Las Vegas casino companies, suppliers have promising outlook

Executives in boardrooms across the gaming industry had to be smiling when first-quarter results began rolling in. Shareholders, too.

The final earnings reports for the three months that ended March 31 were filed with regulators last week.

The reports revealed that casino companies and their suppliers got off to good starts in 2018, and that the outlook for the rest of the year is promising.

The reasons?

The economy is cruising along.

People have jobs and are spending more on leisure.

Mergers and acquisitions have given some companies new revenue generators.

Casino revenue from Macau is returning to levels seen three years ago.

New and refreshed properties are online or close to it.

Companies are investing in facilities to take advantage of a robust convention calendar.

And now that it appears lawful, regulated sports wagering is on the near horizon nationwide, manufacturers are ramping up to supply the anticipated growth and angling for new markets.

A few companies suffered through some bad weather typical of the winter season, but they all know summer is coming.

And Wynn Resorts, a company rocked by scandal during the quarter, is thriving when it easily could have cratered.

Analysts are posting or reiterating “buy” recommendations, seeing opportunities to invest in the future.

Macau soars

Two of the three U.S. companies operating in Macau reported double-digit revenue growth rates.

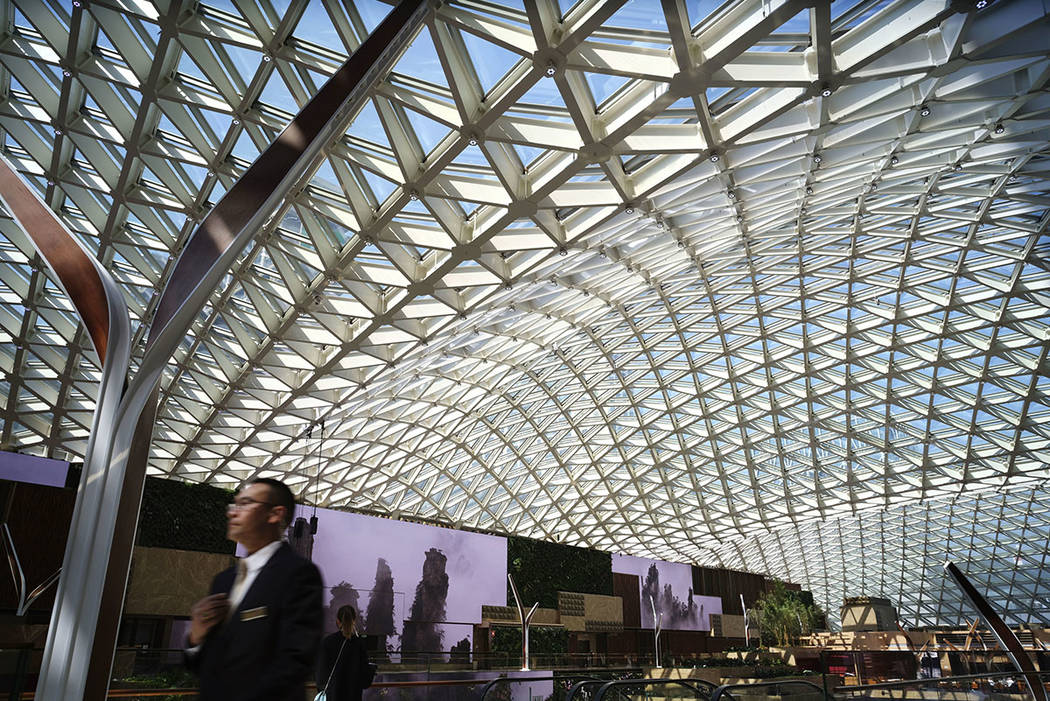

Las Vegas Sands Corp. saw revenue climb 16.7 percent from a year earlier to $3.58 billion, thanks mostly to its success in Macau, where the company is transforming an existing property into the Londoner to match its European-themed Venetian and Parisian resorts.

Sands President and Chief Operating Officer Rob Goldstein was asked during an April 25 conference call with investors why the market has broadened in Macau.

“The way it’s described to us is that the acceleration of younger people who are very affluent bring their families, want to stay as much as four nights. They want to see Bruno Mars or whoever the star is that weekend. They want to shop at the stores. They want to go to the spa, and they like to gamble,” Goldstein said. “It’s quite a great combination. So they stay longer, they gamble more and have more time to spend in our shops.”

Sands is paying a dividend of 75 cents a share this month, and its stock price has climbed more than 9 percent since the April 25 earnings announcement, closing Friday at $79.37.

Wynn Resorts’ 20.5 percent increase in revenue to $1.72 billion also can be attributed to Macau, where the company’s sweet spot is the high-end market.

