Airbnb, short-term rentals see continued growth in Clark County

In the summer of 2019, county officials cracked down on illegal short-term rentals in unincorporated Clark County, strengthening rules meant to deter home-sharing operators that use apps like Airbnb.

Despite these hurdles from lawmakers, the platform expects to grow even more in the coming years. Airbnb recently released data that showed 882,000 guests arrived in Clark County in 2019, earning Airbnb hosts more than $138 million — significantly more than the $100 million earned the year prior.

“These are guests who are generally already making the preference of vacation rental over hotel room. This is not new,” said Ted Newkirk, founder of gaming and tourism tips website Access Vegas. “Vacation rental has been a preference in areas like Destin, Florida, and other popular vacation spots for decades.”

‘Nuisances’ in neighborhoods

Airbnb and other short-term rentals in Southern Nevada face different rules in different municipalities.

In Las Vegas, short-term rentals — those lasting 30 days or less — must have no more than three bedrooms and be at least 660 feet from any other short-term residential rental. The City of Henderson allows short-term vacation rentals to operate in residential areas, as long as renters abide by restrictions such as a minimum two-night stay and a $820 annual registration fee.

Short-term rentals are not permitted in residential areas in North Las Vegas and unincorporated Clark County.

The county has six staff members dedicated to cracking down on illegal short-term rentals, according to Clark County spokesman Dan Kulin.

“Those that we are aware of have been nuisances in our neighborhoods and prompted numerous complaints from residents,” Kulin said. “The complaints we receive include loud, late-night parties, trash in the neighborhood, parking problems, and crowds gathering in the street in the way of traffic.”

Last year, the county opened 1,053 short-term rental cases. It issued almost $900,000 in fines and liens on nearly 6.5 percent of those for violating this ordinance and refusing to shut down.

The majority of the properties were not issued fines because they voluntarily shut down, Kulin said.

Impact on Strip resorts

In 2018, Strip properties made about $18.3 billion in total combined revenue, according to the Nevada Gaming Control Board.

A 2019 report from Telsey Group Advisory showed operators could have made even more, had it not been for Airbnb.

Researchers found Strip resorts may have lost out on as much as $150 million in revenue in 2018 as more visitors booked accommodations through Airbnb. Brian McGill, who worked on the report, said he expected the Strip to lose out on even more revenue in 2019 as the app’s user base continues to grow.

“Over the past few years, Airbnb has seen explosive growth in Las Vegas and the recent Google search trends suggest this will only continue in the near-term,” he said in an April research note. A spokesperson from Telsey declined to comment for this story.

Nevada Resorts Association spokeswoman Dawn Christensen said it’s an issue the organization is monitoring.

A boon to Southern Nevada

Despite pushback from local lawmakers, Laura Spanjian, Airbnb senior policy director for the Southwest, said home sharing could be a boon to the area.

Home sharing “brings an economic boost to small businesses and communities throughout the state,” Spanjian said in a January news release.

According to the report, the average Airbnb guest says 41 percent of their spending occurs in the neighborhood where they stay. And in 2019, Airbnb announced that it delivered $2 billion in tourist-related taxes to local governments. Airbnb hosts operating legally in Las Vegas and Henderson pay the same occupancy taxes as hotels.

Newkirk also saw value from Airbnb and similar platforms adding more rooms in the county, especially as the city gets ready to add more than 2 million square feet of convention space in 2020.

“We’ve been at hotel capacity,” he said. “And, while we have over 10,000 rooms projected to come online, many feel the convention center expansion and growth of Las Vegas as a sports betting mecca will fill those up. Airbnb can help fill continued potential demand.”

The city’s weekend occupancy rate sits just under 95 percent, according to data from the Las Vegas Convention and Visitors Authority.

