Las Vegas DJ-producer makes millions selling NFTs

From the couch he’s currently perched on, Justin Blau sat and watched his life change.

It was a Sunday in late February, and the star DJ-producer was in his living room, tracking the live internet auction of 33 nonfungible tokens, or NFTs, an of-the-moment type of digital asset. The sale was done in conjunction with the third anniversary of his debut album, “Ultraviolet.” This was the fourth and final day of the auction.

As the bidding neared a close, Blau seemed poised to rake in a hefty sum of around $1 million for NFTs that included digital artwork and previously unreleased music.

But then came a flurry of activity.

“We were all sitting here, in front of this TV screen that the leaderboard was up on,” Blau recalls from his modern, west-side home on a recent Thursday. “My whole family was literally on this couch while we were watching it, and that was just … I mean, we had no idea. We had zero clue. It was just an experiment.”

A record-setting one.

Blau ended up selling $11.6 million in NFTs, setting the mark for overall sales for a single NFT drop/collection, as well as the highest price paid ($3.6 million) for a single NFT.

Though they’ve been around since 2017, NFTs have surged into the national consciousness this year.

Digital artist Beeple sold an NFT for $69 million in March. Twitter founder Jack Dorsey tokenized his first tweet and snagged $2.9 million for it. Musicians from popster Grimes to rockers Kings of Leon have tokenized their music and made millions in the process. The NBA Top Shot collectible platform, where pro basketball highlight clips are sold as NFTs, has done over $450 million in sales.

The NFT market has been escalating at a feverish pace in 2021 and showing little signs of letting up: Sales topped $2 billion in the first quarter of this year, which was 20 times greater than the previous quarter, when $93 million in NFTs sold, according to NFT-tracking website Nonfungible.com.

“This year, January, February, it started to really boom,” says Athan Slotkin, an L.A.-based business founder and management consultant. “I think it’s probably the convergence of the development of blockchain in conjunction with a lot of people sitting at home and the further development of technology in general. It’s just kind of boomed.”

Rajiv Kishore, professor and chair of UNLV’s department of management, entrepreneurship and technology, says that NFT growth has followed a standard path of new innovation.

“We see what we call an S-curve,” he explains. “Anything new that comes in, there’s a lot of resistance, the technology’s not there, there is building up, and then suddenly we are in that phase where this is growing and growing at a very nonlinear, exponential pace.”

This is where we’re at now.

“There was this massive explosion in February that I kind of always expected to happen at some point,” Blau explains. “But I felt like it would take years.”

Instead, that future is here, now.

And a Las Vegas musician helped lead the way.

Ahead of the NFT curve

It all began, in a way, with a Scottish artist who was among the first in the world to combine oil paintings with augmented reality technology. That artist, the forward-thinking Trevor Jones, then began rendering his physical art into NFTs.

Blau took notice last summer.

