Las Vegas market sees slow-rising housing prices in 2019

Las Vegas’ housing market ended 2019 with some of the slowest-rising prices in the nation, capping a year marked by a broad cool-down, a new report shows.

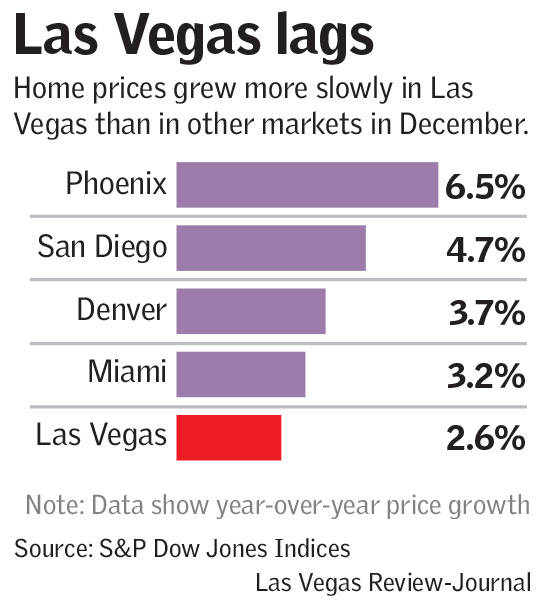

Southern Nevada prices were up 2.6 percent year-over-year in December, compared with 3.8 percent nationwide, according to the S&P CoreLogic Case-Shiller index released Tuesday by S&P Dow Jones Indices.

Phoenix, with a 6.5 percent year-over-year price gain, led the 20 markets in the report for the seventh consecutive month.

Las Vegas and Dallas tied for fourth-lowest, ahead of only San Francisco, at 2.1 percent, and New York and Chicago, which shared the bottom of the pack at 1 percent.

Southern Nevada’s housing market overall cooled off last year with slower price growth and slumping sales, after a heated stretch sparked affordability concerns. Lately, however, the market has seen a big jump in deals.

Around 2,280 single-family homes traded hands in January, up 25 percent from the same month last year, and about 2,600 sold in December, up almost 22 percent, according to the trade group now known as Las Vegas Realtors, which reports data from its listing service.

Slower price growth and lower interests have likely boosted sales in recent months by making homes more affordable, or at least not as expensive as they could be.

Nationally, the average rate on a 30-year home loan was 3.62 percent in January, down from 4.46 percent a year earlier, according to mortgage-finance giant Freddie Mac.

As sales climb, availability has tumbled lately in Southern Nevada.

About 4,900 houses were listed without offers at the end of January, down more than 32 percent year-over-year, according to Las Vegas Realtors data.

Contact Eli Segall at esegall@reviewjournal.com or 702-383-0342. Follow @eli_segall on Twitter.