Continued growth

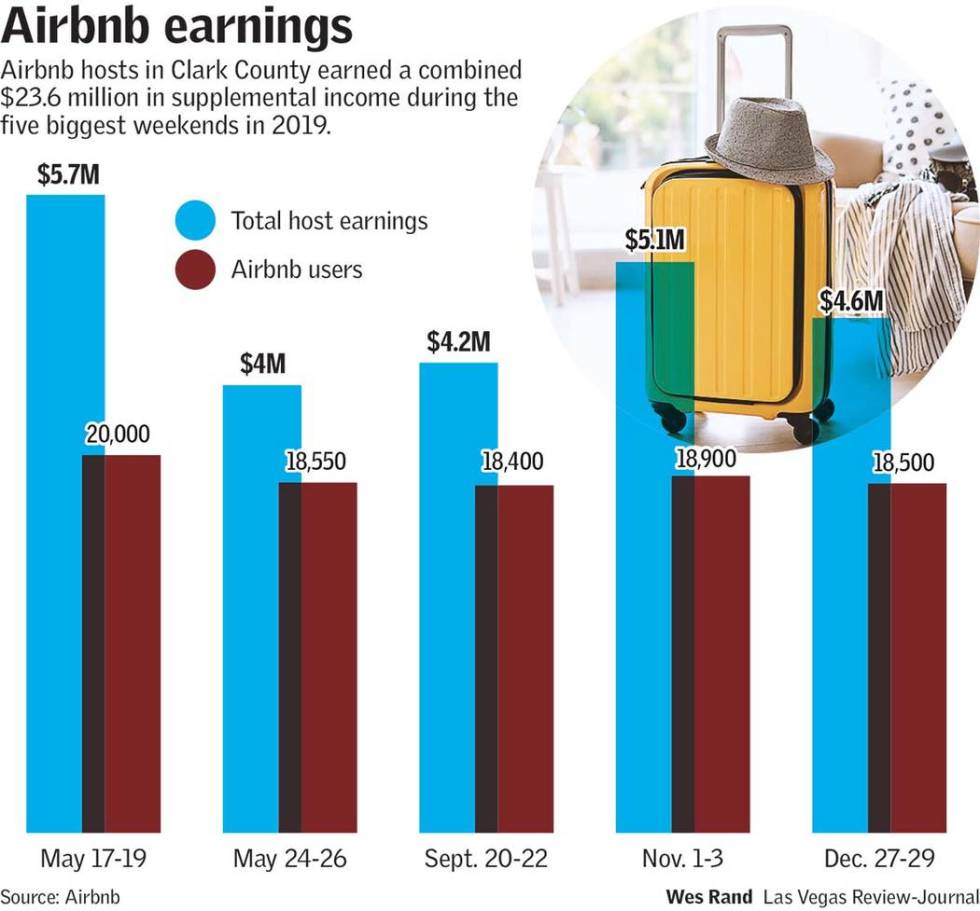

The Airbnb report listed five of the biggest weekends in 2019 for Airbnb travelers in Las Vegas, which brought more than 94,000 guests to Clark County and netted Airbnb hosts a combined $23.6 million.

Those weekends include dates with the Electric Daisy Carnival and Life is Beautiful festivals, as well as the weekend following Christmas.

“These visitors have often been Airbnb users on visits to other cities,” Newkirk said. “It is second nature for them to pull up the app as part of their ‘where to stay’ search.”

Additionally, the absence of parking and resort fees helps make Airbnb prices competitive. Visitors can find attractive Airbnb accommodation near the Strip for $100 or less. Strip hotels often charge $100 to $200 before resort fees that can start in the $30 range.

Airbnb spokeswoman Mattie Zazueta said Airbnb listings offer perks many hotels don’t, including pet-friendly listings, full kitchens and the chance to “live like a local.”

The company expects even more visitors will turn toward these rentals in 2020, as the city welcomes the Raiders and continues to host large events and conventions.

“Short-term rentals will continue to play a pivotal role in meeting the demand for accommodations without the need for additional costly hotel construction,” Zazueta said.

Contact Bailey Schulz at bschulz@reviewjournal.com or 702-383-0233. Follow @bailey_schulz on Twitter.