Despite foreclosure freeze, HOAs sending default notices

Daisy Maldonado knew she was behind on her homeowners association dues. But when a collection agency mailed her a notice recently, she read a dire message.

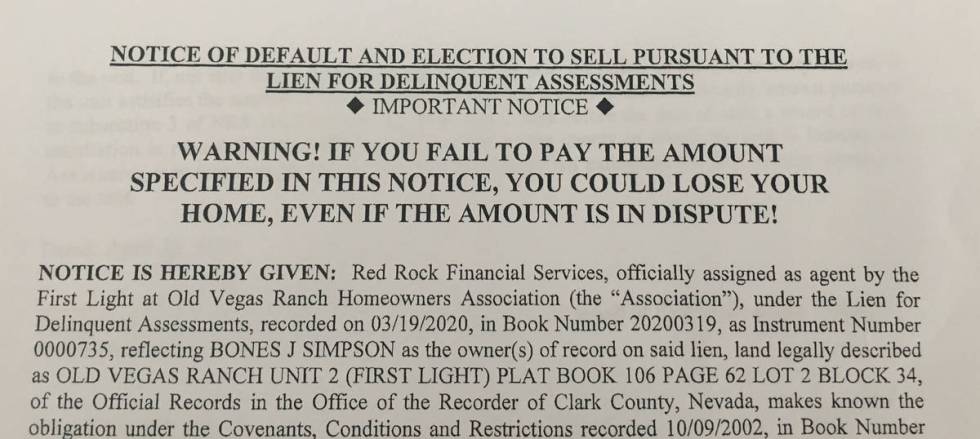

“WARNING!” it declared. “IF YOU FAIL TO PAY THE AMOUNT SPECIFIED IN THIS NOTICE, YOU COULD LOSE YOUR HOME, EVEN IF THE AMOUNT IS IN DISPUTE!”

Maldonado, a 39-year-old auto loan underwriter who lives in North Las Vegas, had been slapped with a notice of default over her late HOA payments. The notice is a step on the trail to foreclosure — and it arrived amid a pandemic-sparked foreclosure moratorium in Nevada.

Gov. Steve Sisolak ordered a temporary freeze on foreclosures and evictions March 29 that is still in effect. Earlier that month, Nevada’s HOA ombudsman also said associations can extend “compassion and understanding” by halting liens and foreclosures amid the chaos.

Still, around 230 notices of default were recorded with Clark County from March 30 through May 26, largely by homeowners associations, a county database indicates.

Getting hit with a default notice does not guarantee a house will be sold at auction. But homes throughout Southern Nevada have been thrown into the foreclosure-processing churn during the coronavirus pandemic, often over a few thousand dollars in HOA-related debt, property records show.

“They’re pretty aggressive,” Maldonado said.

‘Aggressive foreclosure artists’

Sisolak’s order states, in part, that no “foreclosure action” can be “initiated” over a mortgage default during Nevada’s state of emergency, or until the governor ends the ban. It does not mention homeowners associations.

Nevada HOAs can sell homes through foreclosure if the owners fall behind on their association dues, which typically pay for parks, pools, street repairs, and other community work and amenities.

Filing a default notice against a delinquent property owner typically initiates the foreclosure process in Clark County. Filing one during the pandemic, however, is “at tension with the spirit of (Sisolak’s) directive,” UNLV law professor Ngai Pindell said.

Sisolak encouraged banks, borrowers, landlords and tenants to negotiate payment plans for any defaults that stemmed from pandemic-related financial hardships. HOAs are taking a more “formal” and “adversarial” approach, Pindell said.

Despite filing foreclosure warnings, homeowners associations are not scheduling sales or actually auctioning off homes, said Las Vegas attorney John Leach, who has filed default notices for HOA clients during the moratorium.

“If you look at it closely, it doesn’t address HOAs, quite frankly,” Leach said of the governor’s directive, adding: “I think we’re honoring the spirit and intent of that. I really do.”

He said an HOA has “a right to protect its interest”; state law mandates the “WARNING!” message in default notices; and Sisolak’s order cited mortgages.

University of Nevada, Reno political science professor Eric Herzik contends the filings violate “what Sisolak was intending” with the moratorium.

“They just blew off the governor’s directive, and it doesn’t surprise me,” he said, adding HOAs “are probably the most aggressive foreclosure artists in this state.”

The Las Vegas Review-Journal read through 50 default notices recorded in Clark County between March 30 and April 27. Nearly all stemmed from delinquent assessments or HOA dues, the filings said, and the claims averaged $3,218.84.

Red Rock Financial Services, a collection agency, has filed default notices for HOAs during the moratorium. But there is “no way” it would schedule a foreclosure sale until the order is lifted, said Steven Scow, an attorney for the company.

Overall, “99 percent” of foreclosure sales held at the Nevada Legal News building — Las Vegas’ foreclosure auction site — are being postponed or canceled during the pandemic, auctioneer James Vignale indicated.

Some that came up for sale were vacant homes, he noted.

Before the pandemic hit, he figures there were a few HOA sales per week, maybe one a day. Since the directive came down, he has done only one.

Nevada Attorney General Aaron Ford’s office said in a statement, in part, that it has not received any HOA-related foreclosure complaints since the governor issued the moratorium, though it “will continue to enforce the Directive as written for as long as it stays in effect.”

‘Compassion and understanding’

Sisolak’s foreclosure and eviction moratorium did not give tenants and homeowners a green light to live for free. But it was designed to prevent Nevadans from getting locked out of their homes amid the coronavirus outbreak, which shut down much of the economy virtually overnight and sparked skyrocketing job losses.

Nevada’s HOA ombudsman, Charvez Foger, had asked associations in a March 18 letter to put a moratorium on liens and foreclosures amid the turmoil. Such fillings are necessary for operations, he wrote, but “it is times like these where boards can extend their compassion and understanding to their fellow neighbor.”

He also asked boards March 30 to freeze enforcement of certain parking violations, writing that some HOAs “have been overzealous in their towing operations during this difficult time caused by the COVID-19 pandemic.”

The Community Associations Institute, an HOA industry group, has said associations should put a moratorium on foreclosures during the pandemic, waive late fees and penalties for homeowners who face financial hardships, and “continue to record liens to protect their interests.”

Nevada was one of several states to halt foreclosures amid the outbreak, but it “does not have a moratorium on collecting debt,” said Dawn Bauman, senior vice president of government and public affairs at the Community Associations Institute.

The institute, she added, strongly believes in “letting people know what they owe if they missed a payment.”

‘Maybe that’s what they do’

Maldonado, the underwriter, bought her house in 2009. After getting hit with a lien in March, she was slapped with a default notice in late April that said she owed $2,471.08, property records show.

Maldonado said her HOA dues are maybe $60 per quarter, and she agreed to a payment plan of $281 per month to wipe out her debt.

“It was pretty upsetting,” she said.

Heather Kolb, a teacher, bought her south valley house last year. She fell behind on her HOA dues because she thought they were included in her mortgage payment, and she didn’t receive mail for months because of problems with the post office, she said.

Kolb was hit with a lien in March and then a default notice in late April, which said she owed $2,885.18, property records show.

She’s not worried about losing her house, but it seems a little “ridiculous” that a $250,000 home would face foreclosure over a default a fraction of that size, she said.

“But I don’t know,” Kolb said. “Maybe that’s what they do.”

Contact Eli Segall at esegall@reviewjournal.com or 702-383-0342. Follow @eli_segall on Twitter.