New Wynn CEO Matt Maddox spent much of his company’s April 24 call dispelling rumors of a sale of the company or its under-construction Boston Harbor project. He explained how he is working to stabilize the company amid accusations that Steve Wynn sexually assaulted and harassed employees. (The former CEO has denied those allegations.)

“The future is better than the past, no matter what the media likes to say,” Maddox said at one point in his call with analysts.

He seems to be right. On May 10, Wynn stock closed at $201.51, its highest level in nearly four years. Profit-takers have since moved in, and the stock closed Friday at $194.21. Still, after the scandal broke, the stock dropped as low as $156.54.

MGM lags in Las Vegas

The third company with a Macau presence, MGM Resorts International, didn’t fare as well as its competitors, with revenue rising 3.9 percent to $2.82 billion.

MGM’s stock price plunged 8.6 percent to $32.29 on April 26, the day of the company’s earnings announcement. The decline occurred after CEO Jim Murren said it’s taking longer than expected for the company to recover from the Oct. 1 mass shooting from Mandalay Bay, an MGM property, that left 58 people dead and hundreds injured.

Since then, the price has fallen even further. It closed Friday at $31.45 a share.

But MGM sees brighter times on the horizon. Its MGM Cotai property in Macau opened during the first quarter, and MGM Springfield in Massachusetts is scheduled to open its doors by the third quarter. Park MGM — the Strip property formerly known as the Monte Carlo — is expected to be fully renovated by the end of the year. The company’s retail and hotel revenue should get a bump from the unexpected success of the Golden Knights, which has played seven home postseason games so far and could play as many as four more in the Stanley Cup Final.

Gaming analyst Joseph Greff of J.P. Morgan said in a report to investors this month that he remains confident in MGM’s convention traffic and gaming revenue.

“Las Vegas convention visitation trends remain strong, increasing by 6 percent in 2017,” the report said. “Convention visitation is tracking down 3.9 percent year to date, but we note this is attributed to the convention calendar shift (with the triennial ConExpo-Con/Agg show rotating out this year).

“Convention visitation was (down) 16.7 percent in January, but up 11.3 percent year over year in February,” Greff said in his report. “On the gaming front, Las Vegas Strip gross gaming revenue excluding baccarat comparisons get easier as the year progresses, having increased 3.2 percent in 2017.”

MGM also is well-positioned to take advantage of the anticipated wave of sports gambling.

Caesars plans growth abroad

Caesars Entertainment Corp., the largest Las Vegas gaming company without a presence in Macau, is in an international growth spurt in its first full quarter since escaping bankruptcy protection.

In its May 2 earnings call, CEO Mark Frissora noted better-than-expected revenue and cash flow and highlighted plans for two Caesars Palace-branded resorts in Dubai and Mexico. The company is looking to break ground next month on its planned Caesars Forum Convention Center.

Las Vegas’ two other big operators — Boyd Gaming and Red Rock Resorts — didn’t fare as well for different reasons.

Boyd’s revenue declined 0.7 percent to $606.1 million for the quarter. The company cited bad weather at its Midwestern regional casinos and a downturn for its downtown Las Vegas properties. It said reduced access from the $1 billion Interstate 15 highway reconstruction project hurt its downtown operations, and higher jet fuel prices affected its business from Hawaii.

Red Rock Resorts, operator of the Station Casinos properties, has seen revenue decline at Palace Station and its newly acquired Palms property as it invests hundreds of millions of dollars into renovation projects.

Red Rock revenue fell 1.1 percent to $421 million.

The company expects the picture to improve with the Palace Station work nearly complete, but it says it’s going to take until the end of the year for the Palms to get to where executives want it.

Locals market thriving

Executives for Boyd and Red Rock say their hopes are resting on the Las Vegas economy continuing to thrive.

“In our view, the regional consumer is very healthy, and we expect better trends are ahead as winter concludes,” said analyst John DeCree of Las Vegas-based Union Gaming. “The first quarter is always choppy as the unfavorable weather moves around, ultimately impacting one or two markets; this year for Boyd, it was the Midwest, which was also impacted by a new competitor” near its Blue Chip property in northwest Indiana.

Manufacturers with a strong presence in Las Vegas thrived in the quarter, with London-based IGT revenue up 5.2 percent to $1.21 billion, Las Vegas-based Scientific Games up 11.9 percent to $811.8 million and Everi Holdings up 9.9 percent to $111 million.

IGT and Scientific see big opportunities with their technology being used for new sports-betting products in other states. Executives for both companies said when that occurs will depend on the speed at which states begin opening outlets and whether they’ll allow wagering from mobile devices.

The Review-Journal is owned by the family of Las Vegas Sands Corp. Chairman and CEO Sheldon Adelson.

Contact Richard N. Velotta at rvelotta@reviewjournal.com or 702-477-3893. Follow @RickVelotta on Twitter.