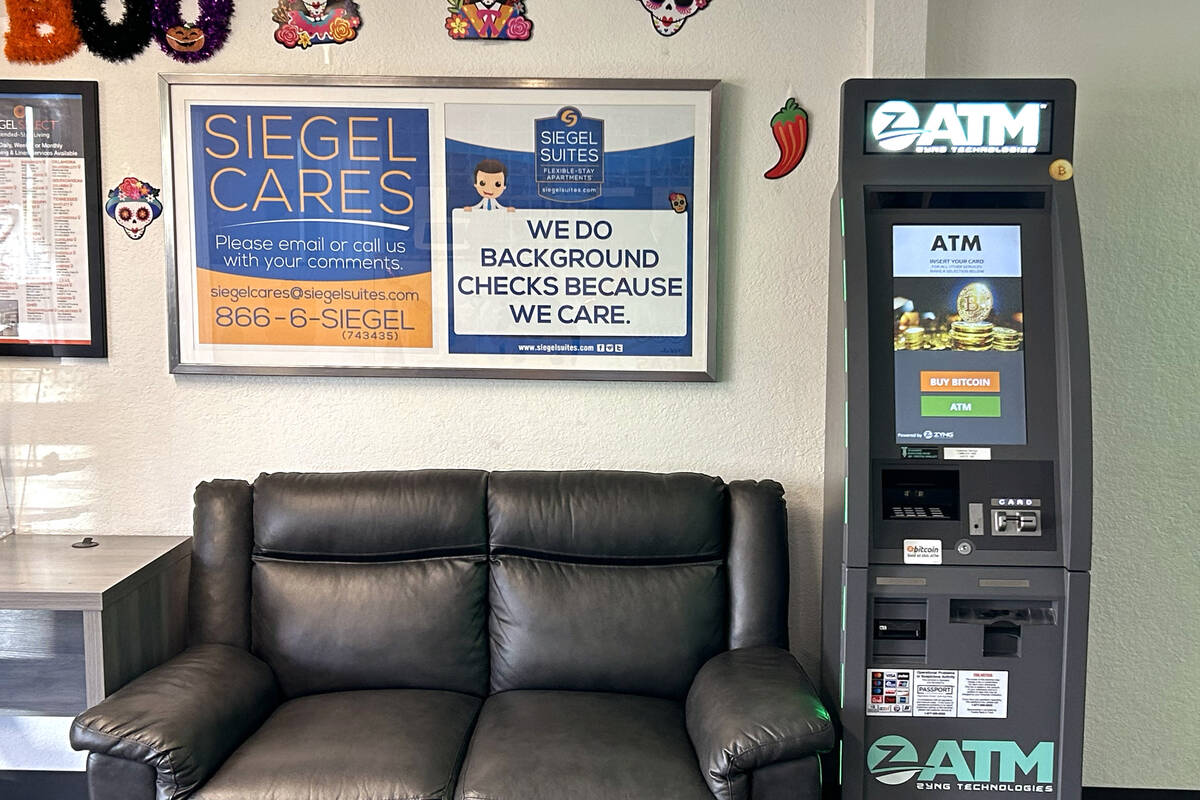

According to its website, Zyng Technologies “develops and integrates financial services.” Zyng Corp is also the majority owner of Zyng ATM, which operations a network of ATMs, the website said.

Zyng Corp Chief Operating Officer David Rankine and Chief Executive Officer Darrell Osadchuk said that while some money from the ATMs is unaccounted for, the amount was less than $1 million, rather than exceeding $4 million.

“A few of our employees may have stuck their hand in the cookie jar, but it was not Zyng’s money,” Osadchuck said in an email. He said that 247 ATM Providers was the owner of the cash, but that Zyng, being responsible for its employees, would have to deal with the loss. “We’re still working through how it was calculated,” Osadchuk said.

Osadchuck said that Chandran was “the only person who could order funds from this account, audit this account and be the guy to discover it.” He added that Zyng is still waiting for new audits and information and that he has not yet been served.

Chandran declined to comment on the lawsuit.

The disputed audit

247 ATM Providers and Zyng Technologies entered into a cash vaulting services agreement, according to the lawsuit. Per the agreement, 247 ATM would provide cash to Zyng Technologies to use to load its ATMs.

But the lawsuit alleges that, in breach of the agreement, employees of Zyng Technologies periodically produced two receipts when handling cash going into the ATMs: one real receipt, and one fraudulent receipt.

The fraudulent receipt, which showed that the intended amount of cash had been loaded into the machine, was submitted to Zyng Technologies for record-keeping purposes, the lawsuit alleges. The real receipt, which showed the discrepancy between the intended funds and the actual funds, after couriers pocketed some for themselves, was thrown away, the lawsuit said.

According to 247 ATM Providers’ attorney, Sagar Raich, ATM machines can’t count money the way machines in banks and casinos do.

The fraudulent receipts were discovered in an audit ordered by Chandran, according to the lawsuit, after he “suspected that Zyng Technologies was engaging in fraud or embezzlement.”

Philip Beckett, an auditor who did not respond to requests for comment, performed an audit on the cash loaded into the machines. The lawsuit said that a report issued Aug. 29 found that a total of $4,425,050 was embezzled.

Speaking on the phone, Rankine said that Zyng’s internal numbers showed that around $850,000 had been embezzled by employees. He added that the systems in place to protect against embezzlement were created by 247 ATM Providers.

“We’re just dealers in the machines,” Rankine said. “It was their procedures and their money.” Rankine and Osadchuck said they dispute the amount in the report.

Osadchuck said that Zyng also did not have access to the bank accounts in question, “and would have no way of catching it if an employee stole cash.”

Alongside Rankine and Osadchuck, four Zyng employees are named as defendants in the lawsuit: Kevin Garcia, Sam Hernandez, Adrian Gaytan and Andrew Chang.

On the phone, Rankine said that the four employees are “low level,” and that the accusations are nothing to do with directors, shareholders or officers of Zyng Technologies, Zyng Corp or Zyng ATM.

Raich said in a statement that “our clients had to file a lawsuit because judicial intervention and going to court was the only way they believe that they can get justice at this time.”

Osadchuck said that Zyng intends to countersue, alleging misinformation and defamation.

Contact Estelle Atkinson at eatkinson@reviewjournal.com. Follow @estellelilym on X and @estelleatkinsonreports on Instagram.