Switch stock drops 21 percent after earnings miss

Delays in getting customers on Switch’s data center service have caused the Las Vegas-based company to reforecast how much money it expects to make this year.

Switch President Thomas Morton said the company has to ensure customers have the right software and equipment to use its services and secure tax abatements.

Though the customers are delayed in getting onto Switch’s service, the contracts are not in danger of falling through, Morton said.

“Those deals are not going away,” he said.

While revenue increased 11 percent to $102.2 million, Switch reported second-quarter net income of $9.5 million, a 37 percent decrease from a year earlier. The company now projects it will earn at least $405 million in revenue this year, down 4 percent from its earlier forecast.

The company’s stock dropped 22 percent after hours to $10.93.

It predicts at least $197 million in adjusted earnings before interest, taxes, depreciation and amortization, down 8 percent from its earlier forecast.

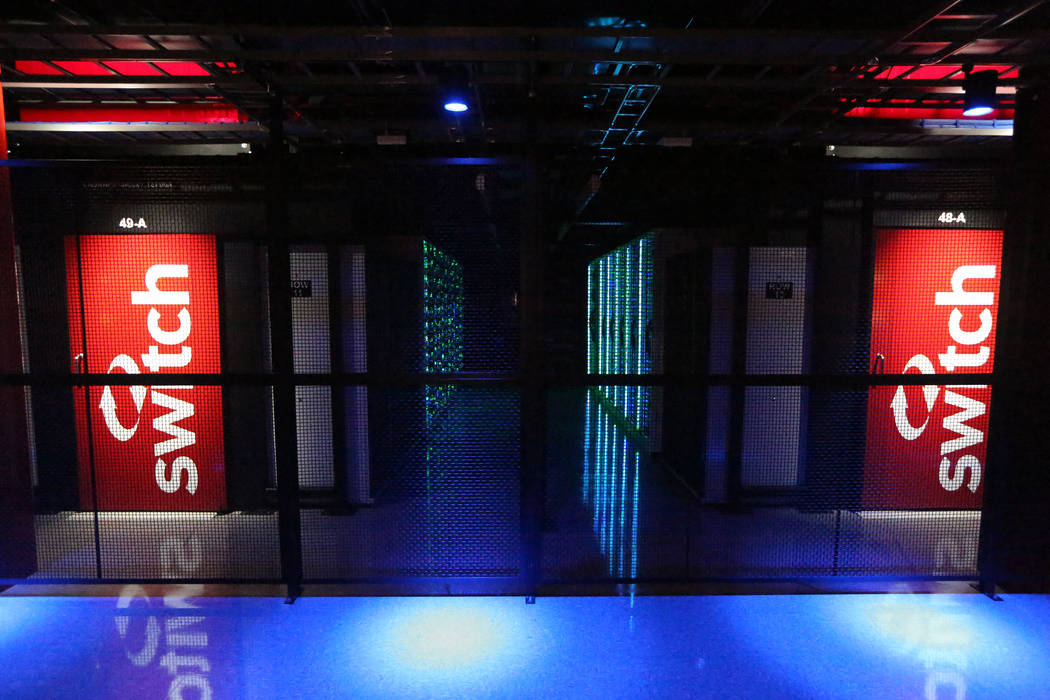

Switch customers range in size from startups to Fortune 100 companies. The company stores digital information created by businesses such as casinos, movie studios and video game makers as well as nonprofits and government agencies.

The company continues to grow existing data centers and build a new one in Atlanta. The Atlanta data center — bringing Switch into a more competitive market than existing buildings in Nevada and Grand Rapids, Michigan — should come online in the second half of 2019.

The new revenue forecast is still a 7 percent increase over the company’s 2017 total revenue of $378 million. The new earnings before interest, taxes, depreciation and amortization forecast is 1 percent above last year’s.

The company has not changed its expected capital spending forecast of at least $260 million for 2018, less than last year’s $403 million in spending.

Switch posted an operating income of $15.8 million for the second quarter, down 33 percent year over year. The company lost $4 million in decreased asset value and spent $2.8 million in hiring over the past year.

Switch saw $8.2 million in equity-based compensation during the quarter compared to $1.3 million the same period last year.

Second-quarter earnings before interest, taxes, depreciation and amortization increased 7 percent year over year to $50.3 million. Second-quarter spending decreased 12 percent year over year to $99.4 million.

The company will conduct a $150 million common stock repurchase program to make up for Switch employees redeeming stock in the future.

Switch reported total debt of $426.9 million as of June 30 and $684 million in cash, cash equivalents and credit.

Contact Wade Tyler Millward at 702-383-4602 or wmillward@reviewjournal.com. Follow @wademillward on Twitter.