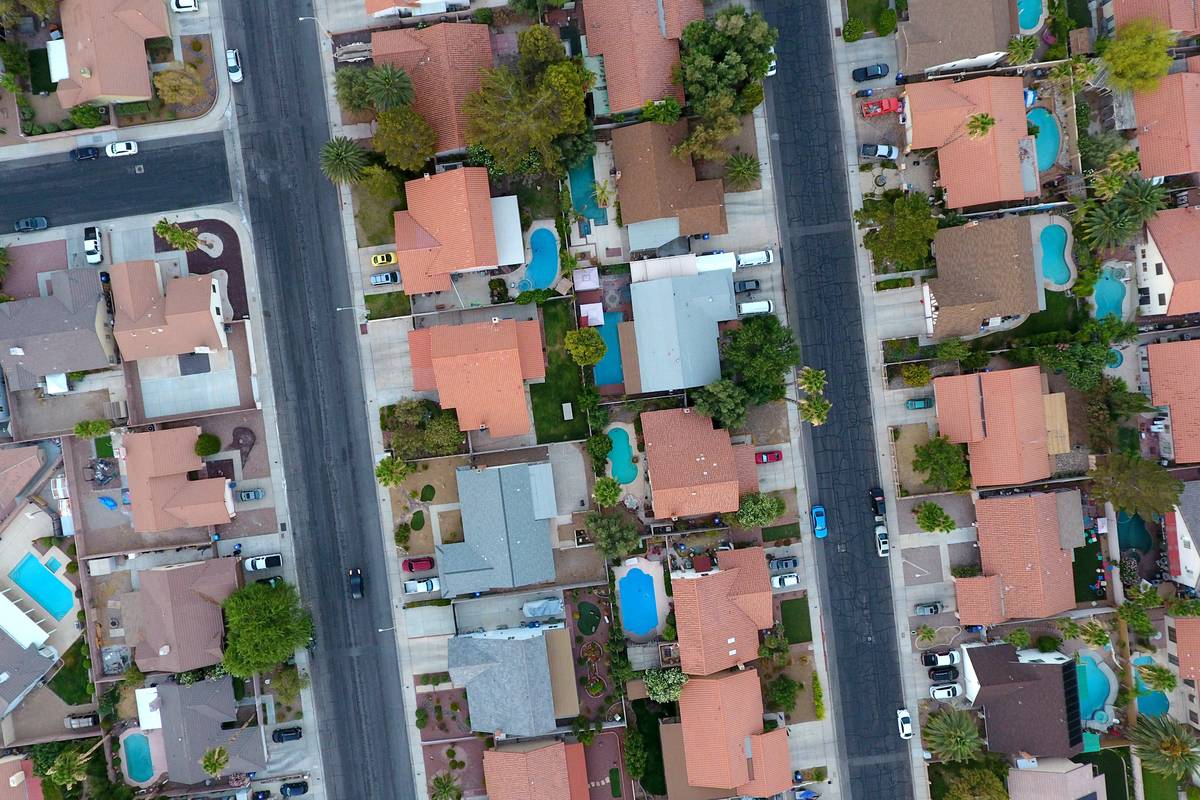

Coronavirus crisis could have sparked big hike in Nevada foreclosures

When Las Vegas’ real estate market crashed more than a decade ago, job losses soared, and lenders foreclosed on homes all over the valley.

Today, the economy is in crisis again because of the coronavirus pandemic — but foreclosures are on pause, stopping what could have been an avalanche of repos.

Gov. Steve Sisolak signed an emergency order Sunday that temporarily freezes eviction and foreclosure proceedings involving residential or commercial real estate, with exceptions for people who pose a threat to others or to their property. It also bars late fees or penalties for nonpayment during the crisis.

Without the order, foreclosures could have soared. Las Vegas’ main financial engine, tourism, has effectively shut down, and early job losses have skyrocketed past Great Recession levels.

Forced shutdown

Despite the intervention, Las Vegas’ housing market is not in the clear. It’s still unknown how long businesses will remain closed, how fast they will staff up when the virus is no longer a threat and how many employers end up shuttered for good because of the outbreak.

Sisolak isn’t the only one giving homeowners a break as much of the country shuts down. Major banks have said borrowers can defer payments for 90 days.

But it only seems fair, given that businesses have closed en masse, including on orders from Sisolak and other government leaders, to help contain the virus’s spread.

“We took our economy and shut it down, and we have the ability to put the economy back on track again once this virus has passed,” said broker Tom Blanchard, president of trade association Las Vegas Realtors.

So far, the fallout from the virus has been swift.

Around 71,940 initial unemployment insurance claims were filed statewide in the week ending March 28, second-highest in Nevada history behind the prior week’s record of nearly 92,300, according to the Nevada Department of Employment, Training and Rehabilitation.

Before the outbreak, the weekly record was 8,945 claims in January 2009 after the housing market crashed.

‘It was ridiculous’

After years of clawing back from the recession, Southern Nevada’s housing market and broader economy were on strong footing before the coronavirus hit. Locals could point to billions of dollars’ worth of real estate projects, tourism numbers were strong, home sales were surging, and foreclosures were evaporating.

Lenders repossessed roughly 1,500 homes in the Las Vegas area last year — down from 35,000 in 2009 alone during the recession, according to housing tracker Attom Data Solutions.

We will find out soon enough whether the outbreak’s aftershocks spark a foreclosure crisis in Las Vegas. But the valley does not want a repeat of the dark days from a decade or so ago when masses of homes emptied after the housing bubble burst, enabling a widespread squatter problem even as the market rebounded in later years.

At one point during the recession, Blanchard said, he sold around 400 bank-owned homes a month.

“It was ridiculous,” he said.

Contact Eli Segall at esegall@reviewjournal.com or 702-383-0342. Follow @eli_segall on Twitter.