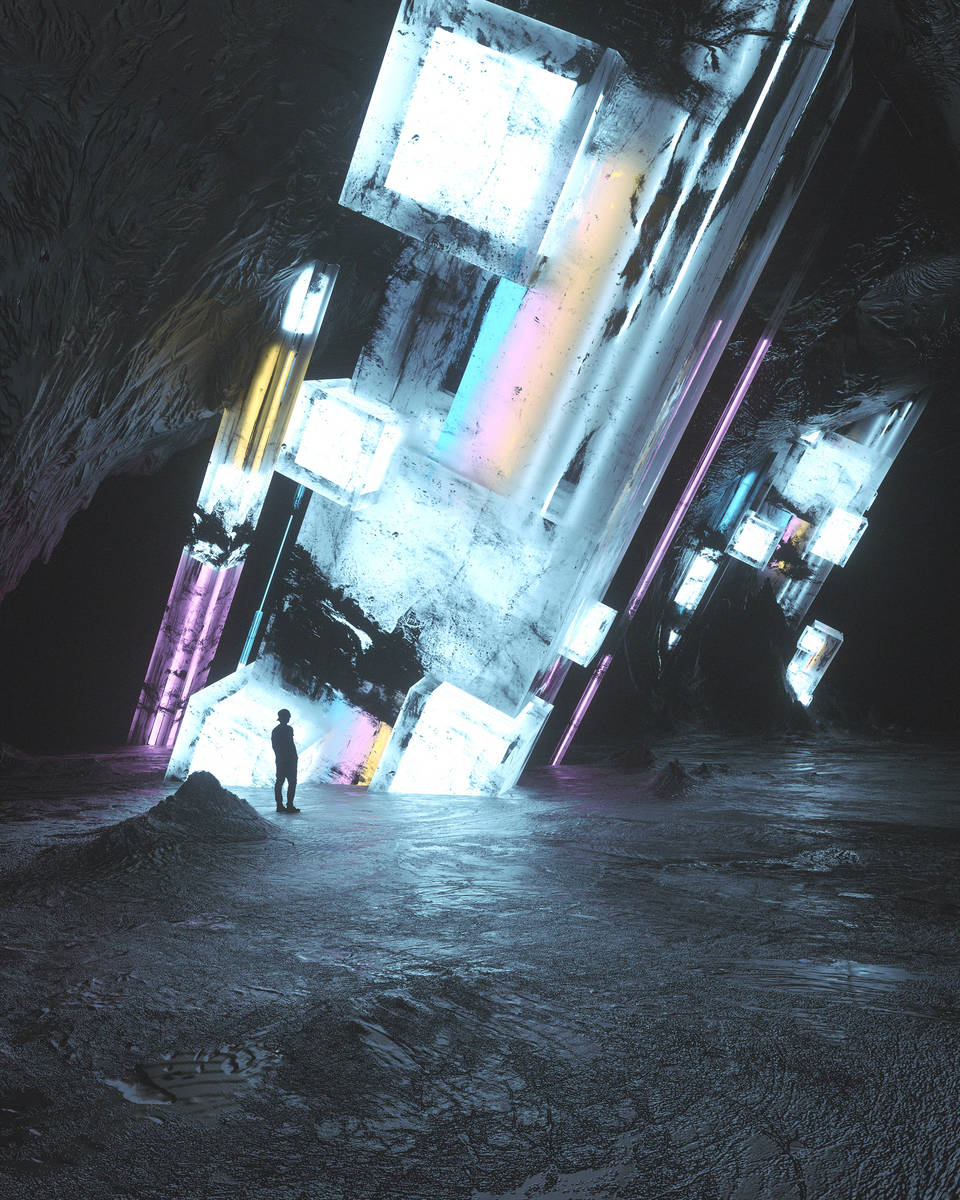

“I just saw people going crazy about it,” he recalls. “So I called my art director (digital collage artist Slimesunday): ‘Let’s make NFTs together.’

“At the time, I wasn’t really sure how it would work for music,” he acknowledges, “but I knew that if we were to create the first audio-visual NFTs, that would mean something significant.”

Blau has long been an ahead-of-the-curve kind of guy. He studied finance at Washington University in St. Louis before leaving school to focus on a music career under the stage name 3LAU, building himself into a star by doing remixes for big names such as Ariana Grande, Rihanna and Katy Perry, performing at tent-pole music festivals such as Electric Daisy Carnival and Lollapalooza and touring heavily.

He’s mated music, technology and finance for pretty much his entire career.

Beginning in 2014, he got heavily into the cryptocurrency world when he was introduced to Bitcoin by future virtual currency billionaires Tyler and Cameron Winklevoss at a spring break gig with Avicii in Mexico.

Two years later, he founded the first not-for-profit dance music record label, Blume Records, which donates all profits to charity and has built schools for children in Guatemala.

In 2018, he launched OMF (Our Music Festival), the first blockchain-powered music festival. OMF wasn’t quite the game changer he wanted it to be then, but Blau learned what would prove to be a lucrative lesson about the potential of digital collectibles.

