Local officials praise Biden plan targeting aid to small businesses

Las Vegas Valley business, banking and city leaders say President Joe Biden’s move Monday to target more federal pandemic assistance to the nation’s smallest businesses and ventures is a welcome move.

Starting Wednesday morning through March 9, only businesses with fewer than 20 employees — the overwhelming majority of small businesses — will be able to apply for the federal Paycheck Protection Program. Less than half of the available assistance in the current round of funding has been used since it relaunched Jan. 11.

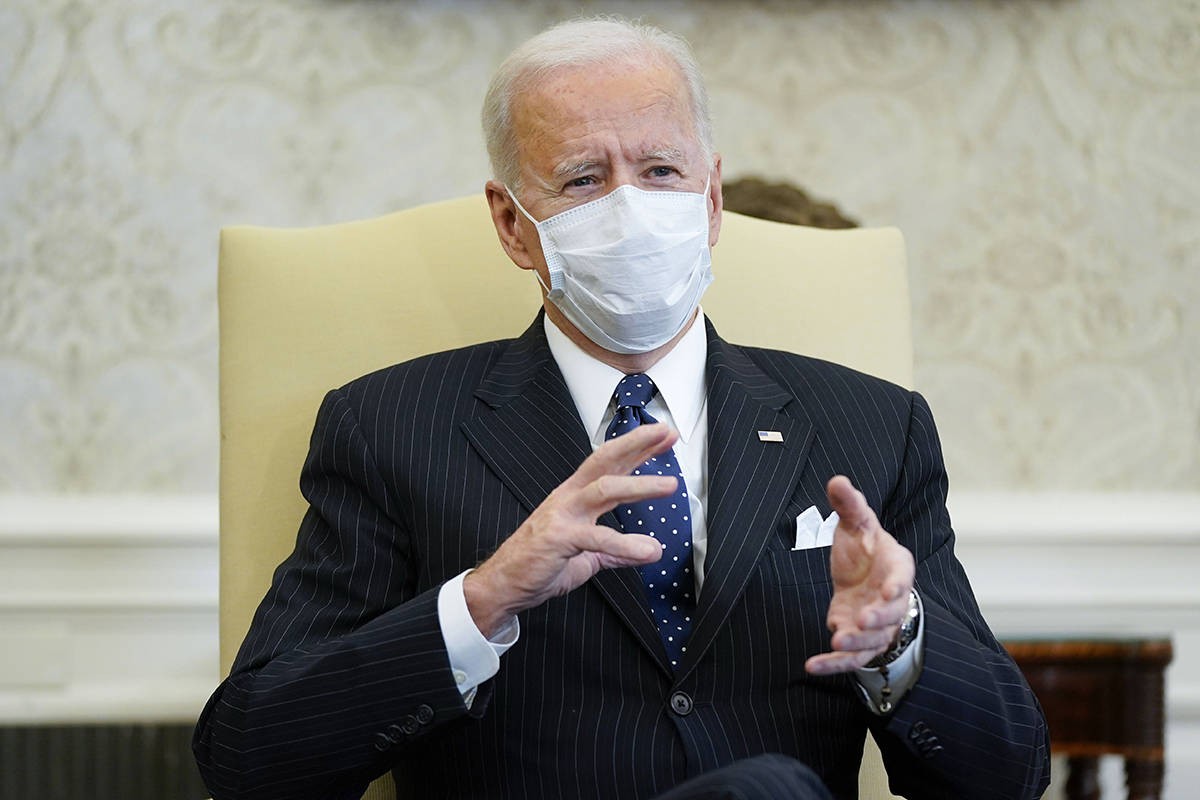

Biden announced the decision on Monday, saying many mom-and-pop businesses “got muscled out of the way” by larger businesses seeking federal money in the early days of the pandemic.

He said changes taking effect Wednesday will provide long-overdue aid to these smaller enterprises that he says are being “crushed” by the pandemic-driven economic downturn.

“America’s small businesses are hurting, hurting badly and they need help now,” Biden said.

‘Smallest of the small businesses’

Rolled out in the earliest days of the pandemic and renewed in December, the program — managed by the U.S. Small Business Administration — was meant to help keep Americans employed.

It allows small and mid-size businesses suffering loss of revenue to access federal loans, which are forgivable if 60 percent of the loan is spent on payroll and the balance on other qualified expenses.

The latest PPP, which began Jan. 11 and runs through the end of March, has already paid out $133.5 billion in loans — about half of the $284 billion allocated by Congress — with an average loan under $74,000.

Local leaders say assistance to help small businesses better navigate the federal loan program is a good move.

“Anything that’s going to help small business, I’m in favor of,” Las Vegas Mayor Carolyn Goodman told the Review-Journal on Monday.

Goodman said she had not yet read the details of Biden’s plan and wanted to understand how it would be funded. She also reiterated her long-held position that businesses should be allowed to fully reopen with health safety measures in place.

Scott Muelrath, CEO and president of the Henderson Chamber of Commerce, said the Biden administration’s announcement places renewed attention on the federal relief program that has helped tens of thousands of Nevada businesses.

“It’s a very welcome move and it is going to help the smallest of the small businesses,” he said. “The first thing it does is it draws attention to the program again. So many of our small business community are just beat up through this pandemic, and maybe they don’t see the headlines and see the opportunity: This puts their face right at the screen again and says ‘Hey take a look if you haven’t done this.’”

“We sent out a notice to over 1,300 of our members — some of those certainly received the first round of PPP — we thought it was such a good thing that we pushed it right out to our small business community immediately once we heard this,” added Muelrath.

Banks, lenders ready

Monday’s announcement for a Wednesday rollout gives banks less than two days to ensure the process goes smoothly.

“They will have to and they will (be ready),” said Phyllis Gurgevich, CEO and president of the Nevada Bankers Association. “There have been a lot of twists and turns and a lot of changes along the way, and our banks and participating lenders have risen to the challenge every time, so there’s no doubt they’ll do it this time as well.”

Gurgevich said the state banking association has been working with various chambers of commerce across Southern Nevada to get the word out on the forgivable loan program, especially for underserved communities.

“Anything that will help ensure the smallest of businesses all get the help they need would always be welcome,” she told the Review-Journal.

One major PPP lender, Wells Fargo, said that as of Monday, the bank has received more than 3,300 Nevada applications requesting a total of $175 million. The money, with an average loan size of $44,900, would save more than 20,000 local jobs.

Company spokesman Anthony Timmons said that 96 percent of its PPP loans funded were from small businesses with fewer than 20 employees.

“We’re waiting for guidance from the SBA on the changes they proposed and look forward to continuing our support of as many small businesses as we can through the PPP,” he said in a statement. “We will be ready to support businesses with 20 or fewer employees starting on Wednesday.”

Contact Jonathan Ng at jng@reviewjournal.com. Follow @ByJonathanNg on Twitter. The Associated Press and Review-Journal staff writer Shea Johnson contributed to this report.