Nevada officials try to clarify new mortgage law

CARSON CITY — State lawmakers, the Gibbons administration and the attorney general’s office are scrambling to clear up confusion over fuzzy wording in a new law that’s making it tougher for some qualified Nevadans to get home loans.

Some major lenders have said they may stop or have already stopped making "stated income" loans because of the wording in Assembly Bill 440, which is intended to ensure that a borrower is able to repay a loan. Ironically, the language was part of a late-session amendment from the banking industry designed to make the law more flexible.

"Stated income" loans account for a quarter of all home loans in the state, and about half of the loans in the Las Vegas area, according to state officials and the Nevada Association of Mortgage Professionals.

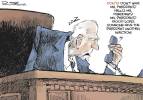

Such loans also have been called "liars’ loans" by some critics who say they encourage people to overstate their income to get a better interest rate — and know they may not have to actually document the income.

The problems with AB440, which takes effect Oct. 1, come at a bad time — with Nevada ranked No. 1 in the nation for foreclosure rates on home loans and experiencing a slowdown in home sales that mirrors a national pattern.

Joe Waltuch, head of the state Mortgage Lending Division, said Wednesday that lenders have overreacted and what’s needed is some common sense.

In a letter to Nevada bank and broker licensees, Waltuch, an attorney, said the law doesn’t specify what methods must be used by lenders to determine whether a borrower can handle a loan — and so relying on methods that "are reasonably and frequently used" will do.

A "good faith" verification effort on the part of lenders will ensure compliance with the new law, Waltuch added.

Brenda Erdoes, chief legislative counsel for state lawmakers, said she’s writing an opinion that will support Waltuch’s letter. And Keith Munro, chief of staff for Attorney General Catherine Cortez Masto, said his office will follow the guidelines from Waltuch and Erdoes.

Assembly Speaker Barbara Buckley, D-Las Vegas, said AB440 was a strong consumer protection law needed because of Nevada’s high foreclosure rate, and Erdoes’ opinion should help in easing fears of "legitimate lenders."

Buckley also announced formation of a Legislative Commission subcommittee, to be chaired by Assemblyman Marcus Conklin, D-Las Vegas, who authored AB440, that will work on ways to help prevent homebuyers from losing their homes.

Conklin said the various state efforts must include an effort to "push back" at out-of-state lenders by providing them with the new information on his bill. He said those lenders "rushed to judgment" and initially misinterpreted the scope of the law.

Marcie Benvin, a Reno mortgage broker and president of the Nevada Association of Mortgage Professionals, said she hopes the efforts work because "we don’t have a lot of time left."

"People need to understand the gravity of the situation," Benvin said. "We’re hoping that the problem gets resolved before it turns into a bigger problem."

AB440, which created the crime of mortgage lending fraud, was one of several bills in the 2007 session aimed at the mortgage industry.

Other measures called for rules for nontraditional mortgage loans, such as interest-only loans and adjustable rate loans; and required appraisals for real estate transactions that are secured by a lien on another property and got rid of an option to waive an appraisal.

In recent months, the mortgage industry has been battered by rising defaults and foreclosures, primarily driven by borrowers with subprime loans and adjustable rate mortgages.

Lagging home sales and flat or decreasing home prices have made it more difficult for homeowners who fall behind on payments to sell their homes and clear the debt, spurring the rise in foreclosure activity.

Housing in Las VegasMore Information