June airline traffic at McCarran up from year ago

The rebound in airline traffic continued in June, with contributions coming from a well-advertised source as well as quieter ones.

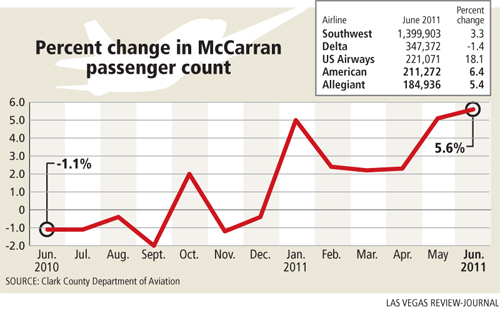

The number of passengers going through McCarran International Airport rose 5.6 percent from one year ago, to 3.6 million, the strongest performance in nearly four years.

That’s still about 13 percent lower than the peak year of 2007.

More than one-third of June’s increase came from discounter Spirit, which saw its passenger count jump nearly fivefold as it significantly ramped up service late last year and has announced several more destinations to launch in the next couple of months. Already this year, Spirit has carried more McCarran passengers than it did in all of 2010.

Although Spirit put out several releases and held a news conference to promote its new flights, US Airways has begun a rebound with much less fanfare. Its passenger count rose 18.1 percent, the biggest gain among the airlines with at least 100,000 passengers a month, by adding or upgrading service to destinations such as San Francisco, Los Angeles and Phoenix.

The company did not respond to a query about its change in strategy. But at the pace of the first six months of this year, it would still transport nearly two-thirds fewer people than it did in 2007, when it ran a hub that was later dismantled.

J.P. Morgan & Co. analyst Joe Greff noted in a recent research report that some airlines, including American and JetBlue, had placed more planes in the Las Vegas market as an apparent reaction to Spirit. For example, the number of flights to Los Angeles International and nearby Long Beach airports have jumped from 228 a week last year to 293, while midweek fares have dropped. Spirit started its LAX route in May, while Allegiant went into Long Beach late last year, with both triggering fare battles.

Wall Street closely watches air service as a barometer of how well the Las Vegas visitor industry will fare. Last year, 41 percent of visitors arrived by plane, and market surveys show they tend to spend more than the drive-in market.

On the other end of the scale, United dropped 26 percent in June, continuing the pattern that has unfolded since its merger last year with Continental. It has slashed flights by one-fourth as it deploys planes elsewhere, while Continental has boosted its schedule only slightly. Both carriers have a common parent company but have not yet received Federal Aviation Administration approval to combine operations under the United banner.

Among international carriers, Canada’s WestJet continued to stretch its lead as the largest at McCarran, boosting its total by one-third. Aeromexico went up 92 percent as it continued to pick up slack left by the collapse of Mexicana in August.

Through the first half of this year the airport has handled 20.4 million passengers, a 3.8 percent gain from last year.

Contact reporter Tim O’Reiley at toreiley

@reviewjournal.com or 702-387-5290.