“If you found me at this music festival and you scanned the QR code that was on my phone, you got a 3LAU loyalty badge,” he explains. “They only made 50 of them. They were gone in a second.

“People just love this idea of owning something that was scarce, whether it was digital or physical,” he continues. “That’s when it clicked. I knew it was the future, but we were just a couple years early.”

Blau’s time came last September, when he Slimesunday did their initial NFT offering. They made $21,000 on their first sale.

“We were like, ‘Holy (expletive), this is real,’ ” Blau recalls. And so they did it again, this time with lower prices and more offerings.

“In our second drop, you could theoretically buy something for 200 bucks,” Blau says. Everything sold out in four seconds.

“Today, some of the things that were priced at $200 are worth $20,000-$30,000,” he says. “Why? Because people want to own digital art. Whether we like it or not, it’s happening.”

‘Not the art itself’

With a click of the remote, Justin Blau demonstrates the appeal of NFTs.

A white-hued piece of abstract art from Slimesunday created through an editing process called pixel-sorting appears on a screen in front of us.

“It’s one thing to say that I found this image on Google and I’m just putting this up in my house,” Blau says. “No, I actually bought this piece. I’m proud to own this.”

But what exactly does he own?

“When you own an NFT, the NFT is not the art itself,” he explains. “It’s a certificate that shows you own the art — it points to a URL that hosts the actual art file. The reason why you know the NFT is authentic is because it comes directly from the artist’s wallet. It’s like a digital signature that the artist actually created it.

“That you’re looking at right there, that’s not the NFT,” he says, pointing to the image on the screen. “The NFT is in my wallet. You own the certificate that says it’s yours.”

So, even if thousands of copies of a given image or song or tweet or whatever have been tokenized and become readily available online in some form, this doesn’t diminish the value of the original any more than, say, prints of “Mona Lisa” take away from the value of the actual painting.

“If this was on the internet and other places — which it is — I’m stoked,” Blau says of the Slimesunday image. “It’s like free marketing for the stuff I own.”

As for the inevitable NFT oversaturation, Blau acknowledges that’s likely to happen but that the marketplace will sort itself out just as it does in other contexts.

“A lot of people are like, ‘Well, what happens when everyone is issuing NFTs?’ ” he says. “The answer is the same as everything else: There are a lot of musicians who can’t make it. There are a lot of artists who don’t.

“Everyone’s going to be making NFTs,” he continues, “and at some point, unless someone’s doing something truly innovative, it could be worth zero. Which is fine. That’s the world.”

Two weeks after his record-setting NFT auction in February, Blau did another offering, netting $5.3 million. John Legere, ex-CEO of T-Mobile, won the biggest prize, paying $1.3 million for the first NFT music video Blau created.

Moving forward, Blau sees NFTs as a way for creators to interact directly with their fans. For musicians, this means they might not need to sign with a record company anymore and can thereby avoid deals whose terms have historically favored the label over the artist.

“The entire label model of ‘Take a million dollars, and we’re going to own 80 percent of you forever,’ that will cease to exist in the next three years,” he predicts. “No one will be signing those deals. The next generation of artists who are coming up, why would they sign those deals when they’ve seen what we did? They’re going to think, ‘We can try it, too.’ And they will.”

Go ahead, roll your eyes.

The man has a track record on his side.

“I have a video clip of me talking with Fox Business News about NFTs in 2018,” Blau says. “It’s like me saying that a nonfungible token might enable access to one of your favorite artists, and the reporter is like, ‘Thanks, yeah, yeah, yeah, I wish I was younger and I wish I was riskier, but I wish you the best. Good luck.’

“Three years later,” he grins, “we’re here.”

Contact Jason Bracelin at jbracelin@reviewjournal.com or 702-383-0476. Follow @JasonBracelin on Twitter and @jbracelin76 on Instagram