Macau drives gaming stocks

For the second straight month, Macau is driving the stock performance of Nevada’s major gaming companies.

Shares of both Wynn Resorts Ltd. and Las Vegas Sands Corp., which operate the largest casinos in the Chinese gaming market, saw their average daily stock prices climb more than 23 percent during September.

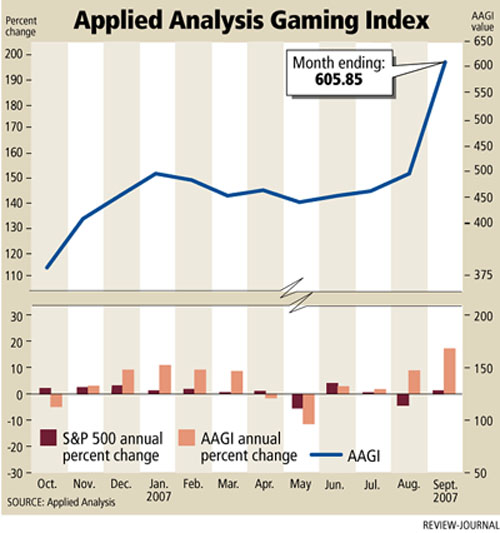

The nine gaming stocks tracked by Las Vegas-based financial consultant Applied Analysis for the company’s gaming index all increased when comparing September with August. The index rose 91 points in September, sending the chart to an all-time high of 605.85 points.

“The key driver for gaming operators during the month was continued strength in and speculation of Asian gaming markets,” Applied Analysis partner Brian Gordon said Friday. “Any concern that investors have had about the size and depth of those markets has alleviated.”

Las Vegas Sands, which at the end of August opened the $2.4 billion Venetian Macau, a 3,000-room hotel with a 546,000-square-foot casino, saw its stock price average $120.66 on the New York Stock Exchange. A year ago, shares of Las Vegas Sands traded at an average $67.73 a share.

Wynn Resorts, which operates the $1.1 billion Wynn Macau, which has 600 hotel rooms, traded on an average of $141.07 a share during September on the Nasdaq National Market. On Friday, the company made a new offering of 3.75 million shares.

Both Sands and Wynn each operate one casino on the Strip and both are building new resorts. The Sands’ $1.8 billion Palazzo opens in December while Wynn’s $2.1 billion Encore is expected to open in early 2009.

MGM Mirage, which expects to open the $1.1 billion MGM Grand Macau by year’s end, averaged $84.96 a share in September, a jump of 11 percent over August. A year ago, shares of MGM Mirage traded on an average of $37.46 a share.

MGM Mirage was helped by its second announced joint venture deal with Dubai World, the holding arm for the Persian Gulf state. Dubai will contribute 25 percent into a joint venture with Kerzner International, which will build a hotel-casino resort on the southwest corner of Sahara Avenue and the Strip on land owned by MGM Mirage. In August, MGM Mirage announced that Dubai World would buy 50 percent of the company’ s $7.4 billion CityCenter development on the Strip and about 9.5 percent of the company’s outstanding shares.

Deutsche Bank gaming analyst Bill Lerner said although Macau has helped the sector, the Federal Reserve cutting 50 basis points off the federal funds interest rate, helped consumer confidence.

“It reduced concerns consumers had about discretionary spending,” Lerner said. “That obviously is good for the gaming industry.”

The average daily stock prices of slot machine makers also jumped in September. Reno-based International Game Technology averaged $40.96 on the New York Stock Exchange, 15 percent higher than August. Resurgent Bally Technologies traded on an average of $32.80 in September, also a 15 percent jump over August. A year ago, shares of Bally Technologies were trading at $16.75.

Gaming analysts suggested that speculation about new domestic gaming markets and the anticipation of increased sales is helping boost slot makers.

In September, the governors of Massachusetts and Maryland floated gaming expansion proposals.

In addition, suburban Kansas City, Kan., accepted proposals to build a casino in the area, one of four potential new casinos Kansas will add in the next few years.