Mortgage company bankrupt

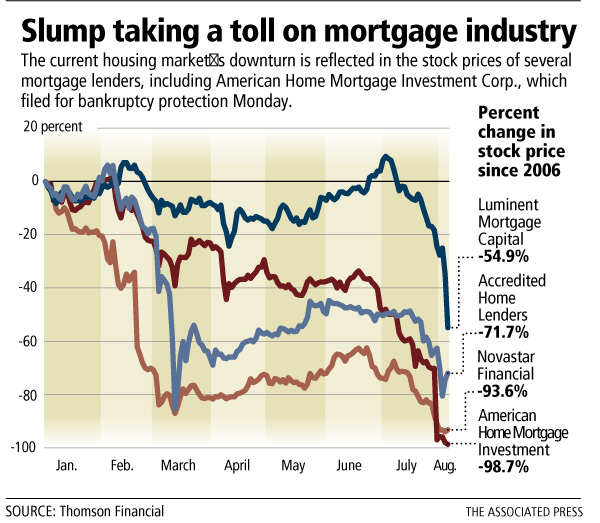

NEW YORK — American Home Mortgage Investment Corp. filed for bankruptcy protection on Monday and two other mortgage lenders said they were not accepting new applications, signs that the worst housing crunch in decades could be widening.

American Home Mortgage had three offices in the Las Vegas area and one in Reno. It employed 44 agents before closing Friday, said Gail Anderson, deputy director of the Nevada Department of Business & Industry.

But it is not believed to have a large market share in the state, because it has been licensed here only since March 2005, according to a state Web site.

Based in Melville, N.Y., and once the nation’s 10th-largest mortgage lender, American Home Mortgage said it fell victim to "extraordinary disruptions" that effectively cut off the funding it needed to make new loans.

Sean Corrigan, president of Aspen Mortgage, said home owners who previously secured loans from American Home Mortgage will not be affected, although the company servicing their loans may change.

Borrowers who were awaiting mortgage funding may need to find a new lender, Corrigan said. Lenders are tightening loan standards every day and often eliminating specific mortgage loan products, he said. As a result, home buyers and people seeking to refinance may find it more difficult to qualify for a home loan from a new lender, Corrigan said.

A local licensee for American Home Mortgage said Indymac Bancorp of Pasadena, Calif., had taken over operations at American Home Mortgage offices in Nevada and a regional office identifies itself as American Home Mortgage-Indymac. A source said Indymac was not acquiring American Home Mortgage employees, but added that American Home Mortgage employees have been submitting applications to work for Indymac.

Corporate communications representatives of Indymac and American Home Mortgage did not return calls for comment.

Falling home prices and a spike in payment defaults have scared investors away from mortgage debt, including bonds and other securities backed by home loans.

Houston-based Aegis Mortgage Corp. said it would not accept any more applications and said it could not meet all of its existing funding obligations. National City Home Equity, a unit of Cleveland-based National City Corp., also stopped taking applications for new home equity loans and lines of credit.

"We are in a market now where value is a fleeting concept," JMP Securities analyst Steven DeLaney said of the vanishing appetite among investors for the bundles of mortgage debt that had been the funding lifeline for the industry. "The market today has just basically shut down."

American Home Mortgage filed for Chapter 11 bankruptcy protection in Wilmington, Del. Its 40 biggest creditors include virtually all the major names of Wall Street. At the top of the list are Deutsche Bank AG and JPMorgan Chase & Co.

In a statement, American Home said it lined up $50 million in debtor-in-possession financing from WL Ross & Co. LLC. WL Ross is led by billionaire Wilbur Ross Jr., who has rescued failed companies in the steel, coal and textile industries.

The company hired Stephen Cooper to be chief restructuring officer. Cooper was also chief restructuring officer for Enron Corp.

While bankrupt lenders carry ominous implications for the housing market and for consumers hoping to take out mortgages, they do not affect the status of mortgage loans already on the books.

A bankrupt lender simply means financial institutions will likely buy the company’s loans as its assets are auctioned off; it does not imperil people’s homes.

Likewise, Ganesh Rathnam, an analyst who tracks investment banks for Morningstar, said he does not expect Wall Street to sustain much damage from American Home, which has less than $20 billion in liabilities.

"The Wall Street banks will go and look for their next source of income, whatever that is," he said. "It is not going to bankrupt them."

American Home Mortgage joins more than 50 lenders in bankruptcy this year. It is bigger than most of the other lenders to go out of business so far, second only to New Century Financial Corp.

But unlike New Century and most other bankrupt lenders, American Home Mortgage was not a "subprime" lender. Subprime lenders cater to home buyers with spotty credit. Almost none of American Home Mortgage’s $58.9 billion in home loans last year were to subprime borrowers.

Last week, the company said many of its lenders wanted their money back, and said it was unable to deliver as much as $800 million in promised loans. It then laid off almost 90 percent of its 7,000 employees.

Houston-based Aegis Mortgage, whose owners include private-equity firm Cerberus Capital Management, said Monday it notified brokers who serve as customers that Aegis would not be able to fund loans currently in the pipeline. Aegis Mortgage spokeswoman Pat Wente said the company’s roughly 30 U.S. branches were open and its 1,300 workers on the job.

"We’ve just announced we’re going to have to suspend lending until we get this figured out," she said. "We’re in the process of reviewing all the alternatives we can."

National City Bank of Cleveland said its decision to stop taking applications for home equity loans and lines of credit is one of a number of steps "taken in recent weeks to help ensure that originations are in line with existing and anticipated market conditions. We are continuing to closely monitor the market and take the appropriate steps to best navigate market conditions."

Separately, NovaStar Financial confirmed it temporarily halted home loans through brokers but said it was honoring existing commitments.

Review-Journal writer John Edwards contributed to this report.

Housing in Las VegasMore Information