Home groan: Slump still on

The Las Vegas housing market continued to slide in July as both new home permits and closings fell dramatically from a year ago, Home Builders Research reported.

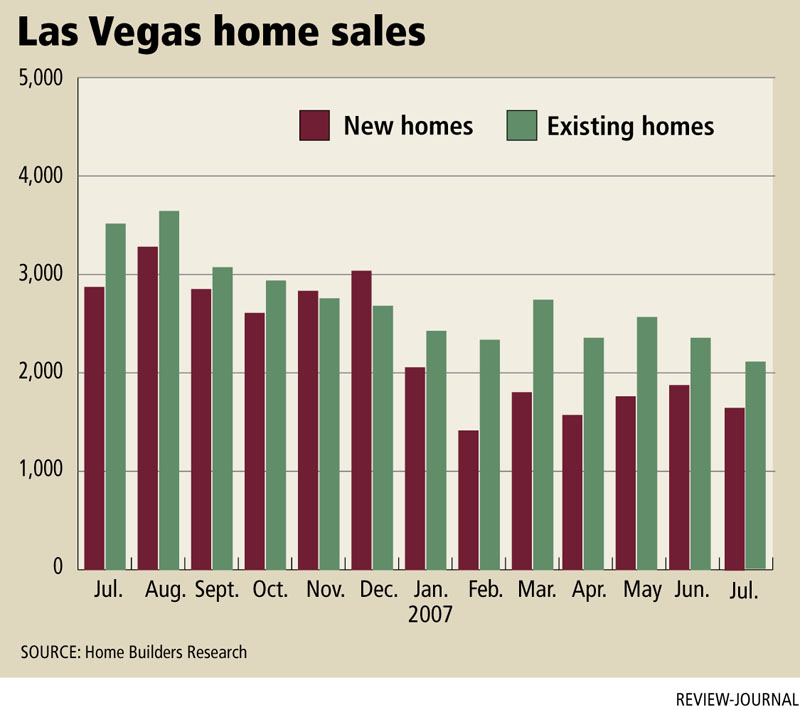

The firm counted 1,724 recorded sales of new homes during the month, down nearly 40 percent from July 2006. The 859 new home permits pulled in Las Vegas, North Las Vegas, Henderson and Clark County are down 45.2 percent from a year ago.

“There are still some national press stories implying that the new home segment is still overbuilt,” Dennis Smith of Home Builders Research said. “At least in Las Vegas, we strongly disagree.”

The median price of a new home rose less than 1 percent from a year ago to $326,750. Smith said the price increase has to be carefully interpreted because 18 percent of recorded sales in July were mid-rise and high-rise condominiums with a median price of $535,000.

The existing home segment also continues to post double-digit sales declines. The 2,101 recorded resales in July represent a 40.2 percent drop. The median resale price fell 4.2 percent to $278,000.

“There’s not a lot to say. It’s more of the same,” housing analyst Larry Murphy of Las Vegas-based SalesTraq said. “The picture does not look any better and continues to go down a little.”

Murphy shows prices continuing to slide a bit for new and resale homes. He’s got the new home median price at $327,790 in July, down 2.6 percent from a year ago, and the existing home median price at $276,500, down 4.3 percent.

New home closings are off 40.1 percent at 1,689 and existing home closings fell 35 percent to 2,232 in July.

“So the news continues to be negative,” Murphy said. “It’s not crashing, just continuing a gentle slide. We will know when we hit bottom when two things happen: inventory quits climbing and prices quit sliding. That did not happen in July.”

Smith said it’s amazing how the subprime mortgage crisis has tacked onto the change in demand for housing in Las Vegas. The mortgage industry started fading six months ago, but now it’s giving the appearance of almost completely shutting down, he said.

“It’ll get worse. I don’t think anybody except people in the industry and down on Wall Street understand the ramifications at this time,” Smith said. “The Feds are starting to see it because they lowered the (discount) rate last week.”

Anybody’s who’s got cash is really in a buyer’s market, but not many people do, he said.

Robin Camacho of Direct Access Lending said foreclosures and short sales in which the bank is willing to take less than the balance owed on a home have doubled as a percentage of listings since the beginning of the year.

In February, there were 995 single-family residences listed as foreclosure or short sale, about 8.5 percent of total inventory. By August, the number had grown to 2,598, roughly 17 percent of homes on the Multiple Listing Service, Camacho found in her research.

Nobody likes to hear about people losing their home to foreclosure and having their credit ruined, but it has become apparent that many of those people ignored caution and continued with their “reckless use of paper equity wealth,” Smith said.

Since early 2004, there were warnings about the ramifications of adjustable-rate mortgage payments, increasing debt loads and the potential for changing market conditions, he said.

“But the greed factor that drove normal people to a level of arrogance and get-rich-quick dreams overwhelmed any caution,” Smith said. “They saw a friend, a relative or a neighbor making a bundle by flipping property and thought, ‘I can do this. Getting overextended won’t happen to me because our housing market is too strong. My equity will continue growing.’ “